GBPUSD Price Analysis: Bears attack 1.1760 resistance-turned-support

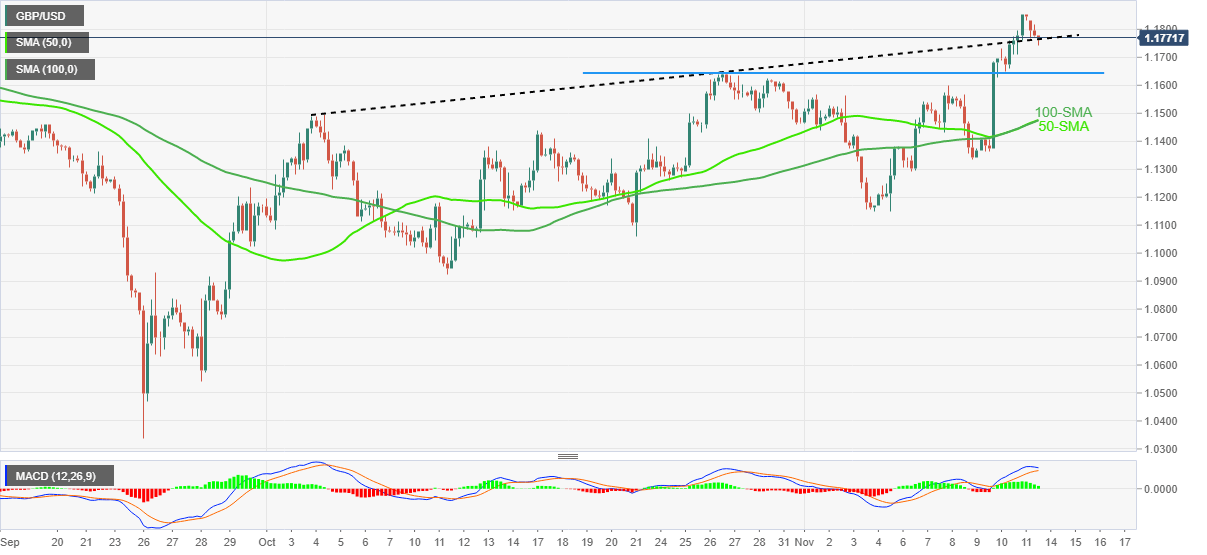

- GBPUSD takes offers to poke previous resistance line from early October.

- Impending bear cross on MACD suggests further downside.

- Fortnight-old horizontal support, the convergence of the key SMAs challenge bears.

- Buyers need validation from the late August highs.

GBPUSD extends the week-start losses as sellers jostle with the one-month-old previous resistance around 1.1760 heading into Monday’s London open. In doing so, the Cable pair prints the first daily loss in three while reversing from a three-month high.

Given the looming bearish signals from the MACD, as well as the Cable pair’s failure to stay beyond 1.1800, the sellers are likely to break the resistance-turned-support.

However, a 13-day-old horizontal support near 1.1650 and a convergence of the 50-SMA and the 100-SMA, close to 1.1470, could challenge the GBPUSD bears afterward.

In a case where the Cable pair breaks the 1.1470 key support, the odds of witnessing a south-run towards the monthly low near 1.1150 can’t be ruled out.

Meanwhile, recovery moves need to refresh the monthly peak, currently surrounding 1.1855, to convince the GBPUSD buyers.

Even so, tops marked during late August, around 1.1900 threshold, could act as an additional upside filter to challenge the bulls.

Overall, GBPUSD is likely to witness a short-term downside but the room to the south is limited unless the pair breaks the 1.1470 support confluence.

GBPUSD: Four-hour chart

Trend: Limited downside expected

Author

Anil Panchal

FXStreet

Anil Panchal has nearly 15 years of experience in tracking financial markets. With a keen interest in macroeconomics, Anil aptly tracks global news/updates and stays well-informed about the global financial moves and their implications.