GBP/USD Price Analysis: Uptrend falters above 21-DMA ahead of BOE rate decision

- GBP/USD’s four-day recovery rally loses steam amid USD rebound.

- The BOE to hike rates by 25bps, more hawkishness is needed to lift the GBP.

- Cable fails to find acceptance above 21-DMA ahead of the BOE announcements.

GBP/USD is battling 1.3550, looking to extend its retreat from an eight-day top of 1.3587, as the US dollar bulls jump onto the bids amid a risk-off market mood.

The cable is snapping its four-day recovery rally also as bulls turn cautious and refrain from placing any fresh bets on the pound ahead of the Bank of England (BOE) showdown.

The BOE is likely to hike rates by another 25-basis points (bps) to 0.50% this ‘Super Thursday’, although it could lead to ‘sell the fact’ trading in the pound, as a 25bps rate lift-off is already discounted.

Further hawkishness from the BOE is needed to revive the uptrend in the cable pair going forward. The ECB policy decision will be also eyed for any cross-driven impact on GBP/USD.

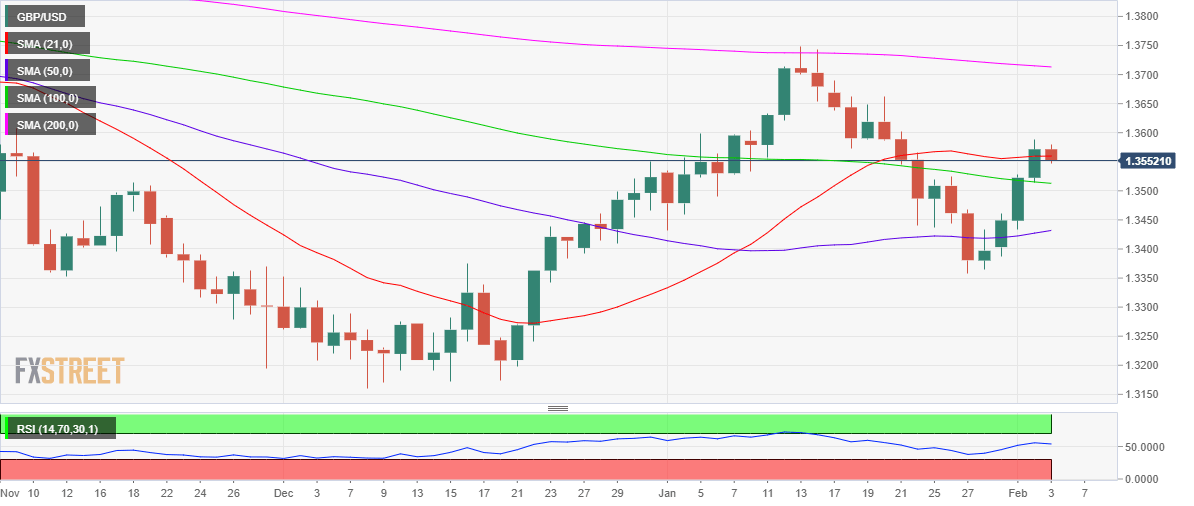

Looking at GBP/USD’s daily chart, the pair is retracing below the 21-Daily Moving Average (DMA) resistance at 1.3560.

The additional decline will see a test of the descending 100-DMA cap at 1.3513. The next downside target is aligned at the 1.3500 round level.

The 14-day Relative Strength Index (RSI) is turning south towards the midline, backing the latest downtick in the price.

GBP/USD: Daily chart

However, if the bulls regain control, then acceptance above the 21-DMA support-turned-resistance is critical for reviving the bullish reversal from multi-week troughs.

Further up, the February 2 highs of 1.3587 will get retested, opening doors for recapturing 1.3600.

GBP/USD: Additional technical levels

Author

Dhwani Mehta

FXStreet

Residing in Mumbai (India), Dhwani is a Senior Analyst and Manager of the Asian session at FXStreet. She has over 10 years of experience in analyzing and covering the global financial markets, with specialization in Forex and commodities markets.