GBP/USD shoots higher as Fed chair sticks to the data dependent script

- GBP/USD bulls have moved in for the kill on the Fed and Fed chair Powell.

- GBP/USD rides daily support and looks to extend the bullish trend.

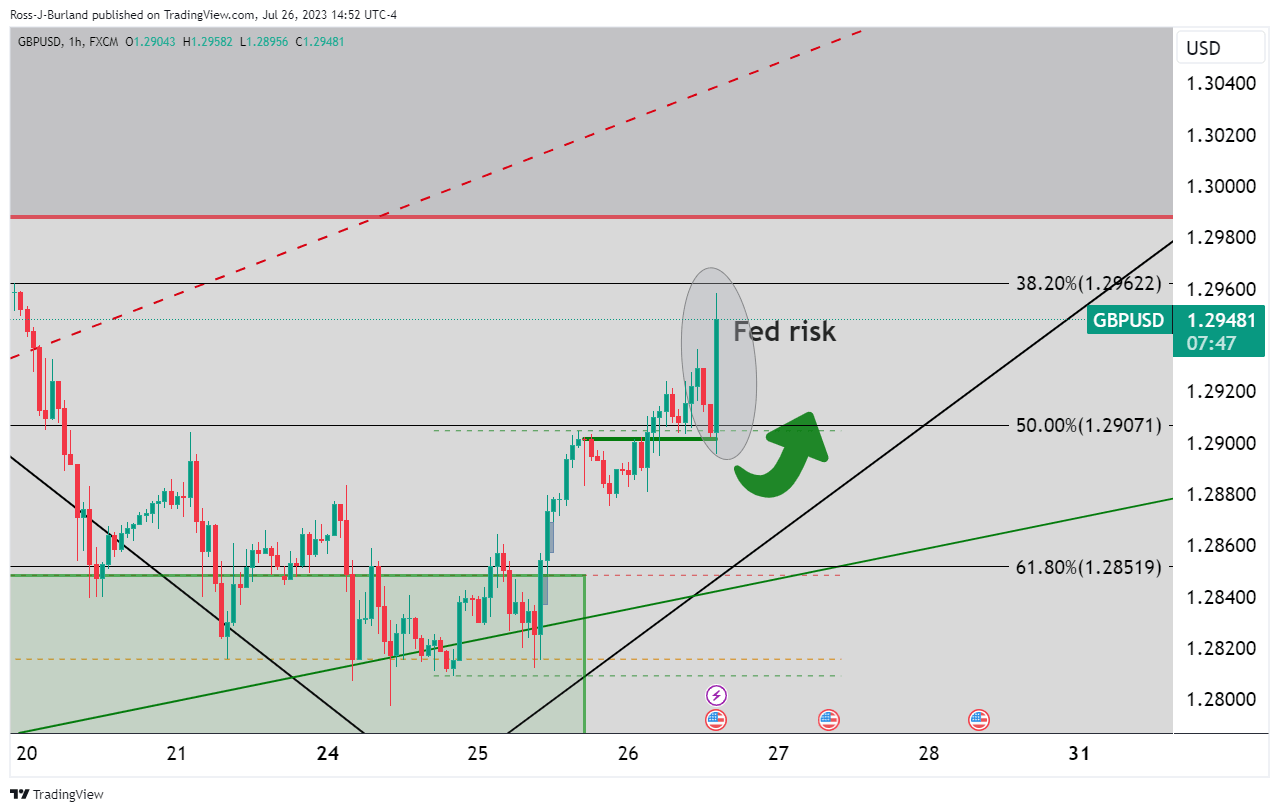

GBP/USD has spiked to break the prior highs of the day and stays the course with regards to the technical bullish correction that is illustrated below. Meanwhile, GBP/USD is trading between 1.2875 and 1.2958 on the day but around the Fed, 1.2895 and 1.2985 have been the range so far.

The Federal Reserve, Fed, raised its interest rate decision by a 25 bps rate hike to 5.25-5.50%, as expected.

Federal Reserve statement, and key notes

- Fed says FOMC vote was unanimous.

- CBO revises 2023 us real Gross Domestic Product growth forecast to 0.9% from 0.1% forecast in Feb due to H1 labour market strength.

- Fed: Will consider extent of additional firming to curb inflation.

- Fed: We will continue to reduce our bond holdings as described in previously announced plans.

- Fed: Tighter credit conditions are likely to weigh on economic activity, hiring and inflation, extent to which remains uncertain.

- Fed: Recent indicators suggest economic activity has been expanding at a moderate pace vs a modest pace in June statement.

- Fed: We will continue to assess additional information and its implications for policy.

- Fed: Banking system is sound and resilient.

As a result of the statement:

- Interest rate futures put chance of Fed hike at 18% in September, 36.5% in November post-FOMC.

- Probability of Fed hike was 18.9% in Sept, 37.3% in nov pre-FOMC.

Fed chair Powell key comments

Federal Reserve Chairman Jerome Powell comments on the policy outlook and responds to questions from the press following the US Federal Reserve (Fed) decision to hike the policy rate:

Powell speech: Labor demand still substantially exceeds supply

Powell speech: We believe monetary policy is restrictive

Powell speech: Will be looking to see if signal from June CPI is replicated

Fed overview

Jerome Powell explains decision to hike interest rate by 25 bps in July, comments on policy

GBP/USD technical analysis

GBP/USD hourly chart shows the bulls are moving in.

The daily chart shows the price heading higher again, riding trendline support, following the recent daily correction.

Author

Ross J Burland

FXStreet

Ross J Burland, born in England, UK, is a sportsman at heart. He played Rugby and Judo for his county, Kent and the South East of England Rugby team.