- GBP/USD bulls catch a breather amid two-day winning streak.

- Risk-on mood triggered US dollar pullback from multi-day top.

- Beijing’s sanctions, EU-UK tussle over vaccine and Brexit gain a little attention.

- UK Retail Sales can help extend the recovery, US Core PCE also in focus.

Following its run-up to 1.3765 during the early Asian session, GBP/USD wavers around 1.3750, easing to 1.3760 by the press time, while heading into the London open on Friday. Even so, the cable prints 0.17% intraday gains while extending the previous day’s run-up.

Although vaccine optimism and upbeat expectations from the UK Retail Sales seem to give background music to the latest run-up, it’s the US dollar’s pullback that plays a major role. The US dollar index (DXY) steps back from early November tops as market sentiment improves.

Behind USD moves, hopes of further stimulus and President Joe Biden’s push for faster vaccinations, as well as upbeat US data, could be cited as major catalysts. Also positive could be comments from the Fed policymakers who keep rejecting reflation fears and convince markets about extended easy money policies.

On the other hand, the European Union (EU) eyes “win-win” situations on the AstraZeneca covid vaccine when discussing terms with the UK. However, Brussels is less friendly on the fisheries to Britain and also warns over further economic hardships to exert pressure. Further, the Northern Ireland (NI) conditions keep worsening as the bloc recently renewed terms for loans to the UK-friendly region’s businesses. It’s worth mentioning that the UK-China tussle brews as Beijing sanctions British institutions, lawyers and diplomats over Xinjiang issues, per The Guardian.

However, British exports of meat and fishing products suggest a recovery in February, per Reuters quoting the UK diplomat, whereas the Confederation of British Industry (CBI) upbeat Retail Sales in March even as February couldn’t please the bulls. The same is the case with the UK’s car production that dropped 14% in February and joined the recently mixed British fundamentals.

Against this backdrop, S&P 500 Futures rise 0.30% whereas US 10-year Treasury yields add 1.8 basis points to stay above 1.60%. Further, the US dollar index (DXY) eases from the fresh multi-day high marked the previous day.

Looking forward, UK’s Retail Sales for February is expected to keep the market optimism on the desk but fears of the US dollar bull’s return can’t be ruled out. “We look for retail sales to bounce a bit from the -8.2% m/m decline that we saw in January, which ended up being worse than the most pessimistic economist forecast. For February, we look for a 3% m/m gain (market forecast 2.1%), as mobility picked up a bit and it appears that some businesses began reopening after a January hibernation. This, however, would still leave the level of retail sales about 9% below its recent October 2020 peak,” said TD Securities.

Read: The February Grab-Bag Preview: Personal Income, Spending, Core PCE Prices and GDP

Technical analysis

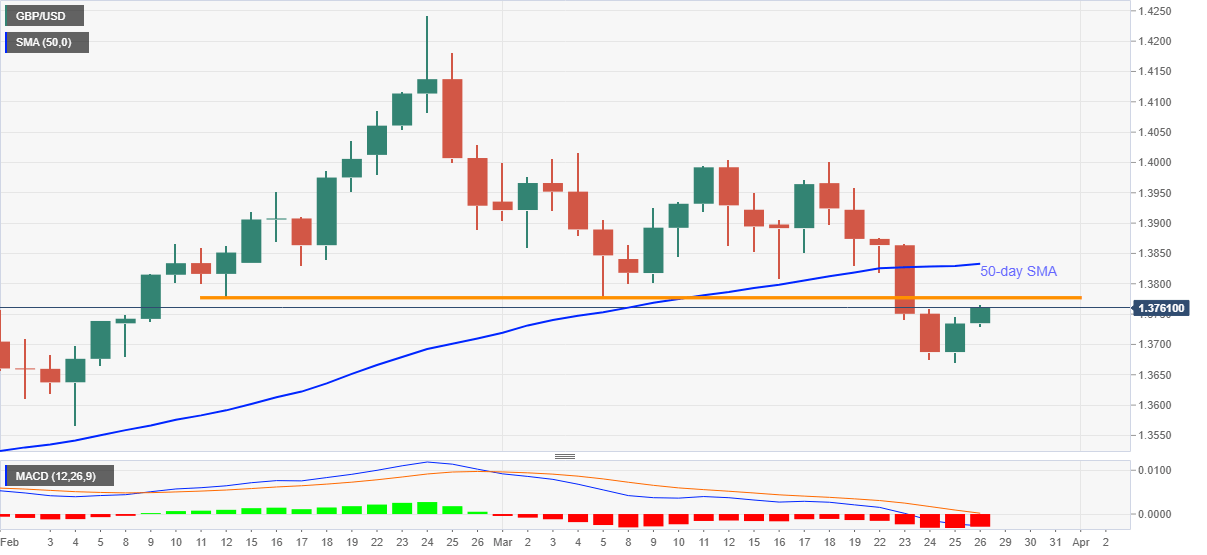

A horizontal area comprising lows marked since February 12, around 1.3775-80, guards the cable’s immediate upside ahead of 50-day SMA near 1.3830. Meanwhile, sellers will wait for a fresh monthly low under 1.3670 for re-entry.

Trend: Pullback expected

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

EUR/USD under pressure below 1.0600 as mood sours

EUR/USD stays under selling pressure and trades below 1.0600 on Tuesday. The US Dollar finds fresh haven demand on escalating geopolitical tensions amid reports that Kremlin is threatening a nuclear response on Ukraine's use of Western missiles against Russia.

GBP/USD stays below 1.2650 after BoE Governor Bailey testimony

GBP/USD trades in the red below 1.2650 on Tuesday. Although BoE Governor Bailey said a gradual approach to removing policy restraint will help them observe risks to the inflation outlook, the sour mood doesn't allow the pair to gain traction.

Gold extends recovery toward $2,640 as geopolitical risks intensify

Gold price builds on Monday's gains and rises toward $2,640 as risk-aversion grips markets amid intensifying geopolitical tensions between Russia and Ukraine. Meanwhile, the 10-year US Treasury bond yield is down more than 1% on the day, further supporting XAU/USD.

Canada CPI expected to rise 1.9% in October, bolstering BoC to further ease policy

The Canadian Consumer Price Index is seen ticking higher by 1.9% YoY in October. The Bank of Canada has reduced its policy rate by 125 basis points so far this year. The Canadian Dollar navigates multi-year lows against its American counterpart.

The week ahead: Powell stumps the US stock rally as Bitcoin surges, as we wait Nvidia earnings, UK CPI

The mood music is shifting for the Trump trade. Stocks fell sharply at the end of last week, led by big tech. The S&P 500 was down by more than 2% last week, its weakest performance in 2 months, while the Nasdaq was lower by 3%. The market has now given back half of the post-Trump election win gains.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.