- GBP/USD prints three-day winning streak to probe September 18 top surrounding 1.3000.

- Resistance line of the bearish chart pattern, 200-bar SMA will be a tough nut to crack for the buyers.

- 100-bar SMA adds to the downside support below rising wedge’s lower line.

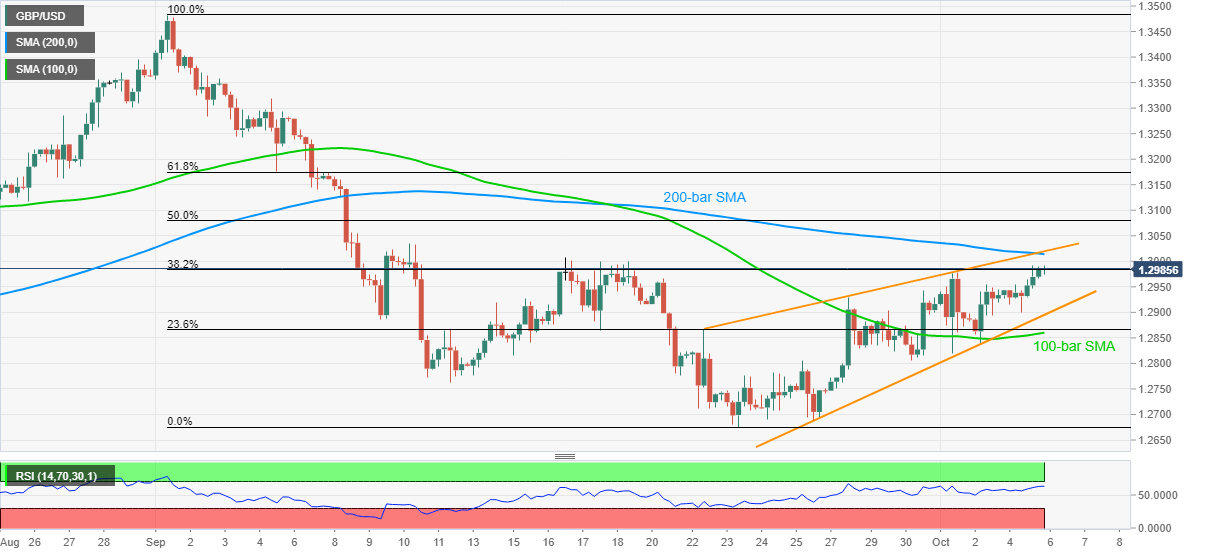

GBP/USD rises to the highest in more than two weeks while trading around 1.2985, the intraday top being 1.2992, during the early Tuesday morning in Asia. In doing so, the Cable attacks 38.2% Fibonacci retracement of the September month’s downside amid upbeat RSI conditions.

However, a bearish chart pattern, the rising wedge, on the four-hour chart (4H) challenges the GBP/USD buyers above the 1.3000 threshold.

Other than the upper line of the sellers’ favorite chart play, 200-bar SMA also adds strength to the 1.3015/20 resistance confluence.

If at all the pair manages to cross 1.3020, the September 10 high near 1.3035 and 61.8% Fibonacci retracement around 1.3175 will be the key to watch.

Alternatively, a downside break of the rising wedge support, at 1.2895 now, needs confirmation from a 100-bar SMA level of 1.2860 before challenging the previous month’s low of 1.2675.

GBP/USD four-hour chart

Trend: Pullback expected

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

EUR/USD drops below 1.0800 on Trump's 'Liberation Day'

EUR/USD is back in the red below 1.0800 in the early European morning on Wednesday as investors rush for the safe-haven US Dollar, aniticpating US President Donald Trump’s long-threatened “reciprocal” tariffs package, due to be announced at 20:00 GMT.

GBP/USD trades with caution above 1.2900, awaits Trump’s tariffs reveal

GBP/USD is trading with caution above 1.2900 early Wednesday, struggles to capitalize on the overnight bounce amid resugent haven demand for the US Dollar. Traders remain wary heading into the US 'reciprocal tariffs' announcement on "Liberation Day' at 20:00 GMT.

Gold price remains close to record high amid concerns over Trump’s reciprocal tariffs

Gold price regains positive traction amid concerns about Trump’s aggressive trade policies. Fed rate cut bets keep the USD bulls on the defensive and further benefiting the XAU/USD pair. A broadly stable risk sentiment might cap gains ahead of Trump’s tariffs announcement.

Bitcoin, Ethereum and Ripple brace for volatility amid Trump’s ‘Liberation Day’

Bitcoin price faces a slight rejection around its $85,000 resistance level on Wednesday after recovering 3.16% the previous day. Ripple follows BTC as it falls below its critical level, indicating weakness and a correction on the horizon.

Is the US economy headed for a recession?

Leading economists say a recession is more likely than originally expected. With new tariffs set to be launched on April 2, investors and economists are growing more concerned about an economic slowdown or recession.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.