- The GBP/USD collapsed over the last twenty-four hours, tumbling back into the 1.2800 region and early Friday trading sees the Cable trapped near Thursday's closing prices, and bears are set to step back in and renew downside pressure on the pair.

- GBP/USD Forecast: Sterling off October lows as 1.2790 target remains intact in a Brexit stalemate

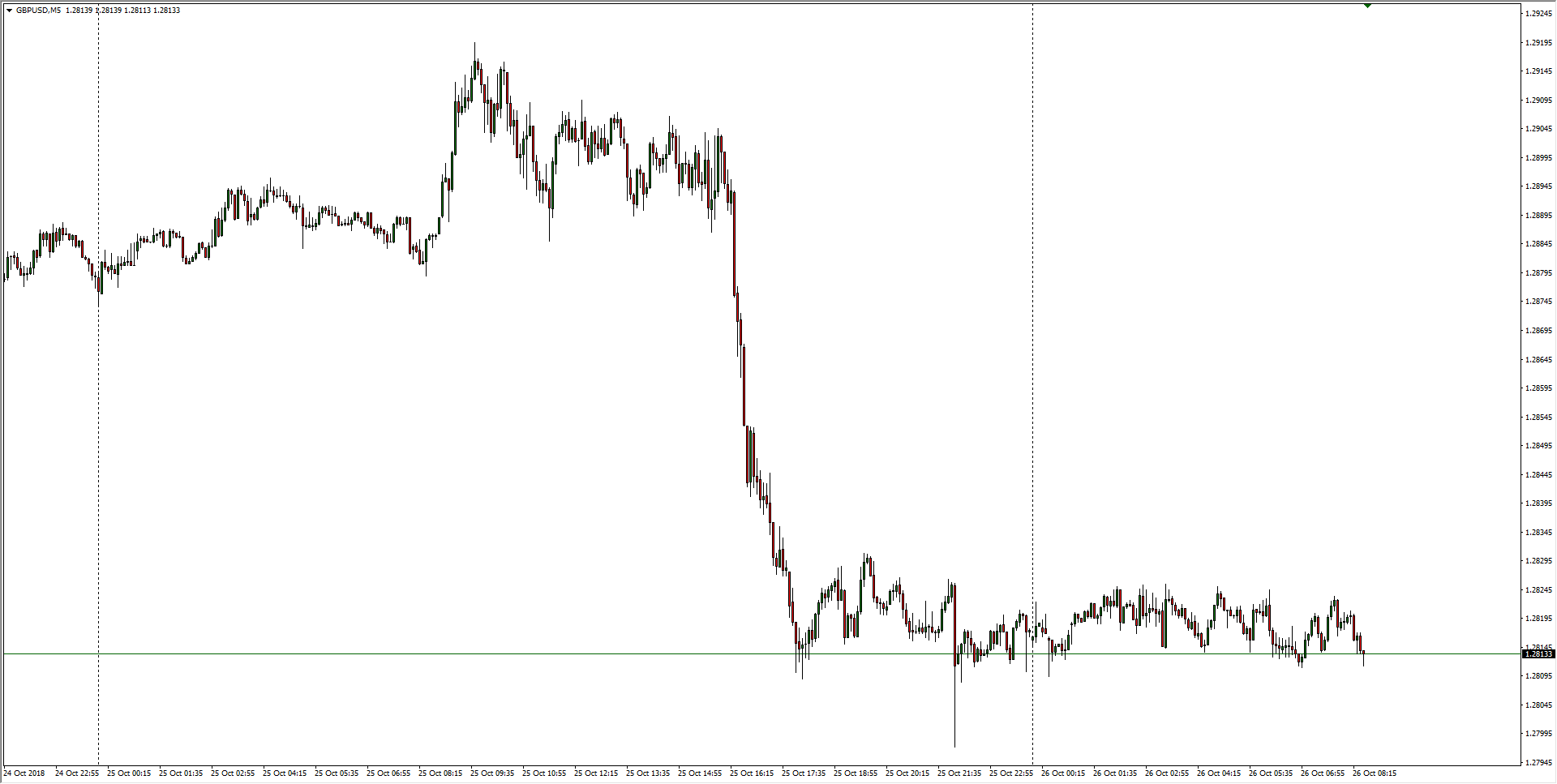

GBP/USD, M5

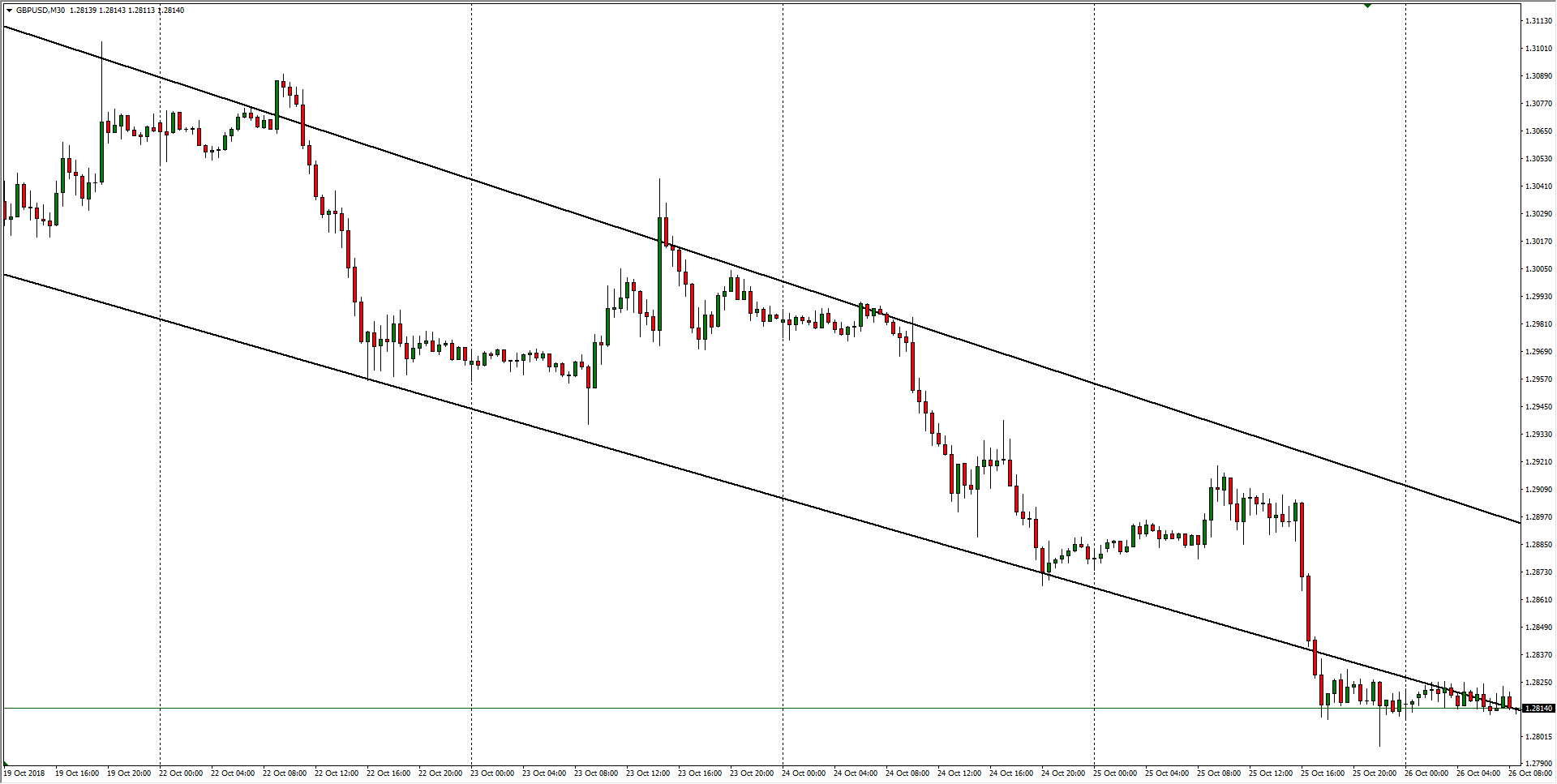

The past week showcases the Cable's downside trend, with the pair testing to the bottom end of a firm bearish channel as sellers routinely step in and force the Sterling lower as Brexit headlines continue to disappoint markets.

GBP/USD, M30

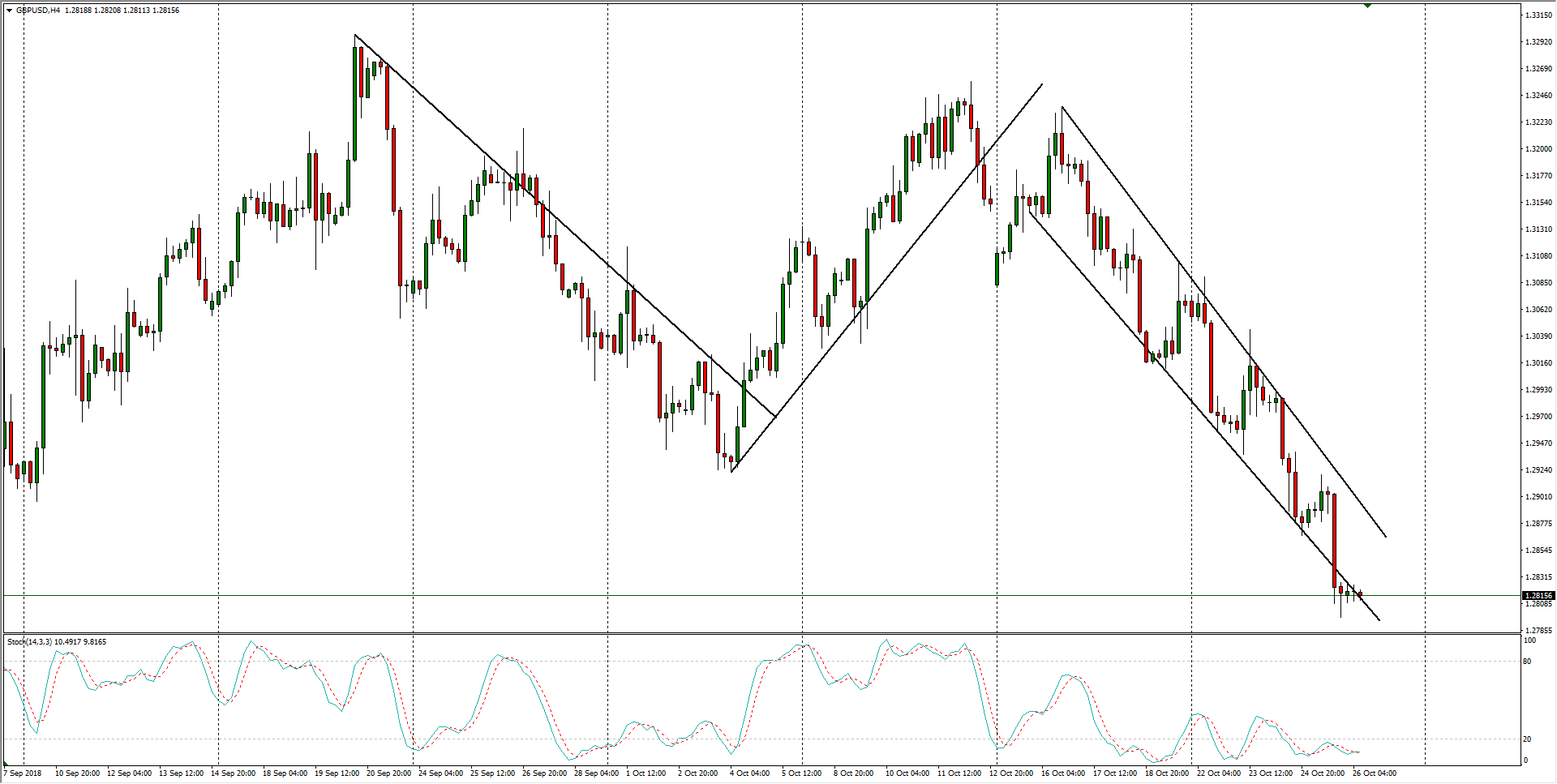

The past six weeks see the Cable struggling to get upcycles into higher territory, with early October's bullish pullback stalling out at familiar levels just above the 1.3200 major handle, and bearish moves are becoming increasingly more aggressive as the Pound moves into fresh lows.

GBP/USD, H4

GBP/USD

Overview:

Last Price: 1.2814

Daily change: -2.0 pips

Daily change: -0.0156%

Daily Open: 1.2816

Trends:

Daily SMA20: 1.3057

Daily SMA50: 1.302

Daily SMA100: 1.3072

Daily SMA200: 1.3464

Levels:

Daily High: 1.292

Daily Low: 1.2797

Weekly High: 1.3238

Weekly Low: 1.3011

Monthly High: 1.33

Monthly Low: 1.2786

Daily Fibonacci 38.2%: 1.2844

Daily Fibonacci 61.8%: 1.2873

Daily Pivot Point S1: 1.2769

Daily Pivot Point S2: 1.2722

Daily Pivot Point S3: 1.2646

Daily Pivot Point R1: 1.2892

Daily Pivot Point R2: 1.2968

Daily Pivot Point R3: 1.3015

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

EUR/USD clings to daily gains near 1.0300 after US PMI data

EUR/USD trades in positive territory at around 1.0300 on Friday. The pair breathes a sigh of relief as the US Dollar rally stalls, even as markets stay cautious amid geopolitical risks and Trump's tariff plans. US ISM PMI improved to 49.3 in December, beating expectations.

GBP/USD holds around 1.2400 as the mood improves

GBP/USD preserves its recovery momentum and trades around 1.2400 in the American session on Friday. A broad pullback in the US Dollar allows the pair to find some respite after losing over 1% on Thursday. A better mood limits US Dollar gains.

Gold retreats below $2,650 in quiet end to the week

Gold shed some ground on Friday after rising more than 1% on Thursday. The benchmark 10-year US Treasury bond yield trimmed pre-opening losses and stands at around 4.57%, undermining demand for the bright metal. Market players await next week's first-tier data.

Stellar bulls aim for double-digit rally ahead

Stellar extends its gains, trading above $0.45 on Friday after rallying more than 32% this week. On-chain data indicates further rally as XLM’s Open Interest and Total Value Locked rise. Additionally, the technical outlook suggests a rally continuation projection of further 40% gains.

Week ahead – US NFP to test the markets, Eurozone CPI data also in focus

King Dollar flexes its muscles ahead of Friday’s NFP. Eurozone flash CPI numbers awaited as euro bleeds. Canada’s jobs data to impact bets of a January BoC cut. Australia’s CPI and Japan’s wages also on tap.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.