GBP/USD Price Forecast: Bears have the upper hand while below 1.3000 mark

- GBP/USD meets with a fresh supply on Tuesday and seems vulnerable to sliding further.

- Bets for smaller Fed rate cuts revive the USD demand and exert pressure on the pair.

- The technical setup favors bears and supports prospects for a further depreciating move.

The GBP/USD pair attracts fresh sellers following the previous day's good two-way price move and slides closer to mid-1.2900s during the Asian session on Tuesday. Spot prices, however, hold above the lowest level since August 16 touched last week and remain at the mercy of the US Dollar (USD) price dynamics.

Bets for a less aggressive policy easing by the Federal Reserve (Fed) assist the USD in stalling its overnight pullback from a three-month peak and drag the GBP/USD pair lower. Apart from this, rising bets for more interest rate cuts by the Bank of England (BoE) in November and December suggest that the path of least resistance for spot prices remains to the downside.

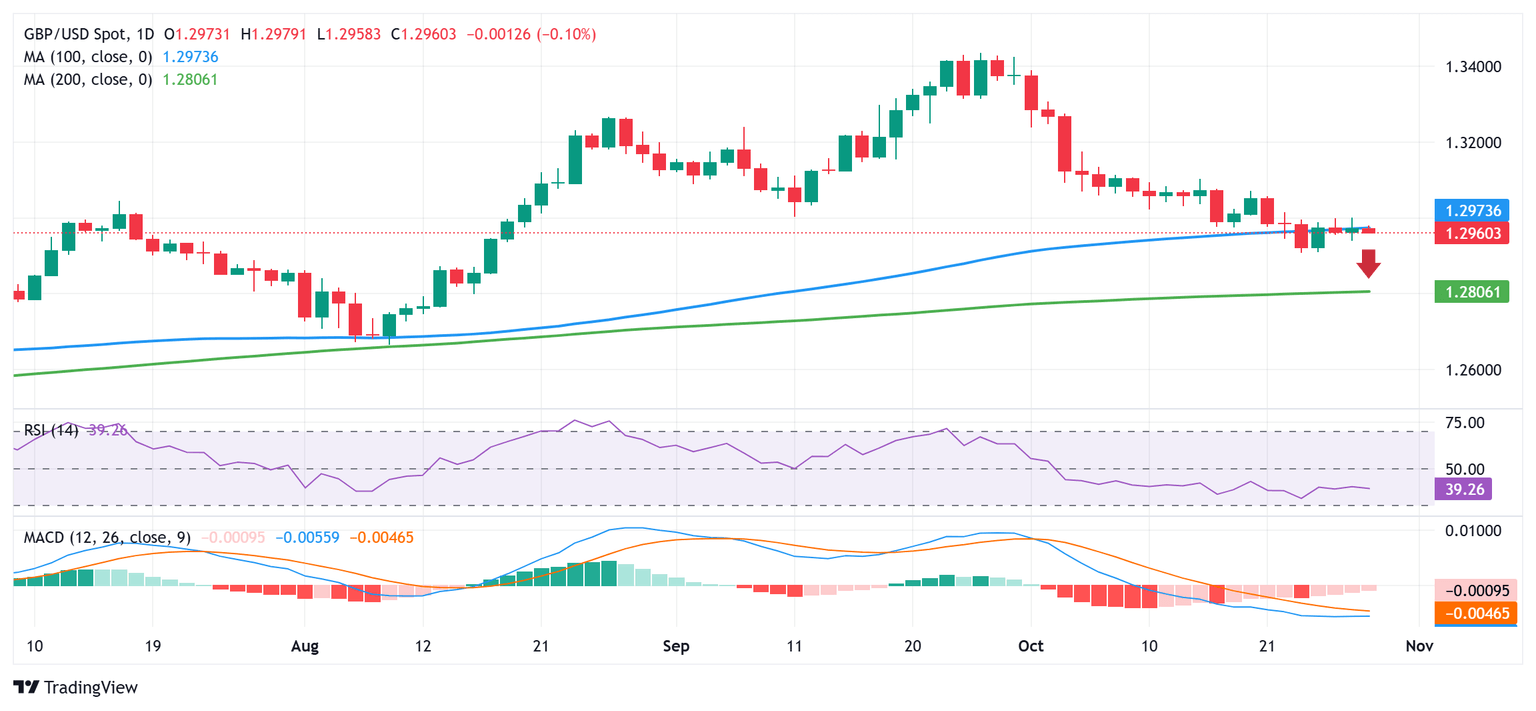

From a technical perspective, the recent repeated failures near the 1.3000 psychological mark and a breakdown below the 100-day Simple Moving Average (SMA) validate the near-term negative outlook. Moreover, oscillators on the daily chart are holding deep in negative territory and are still away from being in the oversold zone. Hence, a subsequent slide back towards the 1.2900 mark, or the monthly swing low, looks like a distinct possibility.

Some follow-through selling will be seen as a fresh trigger for bearish traders and pave the way for an extension of a downtrend from the 1.3435 region, or the highest level since February 2022 touched last month. The GBP/USD pair might then aim to test the very important 200-day SMA, currently pegged near the 1.2800 round-figure mark, with some intermediate support near the 1.2860 region.

On the flip side, the 1.3000 mark now seems to have emerged as an immediate strong barrier, above which spot prices could climb to the 1.3050 supply zone. A sustained strength beyond the latter might trigger a short-covering move and lift the GBP/USD pair beyond the 1.3100 round figure, towards the 1.3115-1.3120 resistance zone. Some follow-through buying will negate the negative outlook and shift the bias in favor of bulls.

GBP/USD daily chart

Pound Sterling FAQs

The Pound Sterling (GBP) is the oldest currency in the world (886 AD) and the official currency of the United Kingdom. It is the fourth most traded unit for foreign exchange (FX) in the world, accounting for 12% of all transactions, averaging $630 billion a day, according to 2022 data. Its key trading pairs are GBP/USD, also known as ‘Cable’, which accounts for 11% of FX, GBP/JPY, or the ‘Dragon’ as it is known by traders (3%), and EUR/GBP (2%). The Pound Sterling is issued by the Bank of England (BoE).

The single most important factor influencing the value of the Pound Sterling is monetary policy decided by the Bank of England. The BoE bases its decisions on whether it has achieved its primary goal of “price stability” – a steady inflation rate of around 2%. Its primary tool for achieving this is the adjustment of interest rates. When inflation is too high, the BoE will try to rein it in by raising interest rates, making it more expensive for people and businesses to access credit. This is generally positive for GBP, as higher interest rates make the UK a more attractive place for global investors to park their money. When inflation falls too low it is a sign economic growth is slowing. In this scenario, the BoE will consider lowering interest rates to cheapen credit so businesses will borrow more to invest in growth-generating projects.

Data releases gauge the health of the economy and can impact the value of the Pound Sterling. Indicators such as GDP, Manufacturing and Services PMIs, and employment can all influence the direction of the GBP. A strong economy is good for Sterling. Not only does it attract more foreign investment but it may encourage the BoE to put up interest rates, which will directly strengthen GBP. Otherwise, if economic data is weak, the Pound Sterling is likely to fall.

Another significant data release for the Pound Sterling is the Trade Balance. This indicator measures the difference between what a country earns from its exports and what it spends on imports over a given period. If a country produces highly sought-after exports, its currency will benefit purely from the extra demand created from foreign buyers seeking to purchase these goods. Therefore, a positive net Trade Balance strengthens a currency and vice versa for a negative balance.

Author

Haresh Menghani

FXStreet

Haresh Menghani is a detail-oriented professional with 10+ years of extensive experience in analysing the global financial markets.