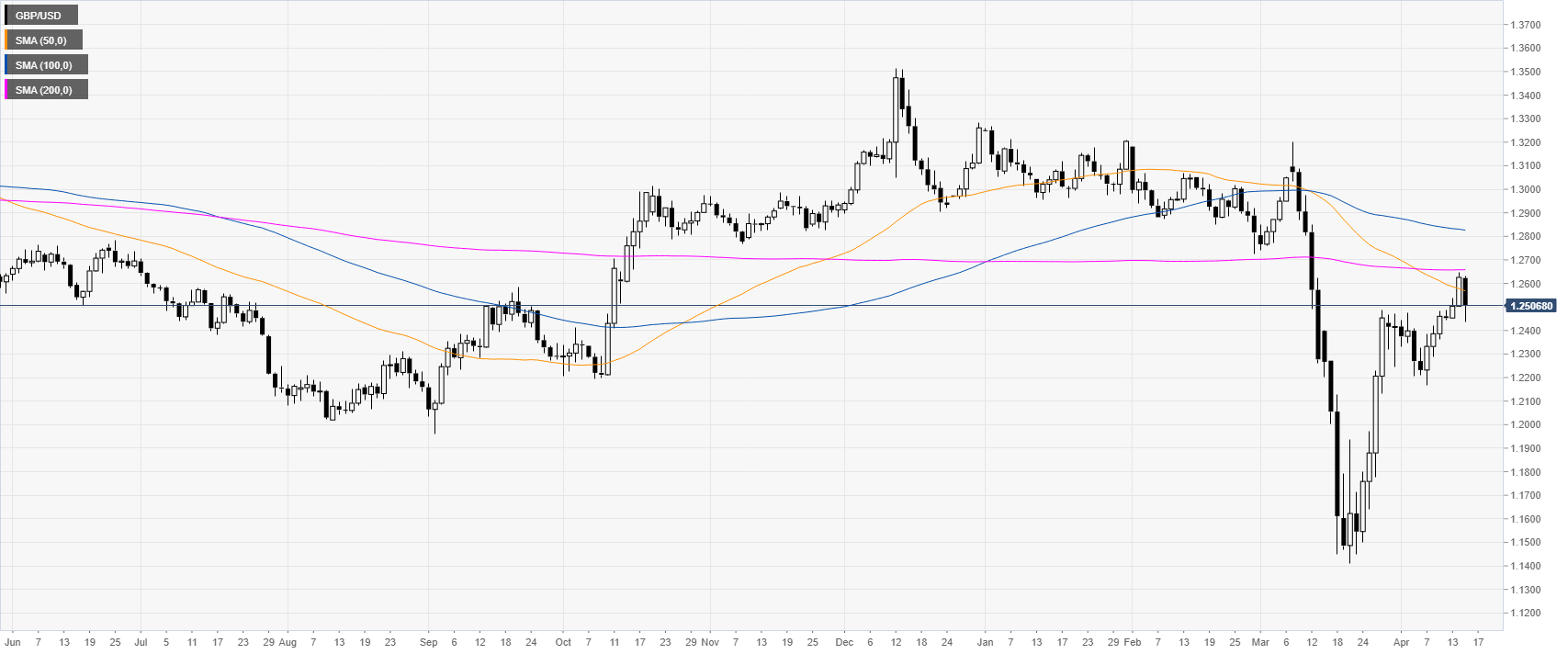

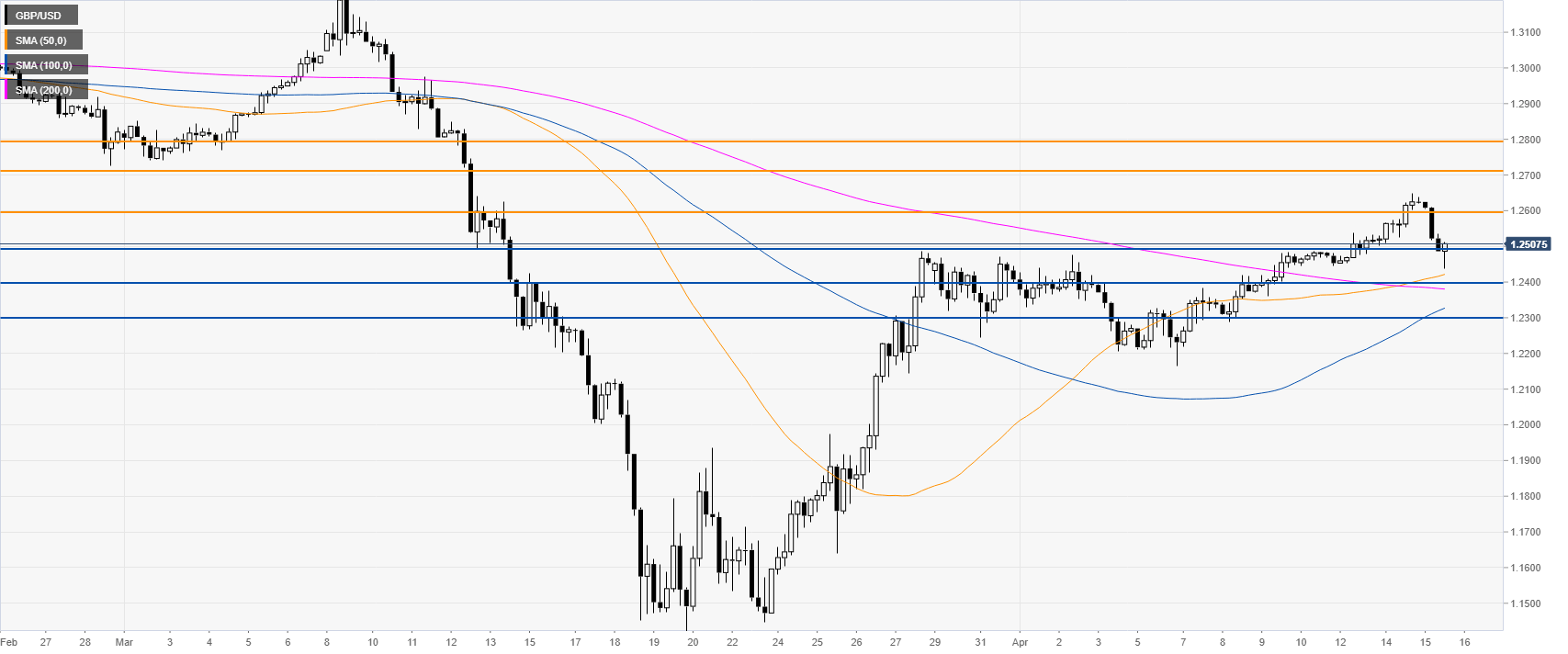

- GBP/USD bullish recovery remains intact despite the small dip to the 1.2500 figure.

- The level to beat for bulls is the 1.2600 resistance.

GBP/USD daily chart

GBP/USD four-hour chart

Additional key levels

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer. Opinions expressed at FXstreet.com are those of the individual authors and do not necessarily represent the opinion of FXstreet.com or its management. Risk Disclosure: Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Recommended content

Editors’ Picks

AUD/USD: Next stop emerges at 0.6580

The downward bias around AUD/USD remained unabated for yet another day, motivating spot to flirt with the area of four-week lows well south of the key 0.6700 region.

EUR/USD looks cautious near 1.0900 ahead of key data

The humble advance in EUR/USD was enough to partially leave behind two consecutive sessions of marked losses, although a convincing surpass of the 1.0900 barrier was still elusive.

Gold extends slide below $2,400

Gold stays under persistent bearish pressure after breaking below the key $2,400 level and trades at its lowest level in over a week below $2,390. In the absence of fundamental drivers, technical developments seem to be causing XAU/USD to stretch lower.

SEC gives final approval for Ethereum ETFs to begin trading

The Securities and Exchange Commission approved the S-1 registration statements of spot Ethereum ETF issuers on Monday, making it the second digital asset ETF to go live in the US, according to the latest filings on its website.

Commodity FX gets no help from higher US equities

Markets were all over the place on Monday. US equities put in a decent recovery, though this did nothing to help beaten down commodity FX, with the Australian Dollar, New Zealand Dollar and Canadian Dollar all getting hammered.