- NYSE: GM is on course for further gains, extending its steady rise.

- General Motors Company's low valuation stands out after NIO's disappointing earnings.

- The veteran automaker's venture into EVs could provide it additional upside.

Will this tortoise surpass the hare? After being in business for more than 112 years, General Motors Company (NYSE: GM) is catching up with the latest technologies. Will its value and eventual dividend meet that of shiny rivals?

See latest in the electric vehicle sector

The fresh interest in the company run by Mary Barra comes after Nio Inc (NYSE: NIO) reported disappointing earnings results. The Shanghai-based electric vehicle maker – once dubbed "China's Tesla" – failed to turn a profit, serving as a reminder that financials still matter.

Stay up to speed with hot stocks' news!

Moreover, Elon Musk's Tesla, that rake in more money than it spends, has a forward P/E close to 200 while GM's is hardly in double digits. Legendary investor Warren Buffet has more funds in BYD than in GM, but even the Oracle from Omaha may be missing something.

Investors are naturally attracted to lean and mean companies that focus solely on technologies of the future and dismiss the old giants. However, General Motors is venturing into electric vehicles, most recently via Brightdrop, a subsidiary. The spin-off focuses on commercial delivery and logistics solutions such as EV600 that will go to FedEx later in the year. Moreover, it is backed up with a cloud-based software platform ready for updating vehicles.

GM Stock Forecast

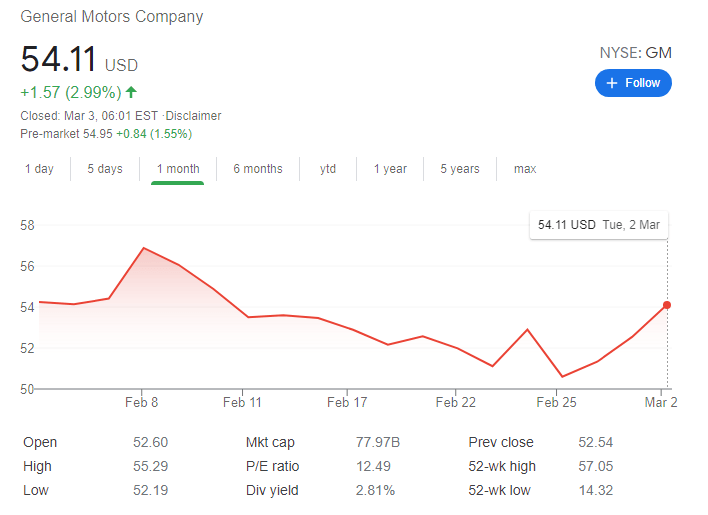

Are investors overlooking GM's jump into new technologies? Trading in recent days – even before NIO's earnings – has shown that General Motors is gaining traction. Shares are set to rise by 1.55% on Wednesday, and that would be the fourth consecutive day of gains.

As the color on the chart above signals, NYSE: GM is still down in February. Nevertheless, it is within striking distance of the 52-week high of $57.05, which serves as the next target. While that may dampen the dividend yield, the Michigan-based veteran may still find buyers even after exceeding that level.

The author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

This article is for information purposes only. The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice. It is important to perform your own research before making any investment and take independent advice from a registered investment advisor.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to accuracy, completeness, or the suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. The author will not be held responsible for information that is found at the end of links posted on this page.

Errors and omissions excepted.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

EUR/USD remains offered around 1.1380

The EUR/USD maintains its bearish tone on Tuesday, presently lingering around the 1.1380 zone amid the persistent buying pressure on the US Dollar. The improved sentiment in the Greenback comes amid rising US yields and mixed US data results from JOLTs and US Factory Orders.

GBP/USD treads water in the low-1.3500s

GBP/USD stays in the offered position on Tuesday and trades in the low-1.3500s, constantly following the strong rise in the Greenback. In the meanwhile, Cable's price movement is in line with Bailey's cautious tone and the mixed data from the US docket.

Gold holds on to higher ground around $3,350

Gold is falling from its multi-week high of over $3,400 achieved on Monday. It is currently losing further momentum and flirting with the $3,350 region per troy ounce on the back of a strong Greenback, higher yields and mixed US data.

Cardano Price Forecast: Sign of robust bullish reversal emerges despite dwindling DeFi TVL volume

Cardano rebounds to test resistance at $0.69 as technical indicator flashes a buy signal. A minor increase in the derivative Open Interest to $831 million suggests growing trader interest in ADA.

AUD/USD drifts lower amid cautious RBA, global trade uncertainty

AUD/USD retreats to 0.6460 as Aussie loses ground after Monday’s rally. RBA minutes reveal that the board debated a 50 bps interest rate cut but opted for a 25 bps cut to preserve predictability. Focus shifts to US JOLTS Job Openings due later in the day, Wednesday’s Australian GDP and Friday’s NFP for fresh cues.