GBP/USD Price Analysis: Struggles at 1.3000, dives beneath 1.2950

- GBP/USD down 0.14%, after failing to break 1.3000 level.

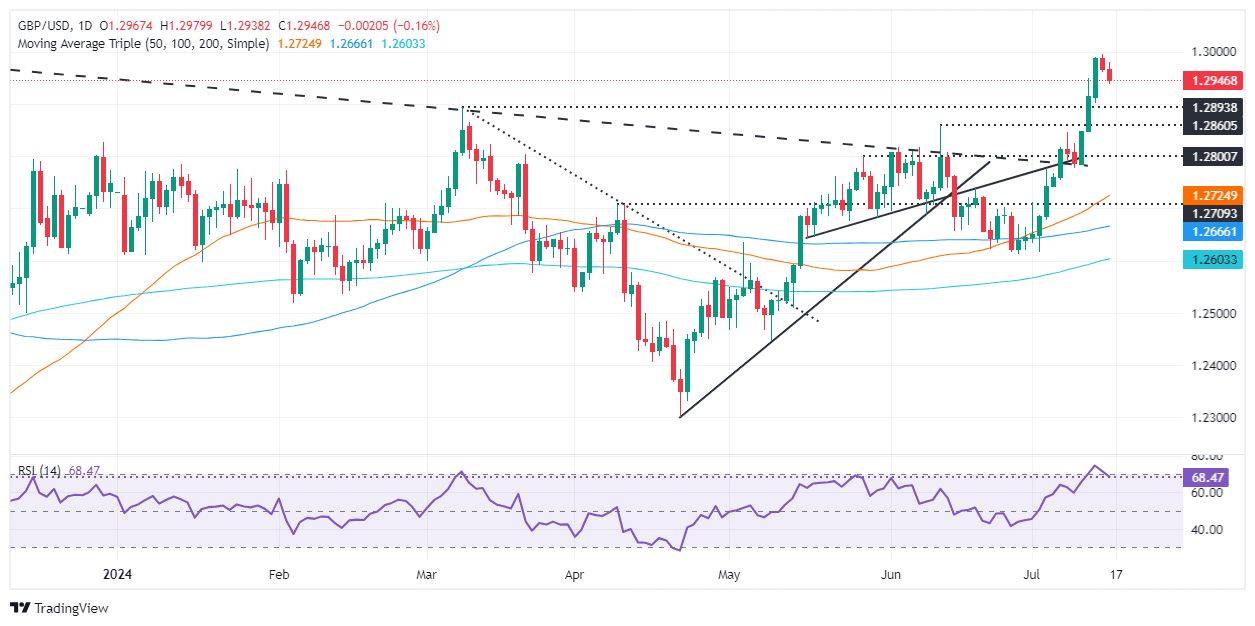

- Technical outlook shows upward bias, but RSI hints at profit booking.

- Key support at 1.2894, with resistance at 1.2995 and 1.3000, ahead of UK inflation data release.

The Pound Sterling begins the North American session on the backfoot and registers losses of 0.14% after failing to crack the 1.3000 figure. The lack of economic data from the United Kingdom boosted the Greenback, which was battered last week. The GBP/USD trades at 1.2946 after hitting a daily high of 1.2979.

GBP/USD Price Analysis: Technical outlook

From a daily chart perspective, the GBP/USD remains upward biased as price action has registered successive series of higher highs and higher lows, though the bullish momentum has slightly vanished. The Relative Strength Index (RSI) remains bullish, but exiting from overbought conditions triggered a sell signal, hinting that buyers are booking profits ahead of the release of UK inflation data on Wednesday.

If GBP/USD drops below the March 8 peak turned support at 1.2894, that would sponsor a leg down to challenge the June 12 high at 1.2860. Further losses are seen beneath those two levels, extending toward the 1.2800 figure, ahead of the 50-day moving average (DMA) at 1.2723.

On the other hand, if GBP/USD holds the forth above 1.2900 and climbs past 1.2950, the first resistance would be the July 27, 2023 high at 1.2995 ahead of 1.3000. Further gains lie overhead at 1.3125, July 18, 2023, peak, followed by last year’s top at 1.3142.

GBP/USD Price Action – Daily Chart

Pound Sterling FAQs

The Pound Sterling (GBP) is the oldest currency in the world (886 AD) and the official currency of the United Kingdom. It is the fourth most traded unit for foreign exchange (FX) in the world, accounting for 12% of all transactions, averaging $630 billion a day, according to 2022 data. Its key trading pairs are GBP/USD, aka ‘Cable’, which accounts for 11% of FX, GBP/JPY, or the ‘Dragon’ as it is known by traders (3%), and EUR/GBP (2%). The Pound Sterling is issued by the Bank of England (BoE).

The single most important factor influencing the value of the Pound Sterling is monetary policy decided by the Bank of England. The BoE bases its decisions on whether it has achieved its primary goal of “price stability” – a steady inflation rate of around 2%. Its primary tool for achieving this is the adjustment of interest rates. When inflation is too high, the BoE will try to rein it in by raising interest rates, making it more expensive for people and businesses to access credit. This is generally positive for GBP, as higher interest rates make the UK a more attractive place for global investors to park their money. When inflation falls too low it is a sign economic growth is slowing. In this scenario, the BoE will consider lowering interest rates to cheapen credit so businesses will borrow more to invest in growth-generating projects.

Data releases gauge the health of the economy and can impact the value of the Pound Sterling. Indicators such as GDP, Manufacturing and Services PMIs, and employment can all influence the direction of the GBP. A strong economy is good for Sterling. Not only does it attract more foreign investment but it may encourage the BoE to put up interest rates, which will directly strengthen GBP. Otherwise, if economic data is weak, the Pound Sterling is likely to fall.

Another significant data release for the Pound Sterling is the Trade Balance. This indicator measures the difference between what a country earns from its exports and what it spends on imports over a given period. If a country produces highly sought-after exports, its currency will benefit purely from the extra demand created from foreign buyers seeking to purchase these goods. Therefore, a positive net Trade Balance strengthens a currency and vice versa for a negative balance.

Author

Christian Borjon Valencia

FXStreet

Markets analyst, news editor, and trading instructor with over 14 years of experience across FX, commodities, US equity indices, and global macro markets.