GBP/USD Price Analysis: Ready to refresh multi-month high above 1.2500

- GBP/USD seesaws near the highest levels since June 2022 during four-day uptrend.

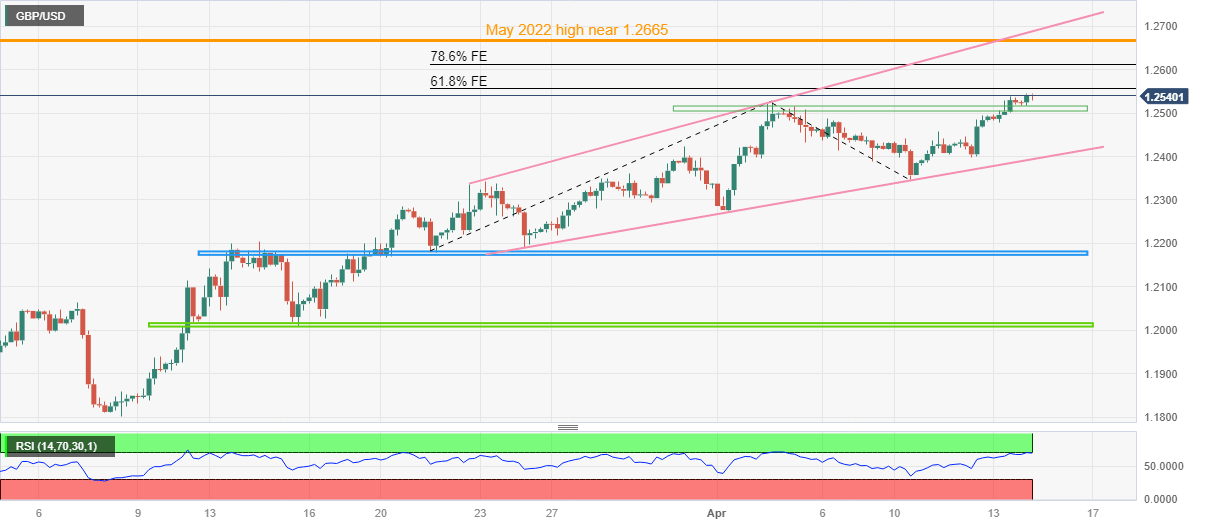

- Clear upside break of eight-day-old horizontal resistance, now support, hints at further advances of the Cable pair.

- Multiple key FE levels, mid-2022 peak can challenge buyer inside megaphone trend-widening pattern.

GBP/USD bulls take a breather at the highest levels in 10 months, making rounds to mid-1.2500s heading into Friday’s London open.

In doing so, the Cable pair bears the burden of the overbought RSI conditions while reassessing the odds of a further upside. However, a clear upside break of the previous key resistance comprising multiple levels marked since April 04, around 1.2510-2500, keeps the GBP/USD bulls hopeful of refreshing the multi-month top.

In that case, the 61.8% and 78.6% Fibonacci Expansion (FE) of the pair’s moves between March 21 and April 10, respectively near 1.2555 and 1.2615, could gain the market’s attention ahead of May 2022 high of around 1.2665.

It’s worth noting, however, that the top line of a three-week-old rising megaphone trend widening chart formation, around 1.2690 by the press time, can restrict the GBP/USD pair’s upside past 1.2665

Alternatively, pullback moves need to provide a convincing break below the 1.2500 round figure to recall the intraday sellers.

Even so, the aforementioned megaphone’s lower line, close to 1.2395 by the press time, can challenge the bears before giving them control.

Should the GBP/USD price remains bearish past 1.2395, multiple levels marked since early March constitute 1.2180-70 and 1.2015-05 as the key support to watch.

Overall, GBP/USD remains on the bull’s radar even if RSI conditions challenge the upside momentum of late.

GBP/USD: Four-hour chart

Trend: Gradual upside expected

Author

Anil Panchal

FXStreet

Anil Panchal has nearly 15 years of experience in tracking financial markets. With a keen interest in macroeconomics, Anil aptly tracks global news/updates and stays well-informed about the global financial moves and their implications.