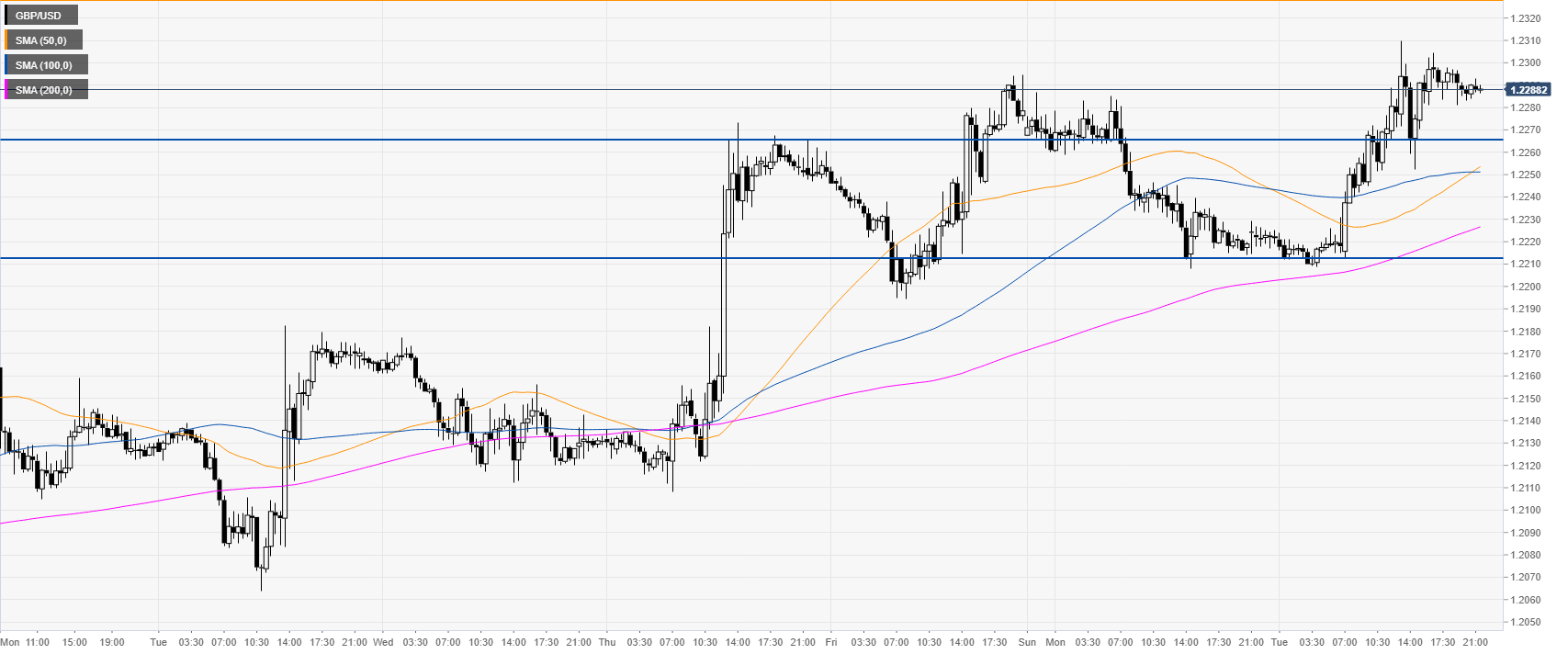

- GBP/USD is trading near its highest point in August, hitting 1.2310 on an intraday basis.

- The levels to beat for bulls are seen at 1.2329, followed by 1.2361 resistances.

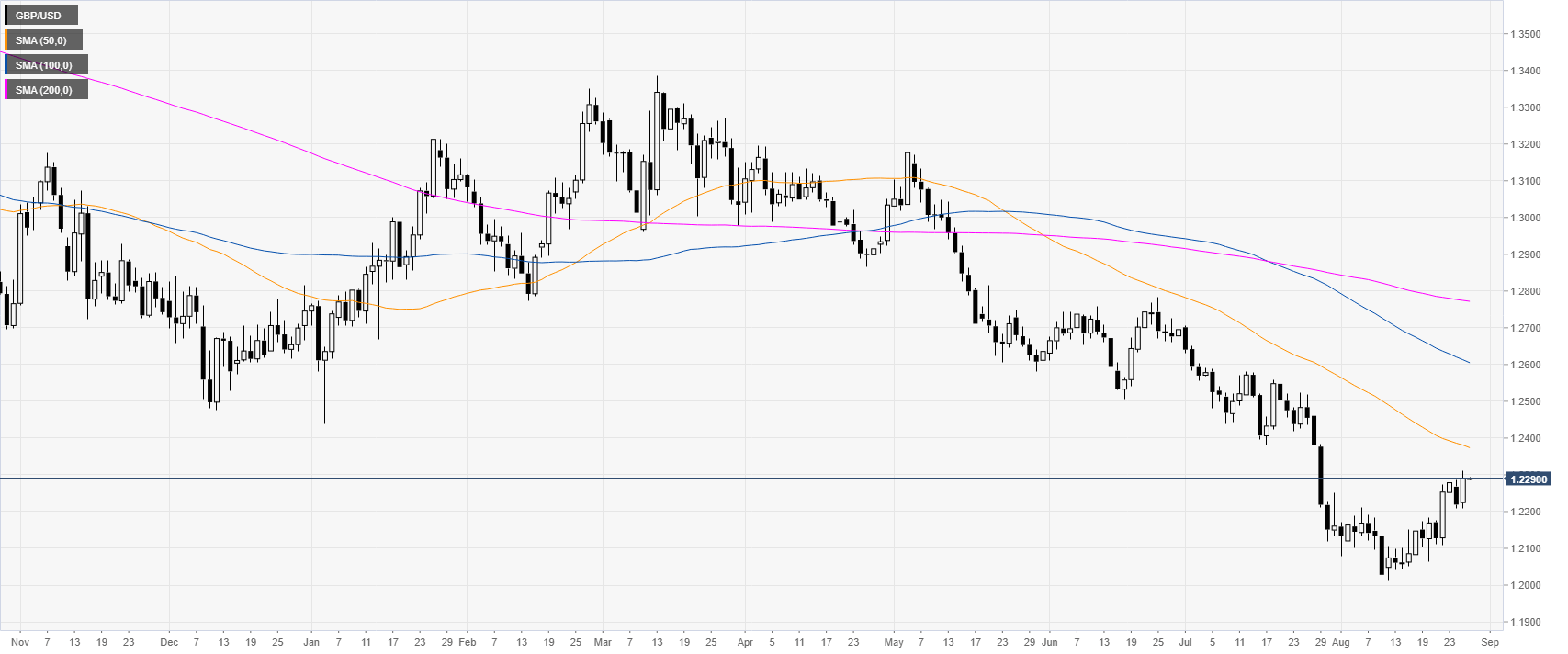

GBP/USD daily chart

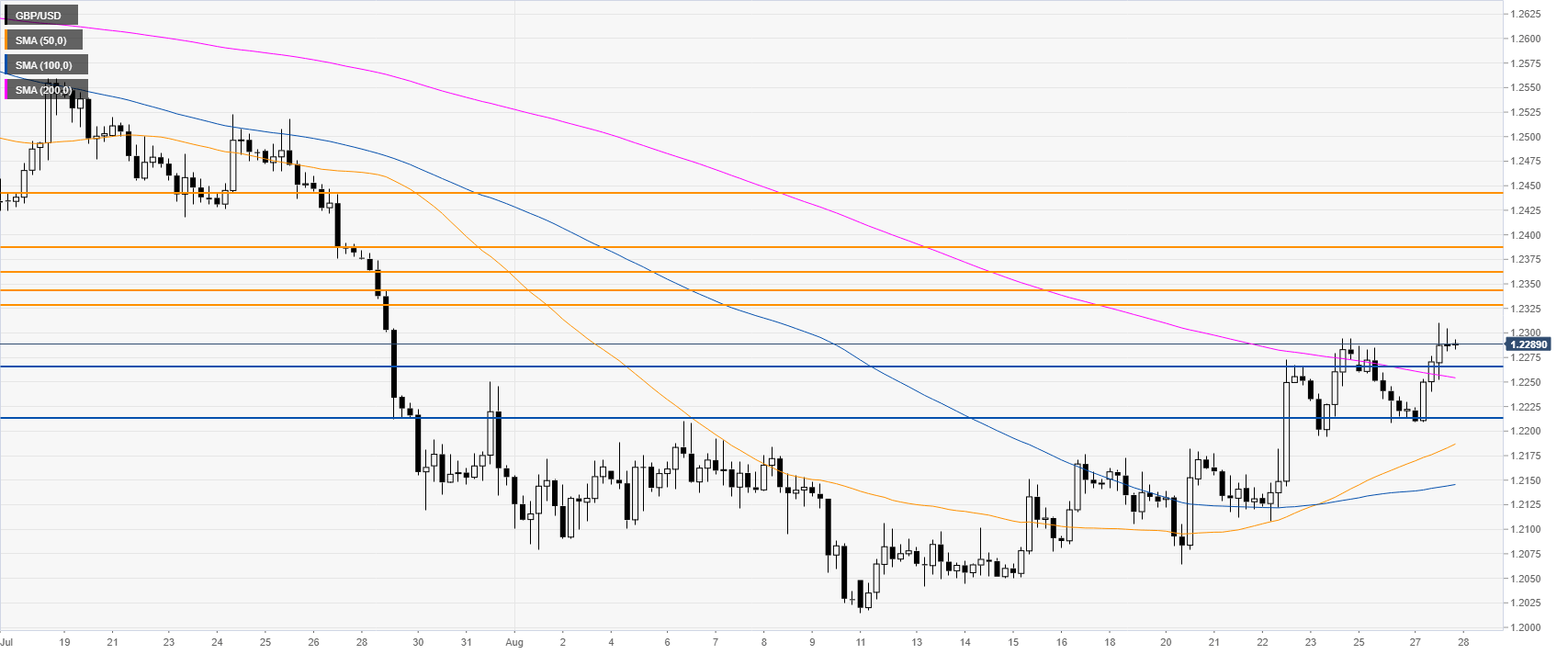

GBP/USD 4-hour chart

GBP/USD 30-minute chart

Additional key levels

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer. Opinions expressed at FXstreet.com are those of the individual authors and do not necessarily represent the opinion of FXstreet.com or its management. Risk Disclosure: Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Recommended content

Editors’ Picks

AUD/USD holds lower ground near 0.6350 after weak Aussie jobs data

AUD/USD is holding lower ground near 0.6350 in Asian trading on Thursday. The downbeat Australian jobs data fans RBA rate cut bets, maintaining the downward pressure on the pair. US-China trade tensions and US Dollar recovery act as a headwind for the pair.

USD/JPY stages a solid recovery toward 143.00 on US-Japan trade optimism

USD/JPY holds the impressive rebound from seven-month lows of 141.61, directed toward 143.00 in the Asian session on Thursday. The pair tracks the US Dollar rebound, fuelled by contrstructive trade talks between the US and Japan. A tepid risk recovery also aids the pair's upswing.

Gold price corrects from record highs of $3,358

Gold price retreats from a fresh all-time peak of $3,358 reached earlier in the Asian session on Thursday. Despite the pullback, tariff uncertainty, the escalating US-China trade war, global recession fears, and expectations of more aggressive Fed easing will likely cishion the Gold price downside.

Ethereum face value-accrual risks due to data availability roadmap

Ethereum declined 1%, trading just below $1,600 in the early Asian session on Thursday, as Binance Research's latest report suggests that the data availability roadmap has been hampering its value accrual.

Future-proofing portfolios: A playbook for tariff and recession risks

It does seem like we will be talking tariffs for a while. And if tariffs stay — in some shape or form — even after negotiations, we’ll likely be talking about recession too. Higher input costs, persistent inflation, and tighter monetary policy are already weighing on global growth.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.