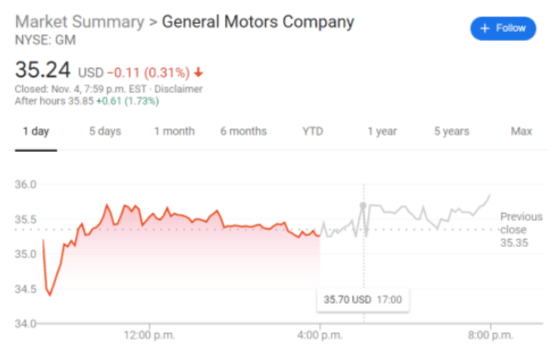

GM Stock Price Today: General Motors Company trades flat ahead of earnings report

- NYSE:GM sheds 0.31% on Wednesday despite broader market gains.

- General Motors gains steam behind its shift to electric vehicle focus.

- General Motors saw an overseas sales boom last quarter despite COVID-19 tailwinds.

NYSE:GM has captured the attention of investors and Wall Street as the normally traditional automaker has shifted its focus to the red-hot electric vehicle sector. On Wednesday General Motors traded flat despite the broader markets surging with post-election momentum. The stock fell by 0.31% to close Wednesday’s trading session at $35.24, which is now within 10% of its 52-week high of $38.96. GM’s stock is clearly on the rise as it is trading above its 50-day and 200-day moving averages, but is still down nearly 8% over the last year.

On November 5th, General Motors will announce its third-quarter earnings results before the opening bell. General consensus is that GM will exceed Wall Street expectations, and for good reason, as this would continue the company’s trend of surpassing estimates which it has done the previous four quarters. There are things to be excited for in GM moving forward not the least of which is the report of year-over-year growth in sales in China, as well as its hard shift towards electric vehicles. General Motors is currently closing its agreement with Nikola (NASDAQ:NKLA) to develop its Badger truck, as well as hydrogen semi-trucks for the future. GM also recently announced its official brand move into electric vehicles with its flagship Hummer EV, and its all-new Cadillac LYRIQ crossover.

GM stock dividend

GM now has a median consensus target estimate of $41.35 which forecasts upward momentum from its current price levels. While it has long been thought of as a traditional company, General Motors is trying its best to change its identity led by CEO Mary Barra. One positive for GM is that both presidential candidates support the “made in America” mentality, which should bode well for General Motors as it moves into the future

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Stocks Reporter

FXStreet