GBP/USD Price Analysis: Retreats towards 1.2050 inside weekly triangle

- GBP/USD snaps two-day winning streak with mild losses.

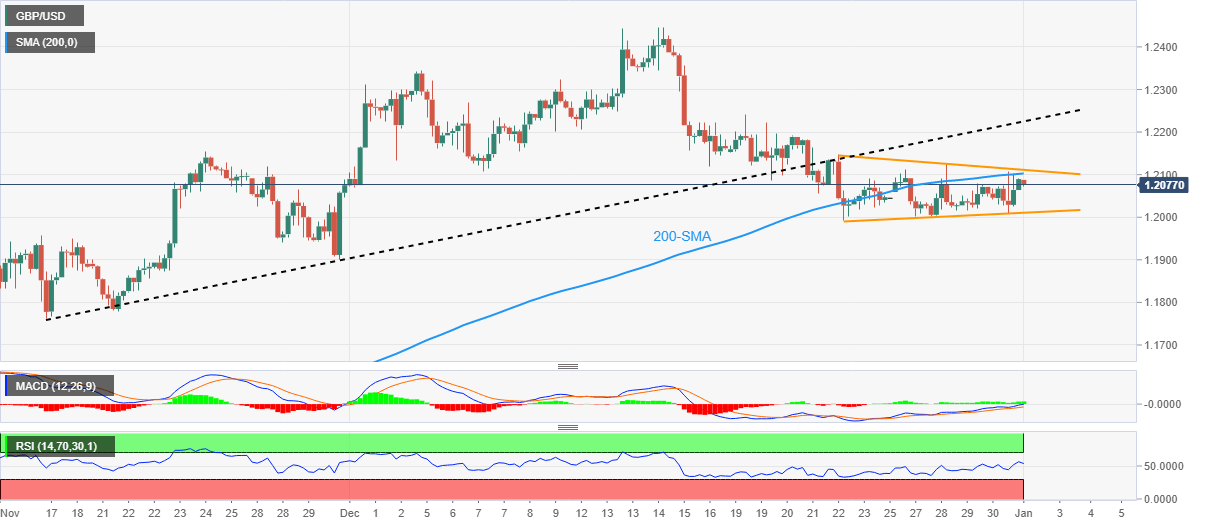

- Another failure to cross 200-SMA triggers pullback inside one-week-old symmetrical triangle.

- Firmer oscillators, 1.2000 psychological magnet challenge the Cable bears.

GBP/USD begins 2023 on a back foot as it prints mild losses near 1.2080 during the early hours of Monday. In doing so, the Cable pair justifies the previous day’s failure to cross the 200-SMA inside a one-week-old symmetrical triangle formation.

That said, the 200-SMA level, around 1.2100 by the press time, precedes the stated triangle’s upper line near 1.2110 to restrict short-term advances of the GBP/USD prices.

It’s worth noting, however, that the bullish MACD signals and the firmer RSI (14), not overbought, join the 1.2000 psychological magnet to limit the Cable pair’s immediate downside.

Hence, the GBP/USD may remain uninteresting between 1.2110 and 1.2000.

That said, the previous support line from November 17, close to 1.2225 at the latest, adds to the upside filters before giving control to the GBP/USD bulls.

In that case, the quote could challenge December’s peak of 1.2446, a break of which could help the bulls to aim for a May 2022 high of around 1.2665.

On the flip side, a clear downside break of the 1.2000 threshold may direct the GBP/USD bears towards the late November swing low of 1.1900 before highlighting the mid-November swing low near 1.1760.

GBP/USD: Four-hour chart

Trend: Limited downside expected

Author

Anil Panchal

FXStreet

Anil Panchal has nearly 15 years of experience in tracking financial markets. With a keen interest in macroeconomics, Anil aptly tracks global news/updates and stays well-informed about the global financial moves and their implications.