GBP/USD springs higher, looking for 1.23

- GBP/USD catches a bid on improving market sentiment, setting a new two-week high.

- UK GDP, manufacturing & production figures due later in the week, BoE Gov Bailey to speak on Friday.

- US inflation data remains a key focus for broader markets, PPI and CPI in the barrel for Wednesday, Thursday.

The GBP/USD is trading higher on Tuesday as market sentiment cautiously recovers following the weekend's Israel-Hamas conflict escalation, and the Pound Sterling (GBP) is catching a bid into fresh two-week highs just shy of 1.2300.

It's a bumper week for US inflation data, with Producer Price Index (PPI) and Consumer Price Index (CPI) figures due tomorrow and Thursday respectively, but the Pound Sterling is also represented on the calendar, with Gross Domestic Product (GDP) and Industrial & Manufacturing Production numbers in the barrel for Thursday.

Federal Reserve (Fed) officials have been hitting the newswires for Tuesday, talking down the potential for further rate hikes, keeping the US Dollar (USD) on the low side and giving risk assets a chance to recover some ground.

Read More:

Fed's Bostic: We don't need to increase rates any more

NY Fed's Perli: No sign yet Fed needs to change balance sheet plans

UK GDP figures on Thursday are expected to show a mild recovery, with the monthly figure for August forecast to print at 0.2%, against the previous -0.5%.

Industrial & Manufacturing Production for the same period is expected to improve but still show minor declines, with the industrial component expected at -0.2% versus the previous -0.7%, and the manufacturing component is seen printing at -0.4% versus the previous -0.8%.

NY Fed: Year-ahead expected inflation edges higher to 3.7% from 3.6% in August

GBP/USD Technical Outlook

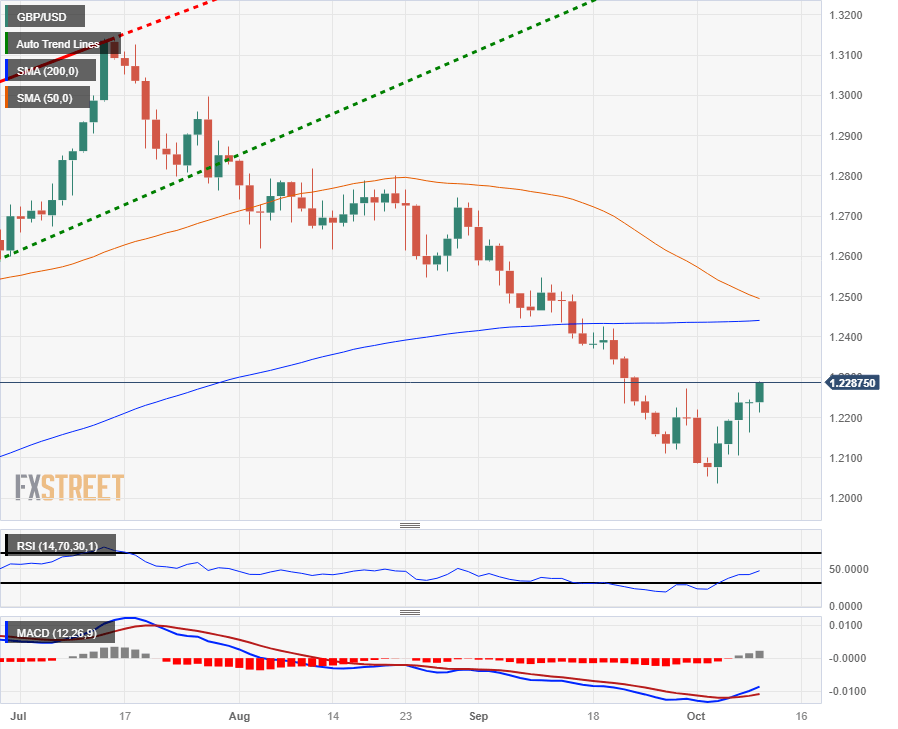

The Pound Sterling is set to close in the green for the fifth straight day against the US Dollar, having climbed over 2% from the last low at 1.2037, and the GBP/USD pair is set to take another run at climbing back over the 200-day Simple Moving Average (SMA) near 1.2441, though the 50-day SMA is moving bearish rapidly, declining into 1.2495 and set for a bearish cross of the longer moving average.

GBP/USD Daily Chart

GBP/USD Technical Levels

Author

Joshua Gibson

FXStreet

Joshua joins the FXStreet team as an Economics and Finance double major from Vancouver Island University with twelve years' experience as an independent trader focusing on technical analysis.