- GBP/JPY experiences gains for the second consecutive day, peaking at a weekly high of 182.95.

- Chikou Span is on the verge of a bullish signal, while flat Tenkan-Sen and Kijun-Sen lines hint at potential subdued movement.

- The 183.00 mark remains pivotal; a breakthrough could lead to testing the YTD high of 184.01.

- Downside risks include supports at 181.37 (August 8 low) and the Ichimoku Cloud top around 180.50/60.

GBP/JPY advanced for the second consecutive day on Tuesday, registering gains of 0.36%, reaching a fresh weekly high of 182.95. Nevertheless, toward the close of the day, the GBP/JPY dipped, and as the Asian session began, the GBP/JPY exchanges hands at 182.65, down 0.03%.

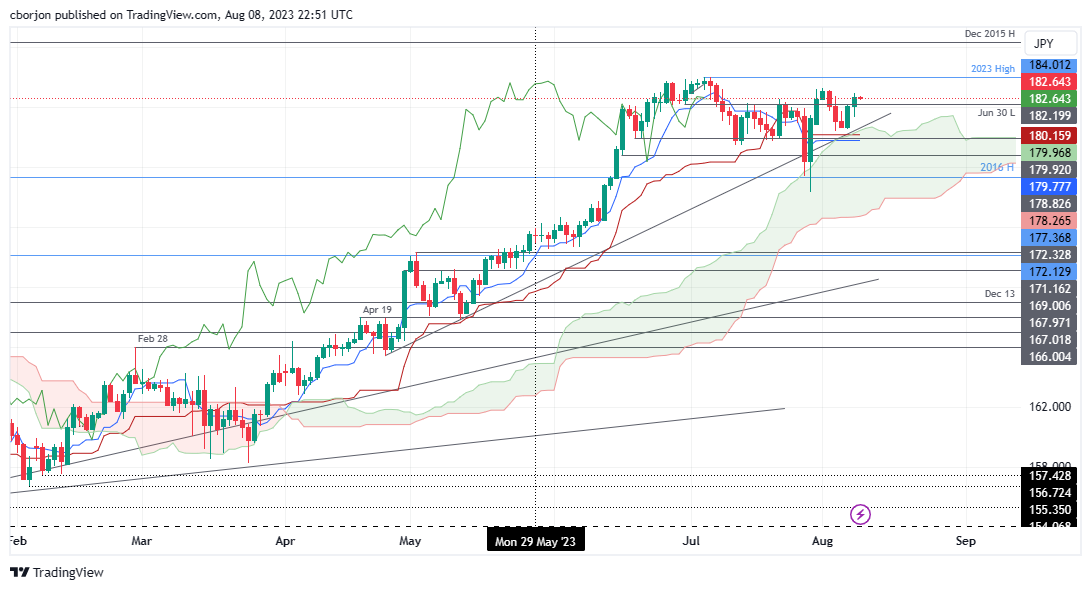

GBP/JPY Price Analysis: Technical outlook

The GBP/JPY remains neutral to upward biased, poised to re-test the year-to-date (YTD) high of 184.01, even though it remains below 183.00. It should be said the Chikou Span is about to give a bullish signal, about to break above price action; however, the Tenkan-Sen remains below the Kijun-Sen, with both lines remaining flat, suggesting the GBP/JPY could remain subdued in the near term.

If GBP/JPY breaks to a new weekly high, the first resistance would be the 183.00 figure. A breach of the latter would expose the August 1 high of 183.24, followed by the YTD high of 184.01

Conversely, if GBP/JPY remains below 183.00, that could open the door for a pullback. First support will emerge at the August 8 daily low of 181.37. The following support would be the top of the Ichimoku Cloud (Kumo) at around 180.50/60, followed by the Kijun-Sen and Tenkan-Sen lines, each at around 180.16 and 179.77, respectively.

GBP/JPY Price Action – Daily chart

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

Australian Dollar appreciates despite stronger US Dollar, PMI awaited

The Australian Dollar (AUD) continues to strengthen against the US Dollar (USD) following the release of mixed Judo Bank Purchasing Managers' Index (PMI) data from Australia on Friday. The AUD also benefits from a hawkish outlook by the Reserve Bank of Australia (RBA) regarding future interest rate decisions.

Japanese Yen remains on the front foot against USD, bulls seem non-committed

The Japanese Yen (JPY) attracts some buyers for the second straight day on Friday amid reviving bets for more interest rate hikes by the Bank of Japan (BoJ), though it lacks any follow-through.

Gold advances to near two-week high, eyes $2,700 on geopolitical tensions

Gold price (XAU/USD) prolongs its uptrend for the fifth consecutive day on Friday and climbs to a nearly two-week top, around the $2,690-2,691 area during the Asian session. Intensifying Russia-Ukraine tensions force investors to take refuge in traditional safe-haven assets and turn out to be a key factor underpinning the precious metal.

Ethereum Price Forecast: ETH open interest surge to all-time high after recent price rally

Ethereum (ETH) is trading near $3,350, experiencing an 10% increase on Thursday. This price surge is attributed to strong bullish sentiment among derivatives traders, driving its open interest above $20 billion for the first time.

A new horizon: The economic outlook in a new leadership and policy era

The economic aftershocks of the COVID pandemic, which have dominated the economic landscape over the past few years, are steadily dissipating. These pandemic-induced economic effects are set to be largely supplanted by economic policy changes that are on the horizon in the United States.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.