GBP/USD rises amid US Dollar weakness, mixed Fed messages

- GBP/USD climbs to 1.264, lifted by soft USD and dovish Fed cues, weak services data.

- Powell ties rate cuts to data; Bostic hints at delayed cuts to late 2024.

- Shifts in BoE and Fed rate cut expectations indicate evolving monetary policies.

The Pound Sterling posted solid gains against the Greenback on Wednesday after bouncing from a seven-week low of 1.2539 on Tuesday. Federal Reserve officials crossing the newswires and weaker-than-expected US services sector data are a headwind for the US Dollar, which tumbled for the second day in a row. The GBP/USD trades at 1.264, gains 0.56%.

GBP/USD rebounds from lows as Fed officials' comments and US services sector data influence currency dynamics

The Institute for Supply Management (ISM) revealed a softer-than-expected Services PMI, along with Fed Chair Jerome Powell, reaffirming that interest rates would be cut, but it would depend on upcoming data. On the contrary, Atlanta’s Fed President Raphael Bostic stood by his stance of just one rate cut, adding that it could happen in the last quarter of 2024.

In the meantime, US Treasury yields trimmed its earlier gains a headwind for the buck. The US Dollar Index (DXY) which tracks the performance of the American currency against other six, tumbles 0.46%, down at 104.26. This comes after the release of the ISM Manufacturing PMI sent the DXY rallying to the 105.00 mark.

Bank of England and Fed rate cut expectations

Money market futures traders see the Bank of England (BoE) cutting rates 25 basis points in June, with odds standing at 66%. Across the Atlantic, traders had fully priced in a 25-basis point cut by the Fed until July 31.

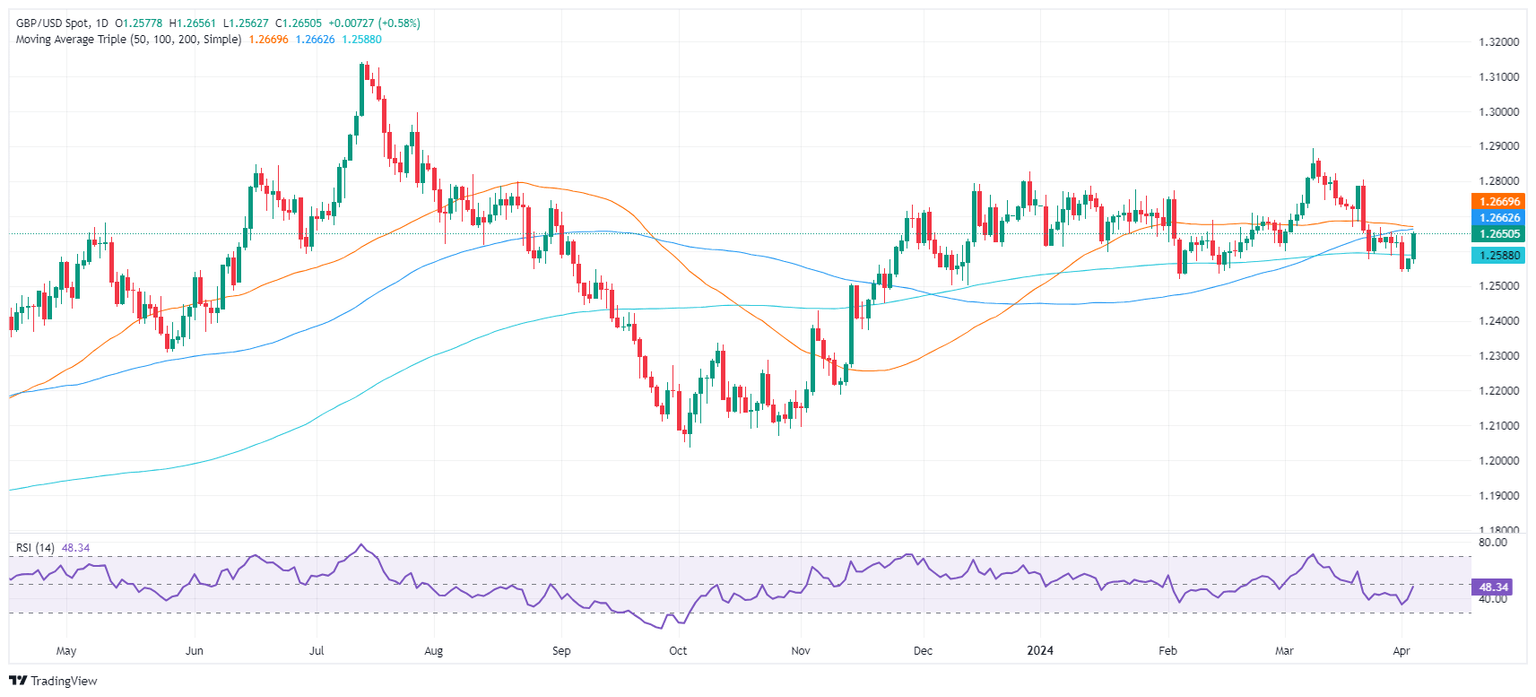

GBP/USD Price Analysis: Technical outlook

Given the fundamental backdrop, GBP/USD price action suggests the pair could test the 50-day moving average (DMA) after reclaiming the 200 and the 100-DMA, each at 1.2586 and 1.2656, respectively. If those levels are taken out of the way, expect further upside at around 1.2700. On the other hand, if sellers step in and push the exchange rate below the 200-DMA at 1.2586, that could spur a test of 1.2500.

Pound Sterling FAQs

The Pound Sterling (GBP) is the oldest currency in the world (886 AD) and the official currency of the United Kingdom. It is the fourth most traded unit for foreign exchange (FX) in the world, accounting for 12% of all transactions, averaging $630 billion a day, according to 2022 data. Its key trading pairs are GBP/USD, aka ‘Cable’, which accounts for 11% of FX, GBP/JPY, or the ‘Dragon’ as it is known by traders (3%), and EUR/GBP (2%). The Pound Sterling is issued by the Bank of England (BoE).

The single most important factor influencing the value of the Pound Sterling is monetary policy decided by the Bank of England. The BoE bases its decisions on whether it has achieved its primary goal of “price stability” – a steady inflation rate of around 2%. Its primary tool for achieving this is the adjustment of interest rates. When inflation is too high, the BoE will try to rein it in by raising interest rates, making it more expensive for people and businesses to access credit. This is generally positive for GBP, as higher interest rates make the UK a more attractive place for global investors to park their money. When inflation falls too low it is a sign economic growth is slowing. In this scenario, the BoE will consider lowering interest rates to cheapen credit so businesses will borrow more to invest in growth-generating projects.

Data releases gauge the health of the economy and can impact the value of the Pound Sterling. Indicators such as GDP, Manufacturing and Services PMIs, and employment can all influence the direction of the GBP. A strong economy is good for Sterling. Not only does it attract more foreign investment but it may encourage the BoE to put up interest rates, which will directly strengthen GBP. Otherwise, if economic data is weak, the Pound Sterling is likely to fall.

Another significant data release for the Pound Sterling is the Trade Balance. This indicator measures the difference between what a country earns from its exports and what it spends on imports over a given period. If a country produces highly sought-after exports, its currency will benefit purely from the extra demand created from foreign buyers seeking to purchase these goods. Therefore, a positive net Trade Balance strengthens a currency and vice versa for a negative balance.

Author

Christian Borjon Valencia

FXStreet

Markets analyst, news editor, and trading instructor with over 14 years of experience across FX, commodities, US equity indices, and global macro markets.