GBP/USD Price Analysis: Retreats from 200-SMA, weekly resistance line, Cable bears eye 1.2425

- GBP/USD takes offers to refresh intraday low, fades the previous day’s corrective bounce off three-week low.

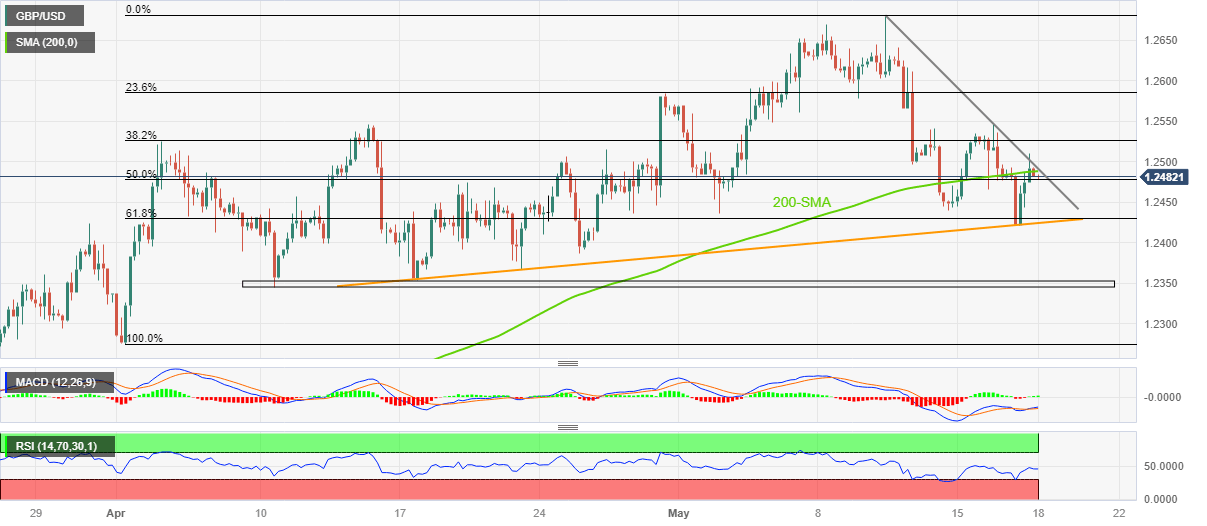

- Convergence of 200-SMA, one-week-old descending trend line guards Sterling Pound’s immediate upside.

- One-month-old rising support line can prod the Cable pair sellers.

GBP/USD prints three-day downtrend despite positing mild losses around 1.2480 during early Thursday, fading the previous day’s bounce off a three-week low.

In doing so, the Pound Sterling takes a U-turn from the convergence of the 200-SMA and a downward-sloping resistance line from May 10, close to 1.2490 at the latest. Adding strength to the pullback moves are the steady RSI (14) line and sluggish MACD signals.

As a result, the Cable pair appears all set to drop towards the 61.8% Fibonacci retracement level of its April-May upside, near 1.2430. However, a one-month-old ascending support line, close to 1.2425 by the press time, appears a tough nut to crack for the GBP/USD bears afterward.

In a case where the GBP/USD price drops below 1.2425, the odds of witnessing a quick fall toward a five-week-old horizontal support zone near 1.2355-45 can’t be ruled out.

On the flip side, the GBP/USD pair’s recovery needs to provide a successful break of the 1.2490 resistance confluence to convince buyers.

Following that, the tops marked during mid-April and 23.6% Fibonacci retracement, respectively near 1.2545 and 1.2585, may challenge the Cable pair buyers before directing them to the recently marked multi-day peak of 1.2680.

GBP/USD: Four-hour chart

Trend: Limited downside expected

Author

Anil Panchal

FXStreet

Anil Panchal has nearly 15 years of experience in tracking financial markets. With a keen interest in macroeconomics, Anil aptly tracks global news/updates and stays well-informed about the global financial moves and their implications.