- NYSE:GE fell by 2.74% as global markets sold off in a massive way on Thursday.

- General Electric announces a new strategic partnership with Altair.

- The latest news brought about yet another analyst upgrade for General Electric.

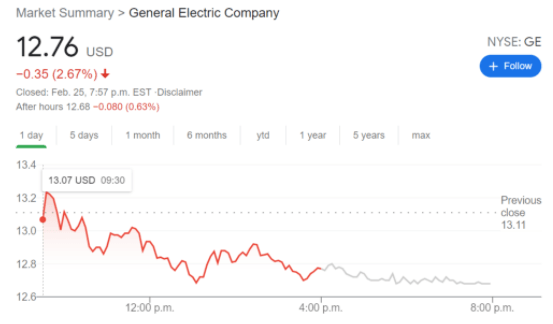

NYSE:GE fell alongside the broader markets on Thursday as the volatile February correction continued with the S&P 500 shedding 2.45%. A day after a solid gain for General Electric, the stock gave it all back, closing the trading session 2.74% lower at $12.76. Shares of the Boston-based industrial company are still up over 20% so far in 2021, as many industry analysts and investors remain bullish on its turnaround. Count Berkshire Hathaway Vice Chairman Charlie Munger amongst those who are optimistic about GE moving forward, as Munger stated that he believed CEO Larry Culp is the right man to fix the company.

Speaking of Culp, General Electric announced a new strategic partnership earlier this week with Altair (NASDAQ:ALTR), which included Altair purchasing the Flow Simulator software from GE Aviation. Altair will work to develop Flow Simulator using artificial intelligence and machine learning to further design new machines and systems. General Electric will also have access to Altair's library of software platforms, as the two aviation companies will look to continue to work together on further projects.

GE stock forecast

The announced partnership with Altair came with another Goldman Sachs upgrade to the price target from $14 to $15 and a reiterated ‘buy’ rating. The news comes on the heels of a much-publicized Pratt and Whitney engine failure which resulted in an emergency landing where luckily everyone involved was unharmed. Pratt and Whitney is a subsidiary of industry rival Raytheon (NYSE:RTX) which also saw its stock fall by 5.70% on Thursday.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

EUR/USD holds above 1.0400 in quiet trading

EUR/USD trades in positive territory above 1.0400 in the American session on Friday. The absence of fundamental drivers and thin trading conditions on the holiday-shortened week make it difficult for the pair to gather directional momentum.

GBP/USD recovers above 1.2550 following earlier decline

GBP/USD regains its traction and trades above 1.2550 after declining toward 1.2500 earlier in the day. Nevertheless, the cautious market mood limits the pair's upside as trading volumes remain low following the Christmas break.

Gold declines below $2,620, erases weekly gains

Gold edges lower in the second half of the day and trades below $2,620, looking to end the week marginally lower. Although the cautious market mood helps XAU/USD hold its ground, growing expectations for a less-dovish Fed policy outlook caps the pair's upside.

Bitcoin misses Santa rally even as on-chain metrics show signs of price recovery

Bitcoin (BTC) price hovers around $97,000 on Friday, erasing most of the gains from earlier this week, as the largest cryptocurrency missed the so-called Santa Claus rally, the increase in prices prior to and immediately following Christmas Day.

2025 outlook: What is next for developed economies and currencies?

As the door closes in 2024, and while the year feels like it has passed in the blink of an eye, a lot has happened. If I had to summarise it all in four words, it would be: ‘a year of surprises’.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.