GBP/USD recovers amid rate cut rumblings in the UK and US

- GBP/USD rises to 1.2639, lifted by speculation over Federal Reserve's potential rate cut in June.

- Fed officials offer varied views on policy direction, contributing to the Dollar's subdued performance.

- UK economic indicators and BoE Governor's rate cut hints set the stage for a cautious market outlook.

The Pound Sterling stages a mild recovery against the US Dollar in the mid-North American session, as the Greenback remains offered amid speculations the Federal Reserve would cut rates in June. At the time of writing, the GBP/USD trades at 1.2639. gains 0.32%.

GBP/USD edges higher as mixed Fed outlook and looming BoE rate cuts stir currency markets.

US economic docket failed to boost the US Dollar, which treads water against most G7 currencies. Three Federal Reserve officials crossed the wires, with Bostic and Cook advocating for a cautious approach, emphasizing the risks of easing policy prematurely, whereas Goolsbee, although also cautious, sees room for more aggressive action pending clear evidence of inflationary declines.

On the data front, the US housing market saw a slight decline in New Home Sales for February, dropping by 0.3% month-over-month from 0.664 million to 0.662 million units. Elsewhere, the Chicago Fed announced the National Activity Index saw improvement, moving from -0.54 to 0.05, with positive developments across all four index categories.

Across the pond, the UK CBI Distributive Trades Survey figures showed the monthly retail sales balance rose in March from a -7 reading a year ago, to 2. With this data out of the way, GBP/USD traders are eyeing the release of the Gross Domestic Product (GDP) for Q4 2023. Expectations sees the economy confirming a technical recession, as the preliminary GDP fell -0.3% QoQ following a fall of -0.1% in Q3.

That data, along with the dovish remarks of Bank of England (BoE) Governor Andrew Bailey, who said that rate cuts are “in play” in an interview with the Financial Times (FT), weighed on the GBP. Money market futures estimates see a 75% chance of a rate cut by the BoE in June, up from 35% at the beginning of last week.

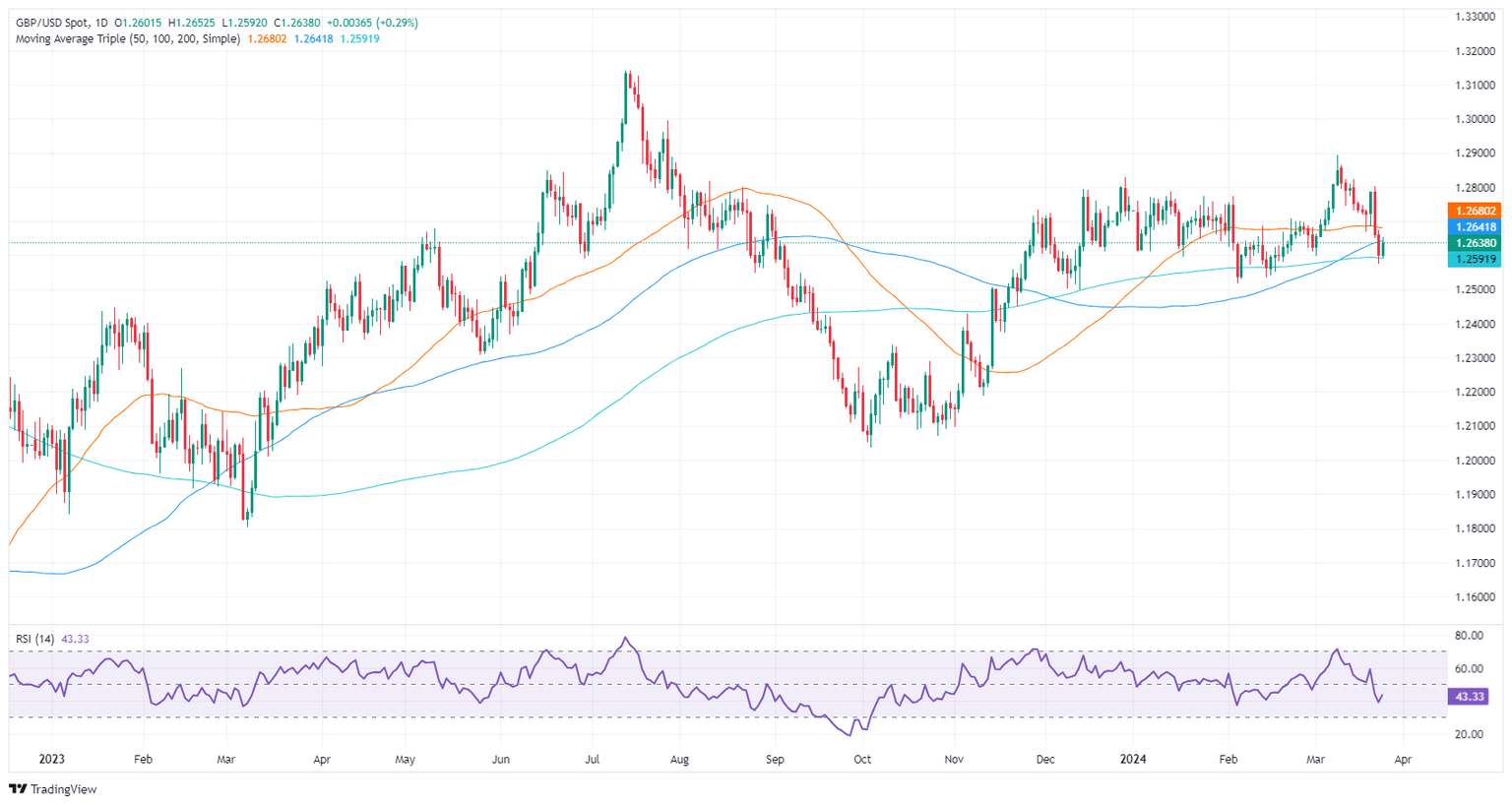

GBP/USD Price Analysis: Technical outlook

Given the fundamental backdrop, the GBP/USD is forming a ‘bullish harami’ which suggests further ipside is seen. Nevertheless, a break above the 50-day moving average (DMA) of 1.2679 is needed, to confirm the reversal pattern. That would expose 1.2700, followed by the March 21 high at 1.2803. On the other hand, if the major slips below the 200-DMA at 1.2591, that would negate the chart pattern, as the pair could extend its losses.

Author

Christian Borjon Valencia

FXStreet

Markets analyst, news editor, and trading instructor with over 14 years of experience across FX, commodities, US equity indices, and global macro markets.