GBP/USD withers into a fresh five-week low

- GBP/USD slid nine-tenths of one percent on Tuesday.

- Pound Sterling continues to soften on social unrest, BoE cuts.

- Markets have pivoted back into Fed rate cut bets.

GBP/USD backslid nearly a full percent on Tuesday as the Pound Sterling continues to deflate against the broader FX market. The US Dollar found a soft patch as markets pivot back into a risk-on stance fueled by ongoing hopes for a September rate cut from the Federal Reserve (Fed), but a rapidly-depreciating GBP sent Cable into fresh five-week lows just south of 1.2700.

Forex Today: Markets’ attention remains on data and rate cut bets

The economic calendar is notably thin for both currencies on Wednesday, leaving markets to whittle away the hours until something structurally changes.

The Pound Sterling is seeing a steady decline after the BoE trimmed interest rates to 5.0% from 5.25% recently, sparking outflows from broad-market positioning that was previously heavily-weighted in favor of the GBP. With social unrest throughout the UK over the weekend and into the new week, investors are leery about the economic outlook for the kingdom, investors are paring back bullish bets on the Pound Sterling and waiting for signs of stabilization and a better read on how many more time the BoE will cut in 2024.

Rate markets have fully priced in a September rate cut, and according to the CME’s FedWatch Tool, investors see two-to-one odds of a double cut for 50 basis points when the Federal Open Market Committee (FOMC) delivers its rate call on September 18. At the current cut, rate markets see zero chance of the Fed holding rates steady anymore in 2024, with a total of four quarter-point cuts expected by the end of the year.

GBP/USD technical outlook

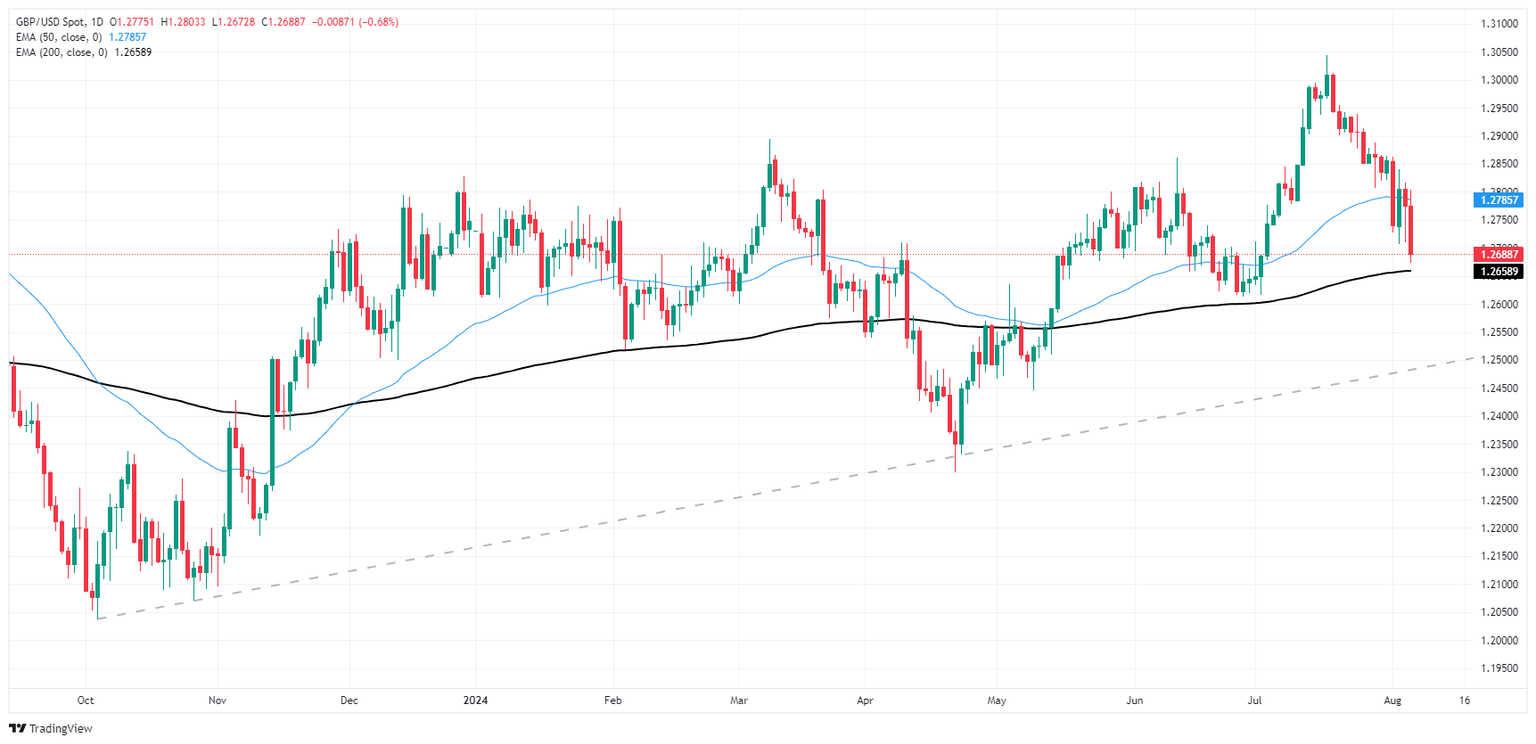

Tuesday’s -0.9% drop on Cable has dragged the pair within touch range of the 200-day Exponential Moving Average (EMA) at 1.2646 for the first time since vaulting over the long-run moving average in May. GBP/USD has shed nearly 3% since declining from a 12-month peak of 1.3045 in July.

The few remaining Pound Sterling bulls will be hoping for a technical recovery off the back of a rising pattern of higher lows on daily candlesticks, but an extended drop into 1.2600 will set GBP/USD price action in a path of steady declines to 2024’s lows of 1.2300.

GBP/USD daily chart

Author

Joshua Gibson

FXStreet

Joshua joins the FXStreet team as an Economics and Finance double major from Vancouver Island University with twelve years' experience as an independent trader focusing on technical analysis.