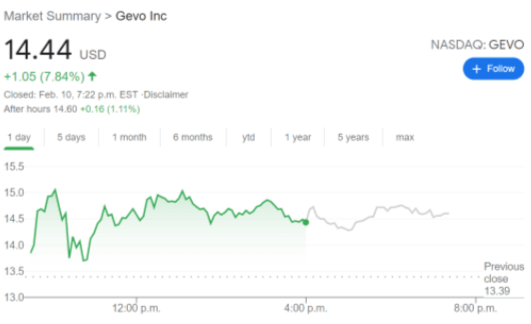

- NASDAQ:GEVO gains 7.84% despite a broader market selloff on Wednesday.

- GEVO has mostly recovered from its short-term correction following its public stock offering.

- GEVO offers a disruptive new clean energy technology that is in its infancy in terms of global usage.

NASDAQ:GEVO has had a stellar start to the new year as the stock has returned well over 200% to investors, even despite a sizable selloff after the company announced a public stock offering in January. On Wednesday, the Colorado-based clean energy firm jumped by 7.84% to close the trading session at $14.44 as the stock rapidly climbs back towards its 52-week high price of $15.24. Gevo is just the latest company to graduate from a penny stock to a near large-cap valuation as it now boasts a market cap that is above $2 billion.

Perhaps a lot of the upside has already been baked into Gevo at this juncture, as with many companies attempting to disrupt an industry, it is far from being a profitable enterprise. Additionally, some investors may be lumping Gevo’s status as a clean energy company within the red-hot electric vehicle sector. Gevo actually produces clean-burning fuel for vehicles, something that is not applicable to electric vehicles at all. Using its patented GIFT or Gevo’s Integrated Fermentation Technology, to produce isobutanol, a flexible component that can be used in anything from clean-burning fuels to plastic and rubber products.

GEVO stock prediction

It is always difficult to predict how a speculative stock will move, especially after it has already run up so far so fast. With the new Biden administration in the White House, it is anticipated that clean energy legislation could be introduced in the near future, which would further provide bullish momentum behind Gevo’s stock trajectory. This year could prove to be an interesting one as 2022 will see the opening of Gevo’s Net Zero 1 processing plant which should really drive up production.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

AUD/USD holds lower ground near 0.6350 after weak Aussie jobs data

AUD/USD is holding lower ground near 0.6350 in Asian trading on Thursday. The downbeat Australian jobs data fans RBA rate cut bets, maintaining the downward pressure on the pair. US-China trade tensions and US Dollar recovery act as a headwind for the pair.

USD/JPY stages a solid recovery toward 143.00 on US-Japan trade optimism

USD/JPY holds the impressive rebound from seven-month lows of 141.61, directed toward 143.00 in the Asian session on Thursday. The pair tracks the US Dollar rebound, fuelled by contrstructive trade talks between the US and Japan. A tepid risk recovery also aids the pair's upswing.

Gold price corrects from record highs of $3,358

Gold price retreats from a fresh all-time peak of $3,358 reached earlier in the Asian session on Thursday. Despite the pullback, tariff uncertainty, the escalating US-China trade war, global recession fears, and expectations of more aggressive Fed easing will likely cishion the Gold price downside.

Ethereum face value-accrual risks due to data availability roadmap

Ethereum declined 1%, trading just below $1,600 in the early Asian session on Thursday, as Binance Research's latest report suggests that the data availability roadmap has been hampering its value accrual.

Future-proofing portfolios: A playbook for tariff and recession risks

It does seem like we will be talking tariffs for a while. And if tariffs stay — in some shape or form — even after negotiations, we’ll likely be talking about recession too. Higher input costs, persistent inflation, and tighter monetary policy are already weighing on global growth.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.