GBP/USD reverses a dip below 1.3600 amid hotter UK inflation, impending bull cross

- GBP/USD continues to find strong support sub-1.3600 levels.

- Hotter UK inflation and softer US dollar help the rebound in cable.

- Impending bulls cross and bullish RSI add credence to the corrective upside.

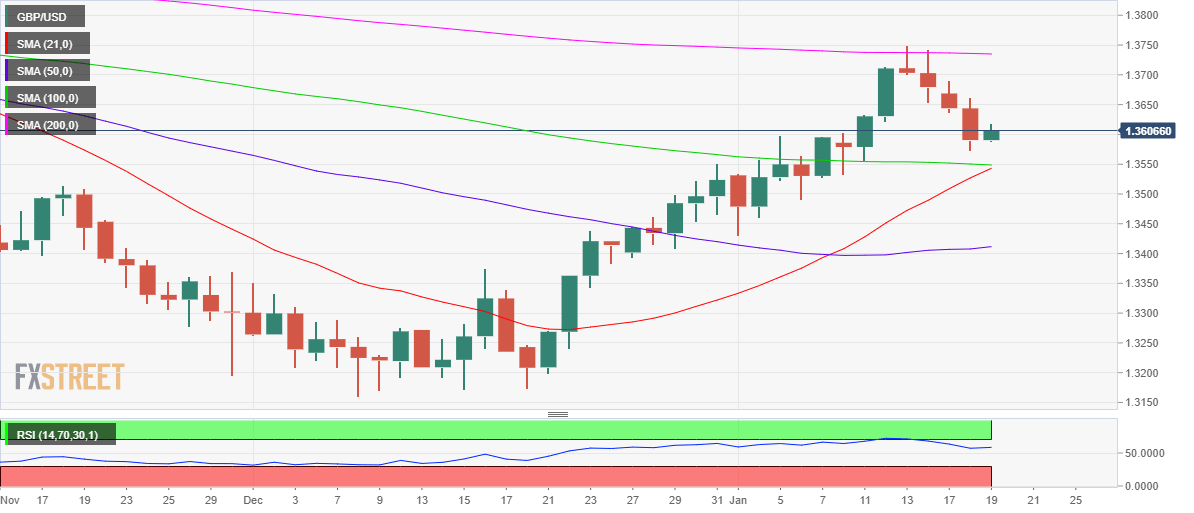

GBP/USD is bouncing back above 1.3600, snapping a four-day winning streak after bulls faced rejection at the 200-Daily Moving Average (DMA), now at 1.3735.

The turnaround in the sentiment around the pound comes on the back of a higher-than-expected UK annualized inflation figure for December, which came in at 5.4%. Hotter UK inflation lifts odds for a Bank of England (BOE) rate hike at its February 3 meeting, the first for this year.

Meanwhile, a recovery in the risk sentiment seems to be weighing on the safe-haven US dollar, collaborating with the upside in the cable pair. The greenback drops despite the fresh two-year highs in the US 10-year Treasury yields, as swap markets now price in a more than 25-bps Fed rate hike in March.

However, it remains to be seen if GBP/USD manages to stand ground amid looming UK political and Brexit risks. “The PM's attendance at the “bring your own booze” Downing Street Garden party during England’s first lockdown in May 2020, is throwing his premiership in jeopardy and the political uncertainty is a weight for the pound. Some MPs are refusing to accept his claim that he thought it was a “work event,” FXStreet’s Analyst Ross Burland notes.

Technically, the downtrend in the major has stalled just ahead of critical support at 1.3545, where the 21-DMA is set to cross the horizontal 100-DMA for the upside.

A bull cross in the making could keep GBP buyers hopeful, as the bullish 14-day Relative Strength Index (RSI) also adds credence to a potential move higher in the spot.

Further upside will gain traction only on a sustained move above 1.3650 should the daily highs of 1.3618 give way.

GBP/USD: Daily chart

GBP/USD: Additional technical levels

Author

Dhwani Mehta

FXStreet

Residing in Mumbai (India), Dhwani is a Senior Analyst and Manager of the Asian session at FXStreet. She has over 10 years of experience in analyzing and covering the global financial markets, with specialization in Forex and commodities markets.