GBP/USD Price Analysis: Retreats towards 1.2450 inside rising wedge, UK Retail Sales eyed

- GBP/USD pares recent gains inside a bearish chart pattern.

- Pullback from resistance, RSI conditions hint at further weakness.

- Bears need validation from 200-HMA to retake control.

- UK Retail Sales hints at a contraction in April.

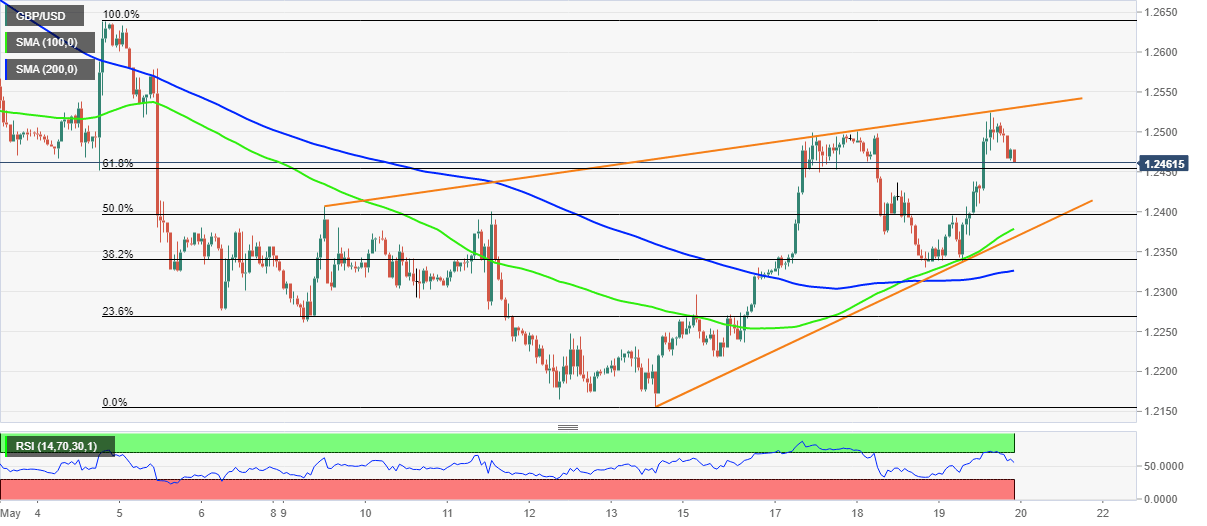

GBP/USD struggles to keep Thursday’s stellar gains inside a rising wedge bearish formation, despite staying on the way to post the first weekly gains in five. That said, the cable pair eases to 1.2475 while stepping back from the wedge’s upper line during the early Friday morning in Asia.

As overbought RSI conditions backed the GBP/USD pair’s latest pullback inside the wedge, further weakness in prices can’t be ruled out.

However, the 61.8% Fibonacci retracement (Fibo.) of May 04-13 downside, near 1.2450, seems to restrict the pair’s immediate declines.

It should be noted, though, that the GBP/USD weakness past 1.2450 will aim for the 1.2400 threshold before directing bears towards the stated bearish chart pattern’s support line around 1.2365.

Although a clear break of the 1.2365 will confirm the bearish formation, theoretically directing the quote towards 1.2100, sustained trading beneath the 200-HMA level of 1.2325 becomes necessary to confirm the south-run.

Meanwhile, recovery moves remain elusive until staying below the stated wedge’s resistance line, around 1.2530.

Following that, 1.2580 and the monthly high close to 1.2640 could lure the GBP/USD bulls.

GBP/USD: Hourly chart

Trend: Pullback expected

Author

Anil Panchal

FXStreet

Anil Panchal has nearly 15 years of experience in tracking financial markets. With a keen interest in macroeconomics, Anil aptly tracks global news/updates and stays well-informed about the global financial moves and their implications.