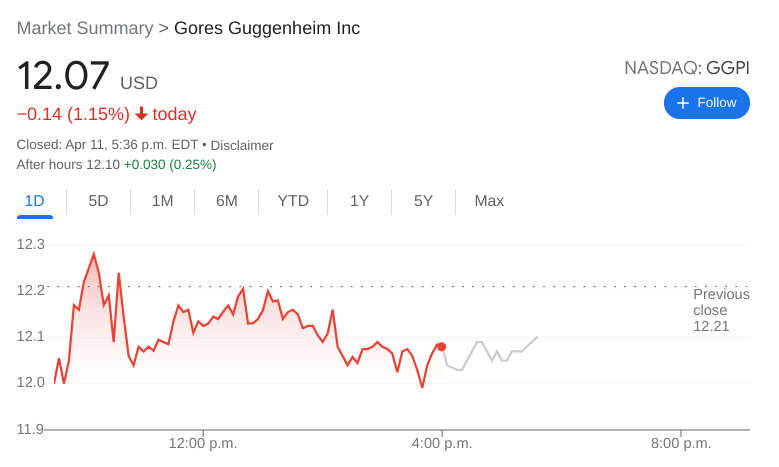

GGPI Stock News: Gores Guggenheim drops to start the week as EV sector tumbles

- NASDAQ:GGPI fell by 1.15% during Monday’s trading session.

- Polestar is looking to add to its momentum from the Hertz announcement.

- Tesla stock falls below $1,000 as Chinese sales stall.

NASDAQ:GGPI started the week off on the back foot as it succumbed to the downward selling pressure in the EV sector and the broader NASDAQ index. On Monday, shares of GGPI fell by 1.15% and closed the trading day at $12.07. US markets tumbled as the key ten-year treasury yields hit a three-year high, jumping above 2.79%. The Fed also warned of extraordinarily high inflation rates for the month of March, which also weighed on the minds of investors. The Dow Jones dropped by 413 basis points, the S&P 500 fell by 1.69%, and the NASDAQ led the way lower once again with a 2.18% loss during the session.

Stay up to speed with hot stocks' news!

As Polestar and GGPI continue to head towards their impending merger, the EV maker is looking to build on its current momentum. Last week, it was announced that Polestar’s vehicles would be added to the lineup of rental cars for Hertz. The company has been upgrading its fleet with electric vehicles, most notably from industry leader Tesla (NASDAQ:TSLA). The order for 65,000 Polestar vehicles is significant, and established the company as a respectable global brand in the EV sector alongside Tesla.

GGPI stock forecast

Speaking of Tesla, the global EV leader continued to see its stock fall on Monday, as the price has fallen back under the $1,000 price level. The recent lockdowns in Shanghai have shut down Tesla’s only GigaFactory in Asia, and has had a major impact on the company’s production numbers for February and March. With the lockdown in Shanghai still in effect, we could see a trailing decline in April as well, which could have another impact on Tesla’s stock.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Stocks Reporter

FXStreet