GBP/USD slumps sharply as BoE signals peak interest rates, US business activity improves

- US Non-Manufacturing PMI data beats expectations, fueling speculation of a possible Fed rate hike in November.

- BoE interest rate probabilities show an 84% chance of a 25 bps hike in September, taking the Bank Rate to 5.50%.

- Boston Fed’s President Susan Collins urges patience in monetary policy decisions, emphasizing the Fed’s commitment to a 2% inflation target.

The British Pound (GBP) continues its free fall against the US Dollar (USD), after the Bank of England’s (BoE) official comments suggest the central bank is about to reach its peak interest rates. This, and data from the United States (US) showing business activity picked up, increases Federal Reserve hike expectations. The GBP/USD is trading at 1.2502 after hitting a daily high of 1.2588.

BoE’s Governor Andrew Bailey’s comments signaling a peak in rates weighed on the GBP; US Non-Manufacturing PMI exceeds forecasts

The appearance of BoE’s Governor Andrew Bailey at the parliament’s Treasury Committee weighed on the Pound, which is set to finish the week with solid losses. In his appearance, Bailey said the BoE is near the top of the cycle of higher interest rates and added that inflation is indeed coming down, but could inflation expectations also come down?

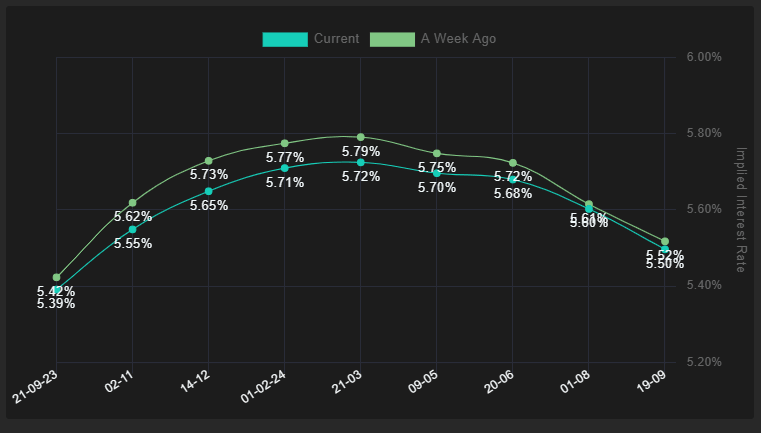

The BoE raised rates 14 times since December 2021 and would hike 25 bps in September, taking the Bank Rate to 5.50%, as shown by interest rate probabilities odds, displaying an 84% chance, as demonstrated by the picture below. The BoE is expected to hike in early 2024, with the markets seeing the Bank Rate at around 5.71%.

Bank of England Interest Rates Expectations

Source: Financialsource

Recently, BoE’s policymakers made similar comments but stressed that rates are unlikely to fall quickly due to the high level of inflation. In the meantime, John Cunliffe said the labor market is cooling down “quite slowly,” while adding that upward pressure in wages was now “crystallizing.” He said future decisions would be “finely balanced.” Swati Dhingra stuck to her dovish stance, says that rates are sufficiently restrictive and can threaten economic growth.

In the United States (US), the pickup in business activity, mainly in the services sector, as revealed by the US Non-Manufacturing PMI, triggered a reassessment of the US Federal Reserve’s monetary policy. The futures market shows odds of 25 bps for November at around 47%.

Recently, the Federal Reserve released its Beige Book, which showed modest economic growth and inflation slowed in most parts of the country.

Boston Fed’s President Susan Collins said the US central bank needs to be patient when deciding the path of monetary policy while stressing the central bank’s commitment to tame inflation to its 2% target. She added Fed officials are discussing if the current level of rates is restrictive enough or more is needed.

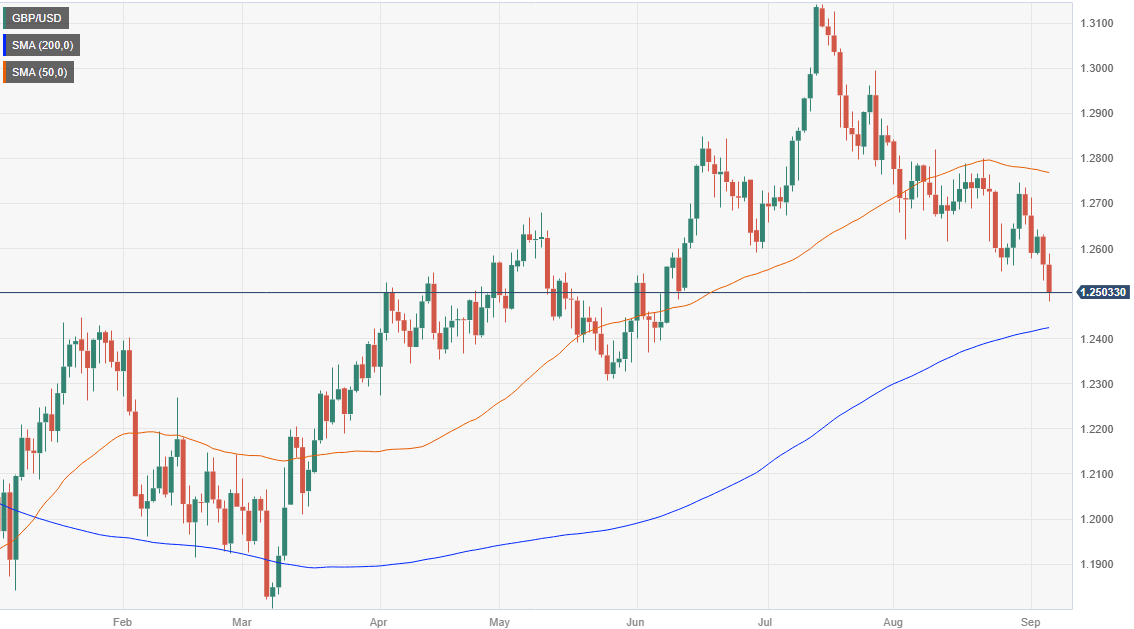

GBP/USD Price Analysis: Technical outlook

Given that the pair reached a daily low of 1.2481, buyers claimed the 1.2500 figure, downside pressures remain. The break of an upslope support trendline drawn from around late May lows accelerated the GBP/USD drop, putting the uptrend into question. If the major achieves a daily close below 1.2500, that could put into play the 200-day Moving Average (DMA) at 1.2422, followed by the May 25 swing low of 1.2308.

Author

Christian Borjon Valencia

FXStreet

Markets analyst, news editor, and trading instructor with over 14 years of experience across FX, commodities, US equity indices, and global macro markets.