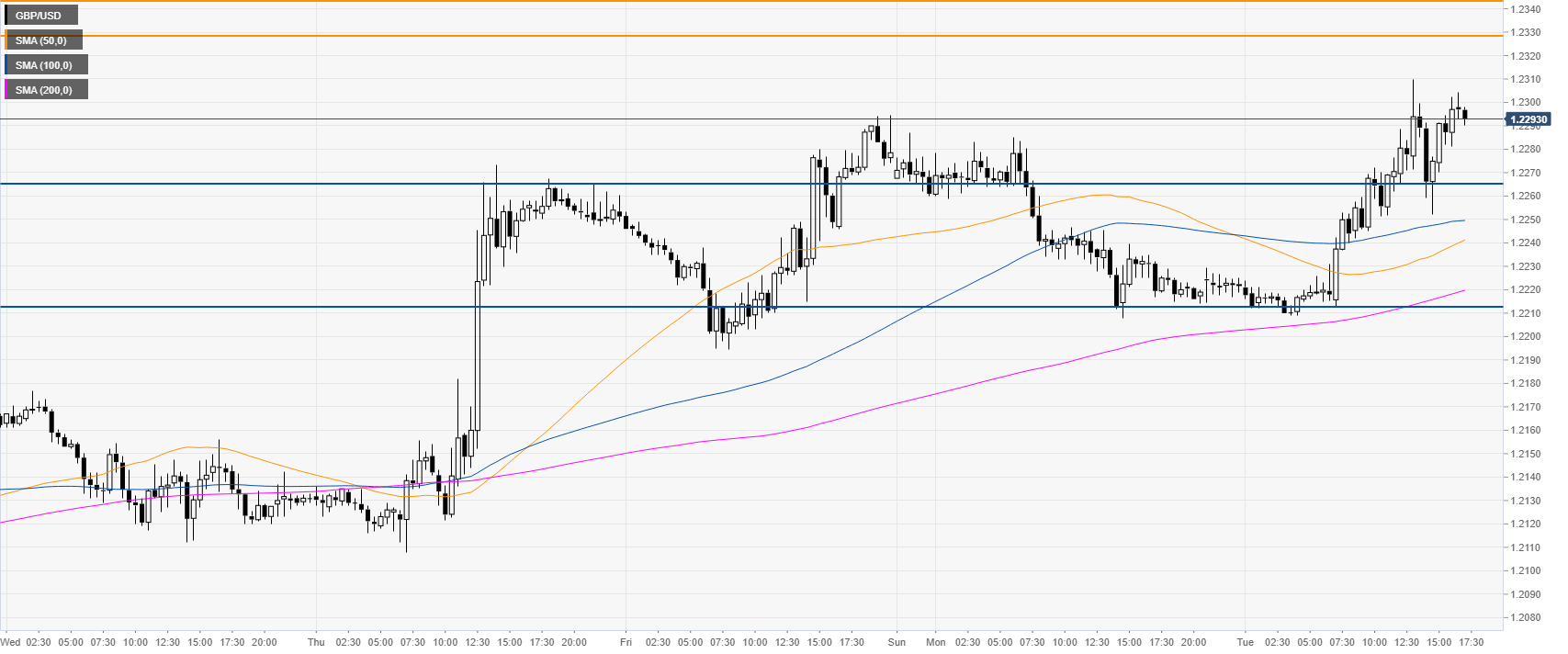

- GBP/USD is trading at its highest in August, reaching 1.2310 on an intraday basis.

- The levels to beat for bulls are seen at 1.2329, followed by 1.2361 resistances.

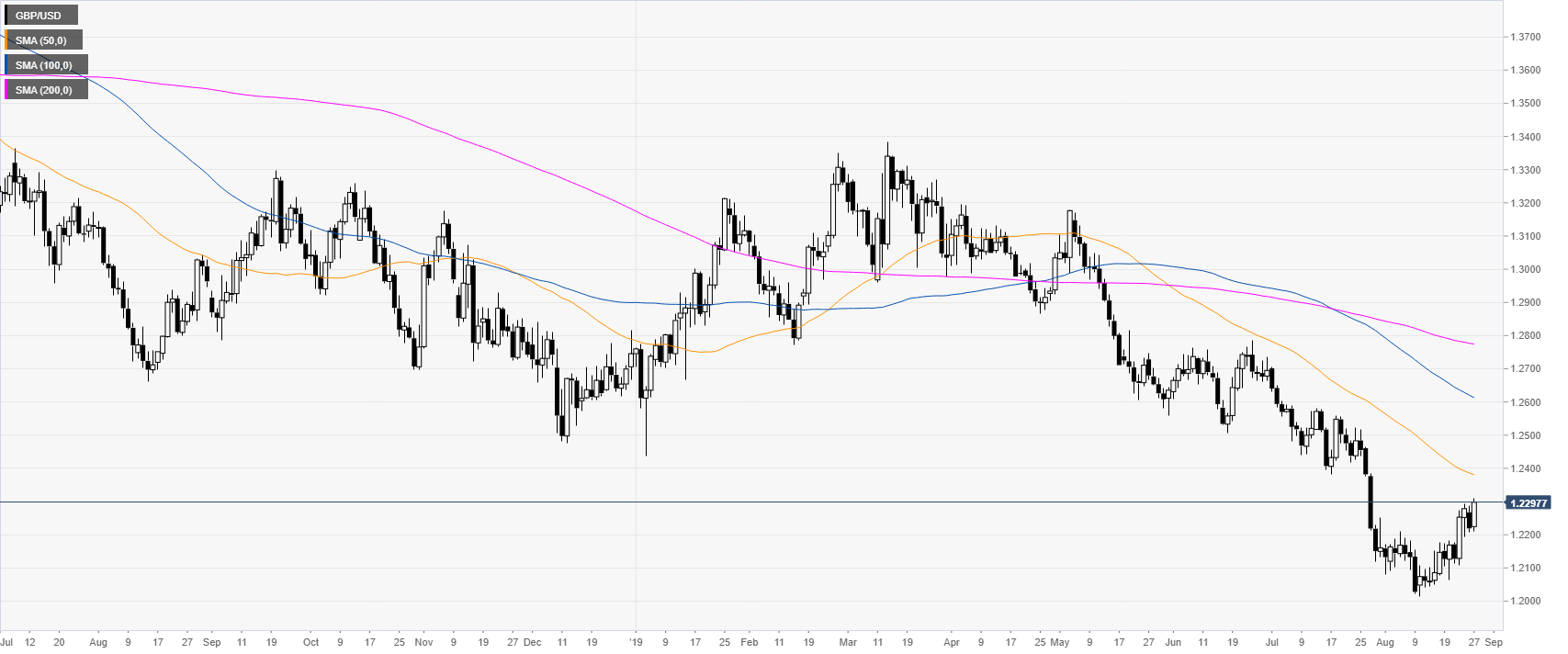

GBP/USD daily chart

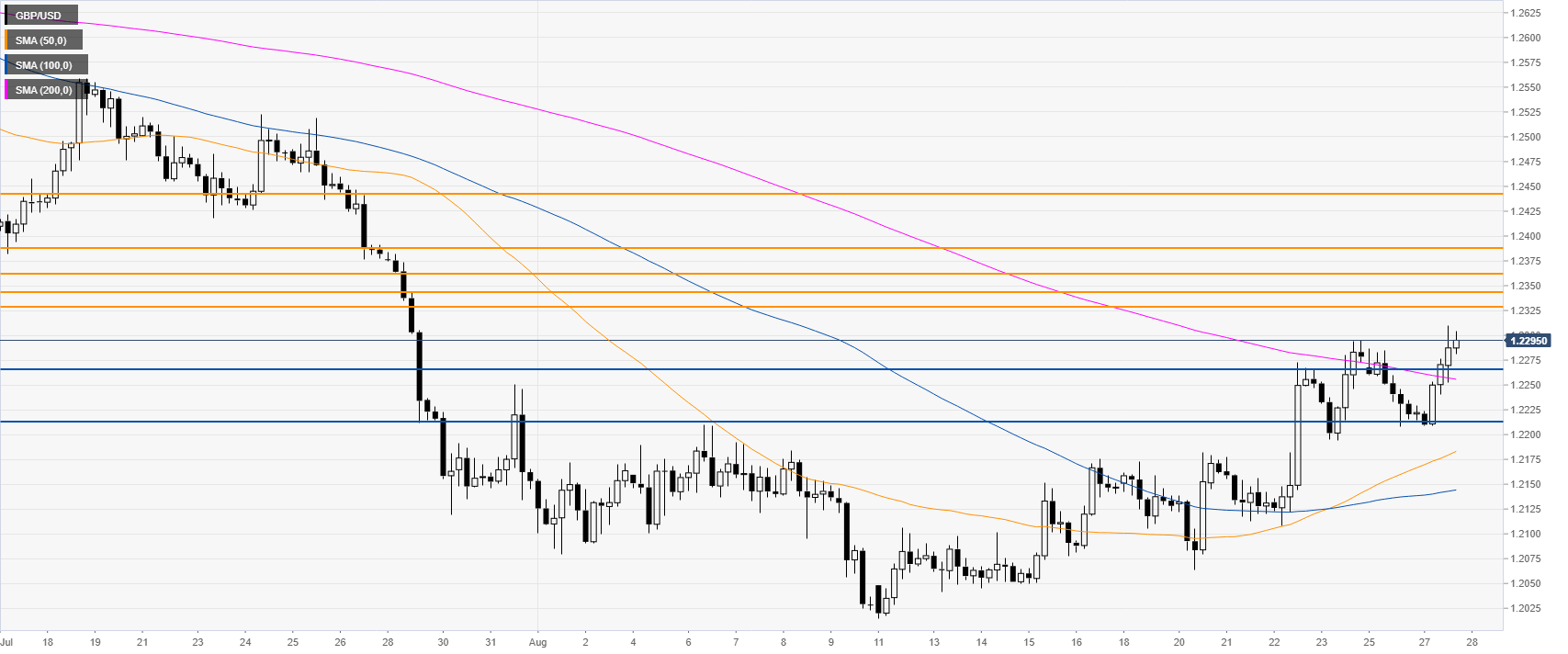

GBP/USD 4-hour chart

GBP/USD 30-minute chart

Additional key levels

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer. Opinions expressed at FXstreet.com are those of the individual authors and do not necessarily represent the opinion of FXstreet.com or its management. Risk Disclosure: Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Recommended content

Editors’ Picks

AUD/USD strengthens as Trump confirms talks with China

The Australian Dollar extends its rally, with the AUD/USD gaining ground as the US Dollar weakens amid growing concerns over the economic impact of tariffs on the United States. Market participants are closely monitoring developments in US trade negotiations, although trading activity is expected to be subdued due to the Good Friday holiday.

USD/JPY weakens below 142.50 as Japanese CPI came in at 3.6% YoY in March

The USD/JPY pair softens to near 142.25 in a thin trading volume session on Friday. The US Dollar edges lower against the Japanese Yen amid concerns over the economic impact of tariffs.

Gold price loses momentum on profit-taking

Gold price holds steady on Friday after retreating from an all-time high of $3,358 as investors book profits during a long Easter weekend. Significant uncertainty over US President Donald Trump's tariffs on imports into the US and ongoing geopolitical tensions could underpin the Gold price.

Ethereum ETFs total net assets plummet over 60%; Justin Sun says he won't sell ETH

Ethereum traded just below $1,600 on Thursday following a 60% plunge in the total net assets of US spot Ether ETFs. Meanwhile, Tron founder Justin Sun said that he won't sell his ETH holdings despite the sustained downtrend in the top altcoin’s price.

Future-proofing portfolios: A playbook for tariff and recession risks

It does seem like we will be talking tariffs for a while. And if tariffs stay — in some shape or form — even after negotiations, we’ll likely be talking about recession too. Higher input costs, persistent inflation, and tighter monetary policy are already weighing on global growth.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.