General Electric (GE) continued rally after Elliott Wave triangle pattern

In this technical blog we’re going to take a quick look at the Elliott Wave charts of General Electric ( GE ), published in members area of the website. As our members know, GE has recently given sideways correction in wave (4) that has completed as Elliott Wave Triangle pattern. The stock made the rally after completing the sideways correction. In the further text we are going to explain the Elliott Wave Pattern and the forecast. Before we take a look at the real market example, let’s explain Elliott Wave Triangle Pattern

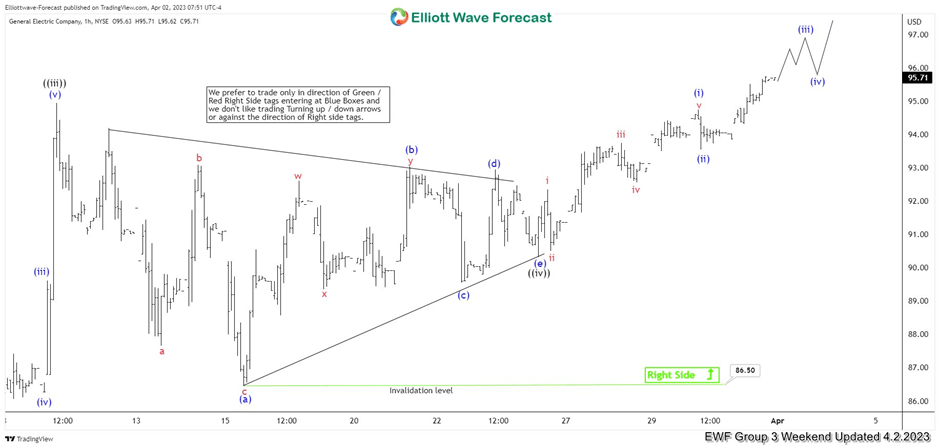

At the chart below we can see what Elliott Wave Triangle pattern looks like in real market.

GE H1 London update 03.26.2023

GE has given us sideways consolidation in wave (4) blue correction. We got sideways consolidation, the stock made contractions in both price and momentum. Now, we can count clear 5 waves within the pattern. Each one has corrective sequences. Consequently we believe that wave (4) could have ended as a Triangle Pattern. We are looking for further strength in the stock. Once we get break of (3) blue peak, the price will confirm that next leg up is in progress toward 96.18-98.2 area.

GE H1 London update 04.02.2023

The price break upper line of triangle. As a result we got continuation higher as expected. Once the stock broke previous peak at 94.9, we got confirmation that we should ideally see extension up toward 96.18-98.2 area at least.

Author

Elliott Wave Forecast Team

ElliottWave-Forecast.com