GE Stock Price Forecast: General Electric Company falls as CEO faces backlash over bonus

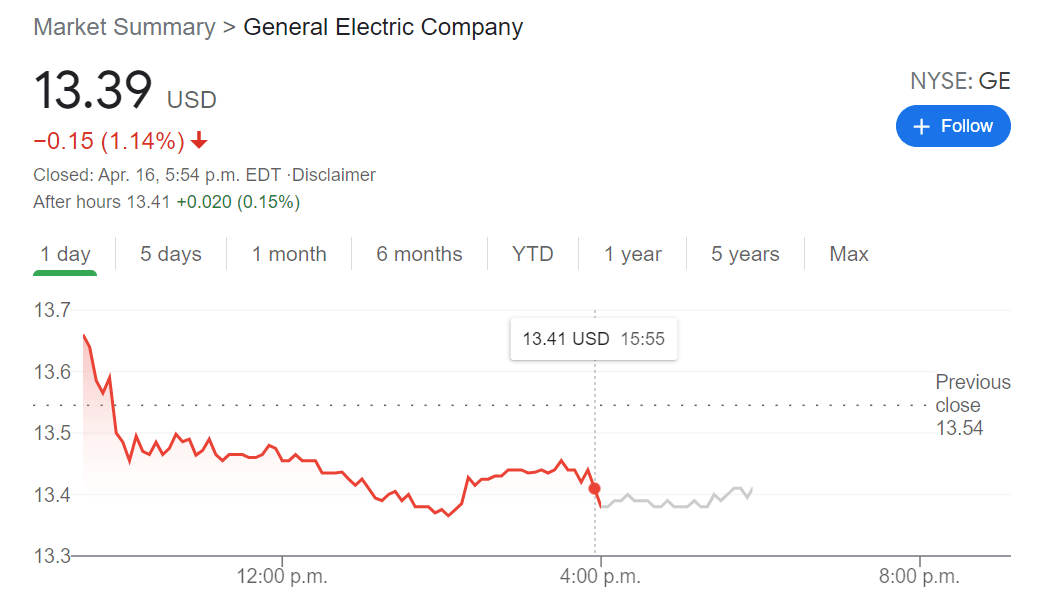

- NYSE:GE dipped by 1.18% on Friday, lagging the broader markets which finished positive for the week.

- General Electric CEO Larry Culp is in some hot water with shareholders over a big payday.

- Culp does now have incentive to raise the price of GE’s stock, as it remains a reopening play to investors.

NYSE:GE has experienced more volatility than a century-old company with a $117 billion market cap is used to having and shareholders may be getting impatient. Friday saw General Electric fall by 1.18% to close the final trading session of the week at $13.39. This concluded another choppy week for the industrial conglomerate, although the stock remains above its 50-day and 200-day moving averages, which shows that General Electric is exhibiting higher highs and higher lows.

Stay up to speed with hot stocks' news!

A recent announcement by General Electric about the restructuring of CEO Larry Culp’s pay has shareholders and shareholder advisors up in arms. Nobody is denying that Culp has done an excellent job of remodelling the century old company into a wonderful turnaround story, after the stock remained stagnant for years. But when Culp took over, there was a clause in his contract for a $232 million bonus if the stock price were to climb above $31 per share. Now, citing issues related to the COVID-19 pandemic, General Electric has lowered that share price to $16.68 for a total of 30 consecutive days.

GE Price prediction

Naturally, shareholders are upset as a lower price target for Culp’s bonus theoretically means he needs to achieve less for the company in order to meet the lower threshold. While General Electric remains a popular play on the reopening of the economy, especially considering its aviation and healthcare businesses, investors may have some pause now about how dedicated Culp is to the long-term health of the stock.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Stocks Reporter

FXStreet