GGPI Stock Forecast: Gores Guggenheim extends declines during market collapse

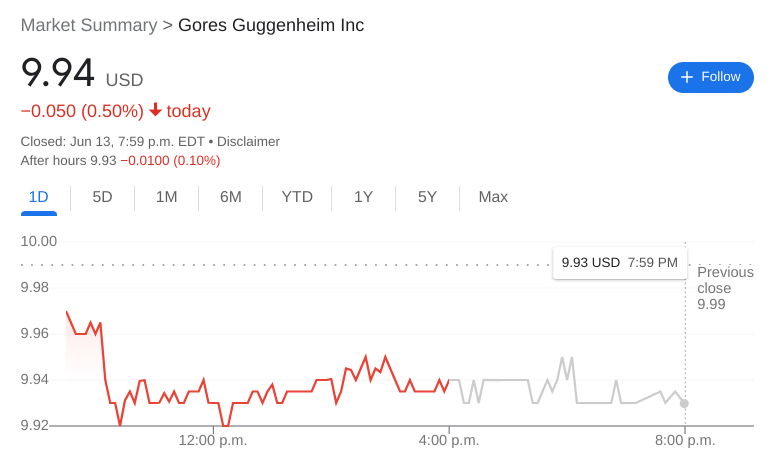

- NASDAQ:GGPI fell by 0.50% during Monday’s trading session.

- Former EV SPAC Electric Last Mile is about to declare bankruptcy.

- EV stocks tumble as Tesla sees no momentum from stock split announcement.

NASDAQ:GGPI started the week off on the back foot alongside the broader markets as the carnage from May’s CPI report carried over from last week. On Monday, shares of GGPI fell a further 0.50% and closed the trading session at $9.94. It was an ugly start to the week for stocks as all three major averages tumbled lower to start the week. The Dow Jones dropped by 876 basis points, the NASDAQ sank by 4.68%, and the S&P 500 officially re-entered bear market territory with a 3.88% loss during the session.

Stay up to speed with hot stocks' news!

Things just got grimmer for the EV SPAC sector, as Electric Last Mile Solutions (NASDAQ:ELMS) announced it would be liquidating the company and filing for bankruptcy. The announcement comes just a year after the company went public, and shares saw the bottom drop out with a 62% loss on Monday. ELMS is just one in a long line of EV SPAC companies that have underperformed. The list includes Lucid (NASDAQ:LCID), Nikola (NASDAQ:NKLA), and Lordstown Motors (NASDAQ:RIDE) as major disappointments since completing their SPAC mergers. Last Mile Solutions has been riddled with issues including the departure of the CEO in February as well as an ongoing SEC investigation into the company.

GGPI stock price

Despite announcing a 3 for 1 stock split after markets closed on Friday, shares of Tesla (NASDAQ:TSLA) tanked by a further 7.10% during Monday’s session. Other EV stocks on the decline included Lucid, Rivian (NASDAQ:RIVN), and Chinese EV maker Nio (NYSE:NIO) which saw a staggering 11.85% loss on Monday.

Like this article? Help us with some feedback by answering this survey:

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Stocks Reporter

FXStreet