- NYSE:GE trades around year-to-date lows despite promising developments have arisen for 2021.

- A new deal for GE Renewable Energy promises 187 wind turbines to be delivered.

- News of Boeing 737 Max also boosted the stock as GE Aviation is an engine supplier for the planes.

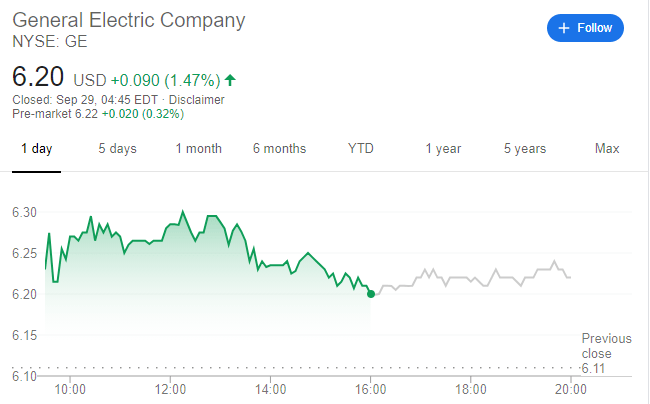

NYSE:GE has had a rough year as many of its main revenue streams have been affected in some way or another by the COVID-19 pandemic. Shares of the industrial company are down over 30% this year, lagging the S&P 500 by over 40%. The stock is now cruising near all-time lows, adding to its losses early on Tuesday session, losing around 1% in the first hour of trading. GE’s stock is now trading at levels below its 50-day and 200-day moving average so even with all of these new deals on the horizon, the needle has barely moved in the investor's eyes.

GE Renewable Energy has officially won its wind turbine deal from Invenergy as the alternative energy arm of General Electric will deliver 187 wind turbines around the United States. GE has also secured numerous other contracts with Morocco, Austria, and India, in its efforts to provide clean and alternative energy power to countries all over the world. Finally, General Electric’s Aviation wing also received a boost as Boeing (NYSE:BA) announced that its troublesome 737 MAX plane was ready to be test flown again by the FAA. GE builds the engines for these planes and if they once again cleared for flight, demand should start to build again.

GE stock forecast

GE’s stock has not really budged but at this point, bargain investors could do worse than starting a position at the ground floor. With the economy slowly opening back up, General Electric’s main revenue streams should follow suit. The renewable energy and aviation news are positives for GE, something the company has not had much of in 2020, so undoubtedly investors are hoping 2021 will be a much better year for the stock.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

EUR/USD remains near 1.0400 post-US PCE

The US Dollar’s inconclusive price action allows some recovery in EUR/USD, keeping the pair around the 1.0400 region following the release of PCE inflation data for the month of January.

Gold slumps to fresh multi-week lows below $2,840

Gold stays under bearish pressure and trades at its lowest level in three weeks below $2,840. The uncertainty surrounding the Trump administration's trade policy and month-end flows seem to be weighing on XAU/USD, which remains on track to snap an eight-week winning streak.

GBP/USD clings to gains just above 1.2600 after PCE data

GBP/USD remains positively oriented in the 1.2600 neighbourhood as the Greenback is navigating a vacillating range following the PCE inflation release.

The week ahead – US Payrolls, ECB rate meeting, ITV results – W/c 3rd March

Having seen the Federal Reserve keep rates on hold last month the US labour market continues to show remarkable resilience, despite seeing a slowdown in hiring in January, after a blow out December number.

Weekly focus – Tariff fears are back on the agenda

While the timing of the EU measures remains still uncertain, Trump surprised markets on Thursday by signalling that the 25% tariffs on Canada and Mexico will be enacted when the one-month delay runs out next Tuesday.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.