GBP/USD Price Analysis: Remains subdued above 1.2700

- GBP/USD edges up, with buyers eyeing a clear break of the weekly high.

- Key resistance levels lie at 1.2803, and YTD high at 1.2893.

- The major can turn bearish below, falling below 1.2681.

The Pound Sterling registered minuscule gains versus the US Dollar in early trading during the North American session. Investors’ sentiment is upbeat as most US equity indices are rising, US Treasury bond yields are falling, and the Greenback was virtually unchanged against a basket of its peers. Therefore, the GBP/USD trades at 1.2719, up 0.11%.

GBP/USD Price Analysis: Technical outlook

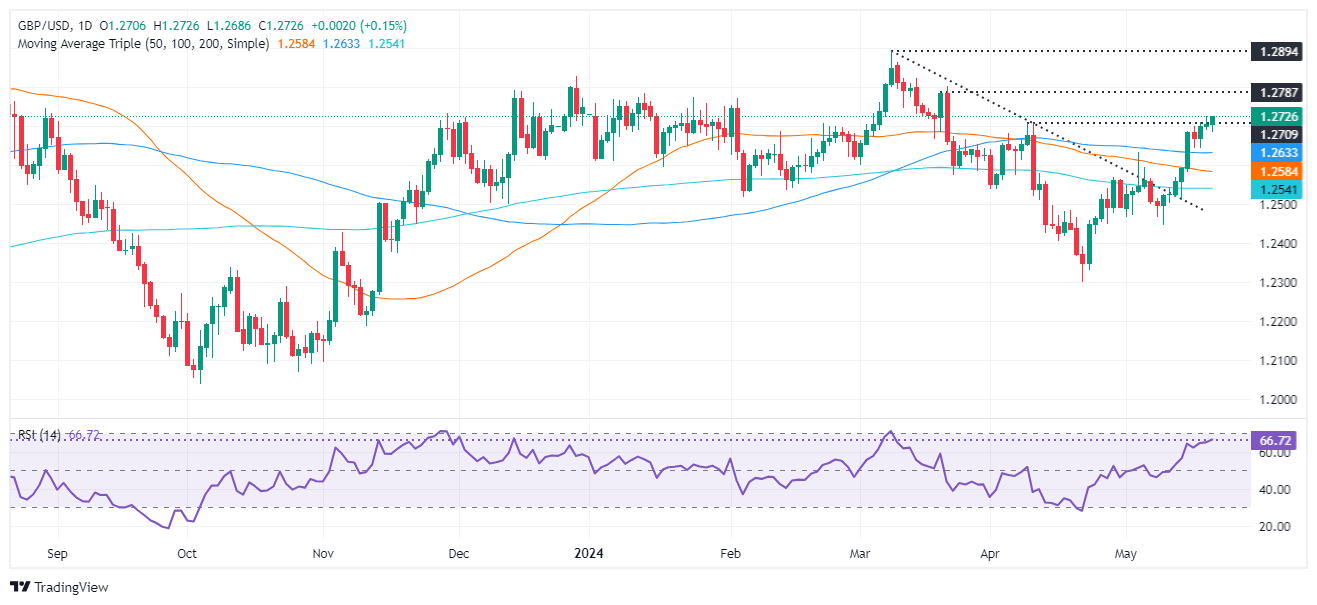

The GBP/USD pair shows a clear upward bias in the near term. While it has yet to print a new weekly high above Monday’s 1.2725, this could potentially pave the way for significant further gains.

Momentum is in favor of the buyers, as depicted by the Relative Strength Index (RSI), which is in bullish territory, though it’s about to turn overbought.

If GBP/USD buyers reclaim 1.2725, that could exacerbate a rally to the next pivot high at 1.2803, the March 21 high. Once surpassed, the next resistance would be the year-to-date (YTD) high at 1.2893.

Conversely, the pair could aim downwards if it registers a daily close below May 20’s low of 1.2681. That can expose the 100-day moving average (DMA) at 1.2634, followed by the 50-DMA at 1.2583.

GBP/USD Price Action – Daily Chart

British Pound PRICE Today

The table below shows the percentage change of British Pound (GBP) against listed major currencies today. British Pound was the strongest against the Canadian Dollar.

| USD | EUR | GBP | JPY | CAD | AUD | NZD | CHF | |

|---|---|---|---|---|---|---|---|---|

| USD | -0.02% | -0.14% | -0.17% | 0.13% | -0.10% | 0.07% | -0.09% | |

| EUR | 0.02% | -0.13% | -0.14% | 0.13% | -0.08% | 0.07% | -0.07% | |

| GBP | 0.14% | 0.13% | -0.04% | 0.28% | 0.04% | 0.20% | 0.05% | |

| JPY | 0.17% | 0.14% | 0.04% | 0.31% | 0.07% | 0.22% | 0.08% | |

| CAD | -0.13% | -0.13% | -0.28% | -0.31% | -0.23% | -0.07% | -0.23% | |

| AUD | 0.10% | 0.08% | -0.04% | -0.07% | 0.23% | 0.16% | 0.03% | |

| NZD | -0.07% | -0.07% | -0.20% | -0.22% | 0.07% | -0.16% | -0.15% | |

| CHF | 0.09% | 0.07% | -0.05% | -0.08% | 0.23% | -0.03% | 0.15% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the British Pound from the left column and move along the horizontal line to the US Dollar, the percentage change displayed in the box will represent GBP (base)/USD (quote).

Author

Christian Borjon Valencia

FXStreet

Markets analyst, news editor, and trading instructor with over 14 years of experience across FX, commodities, US equity indices, and global macro markets.