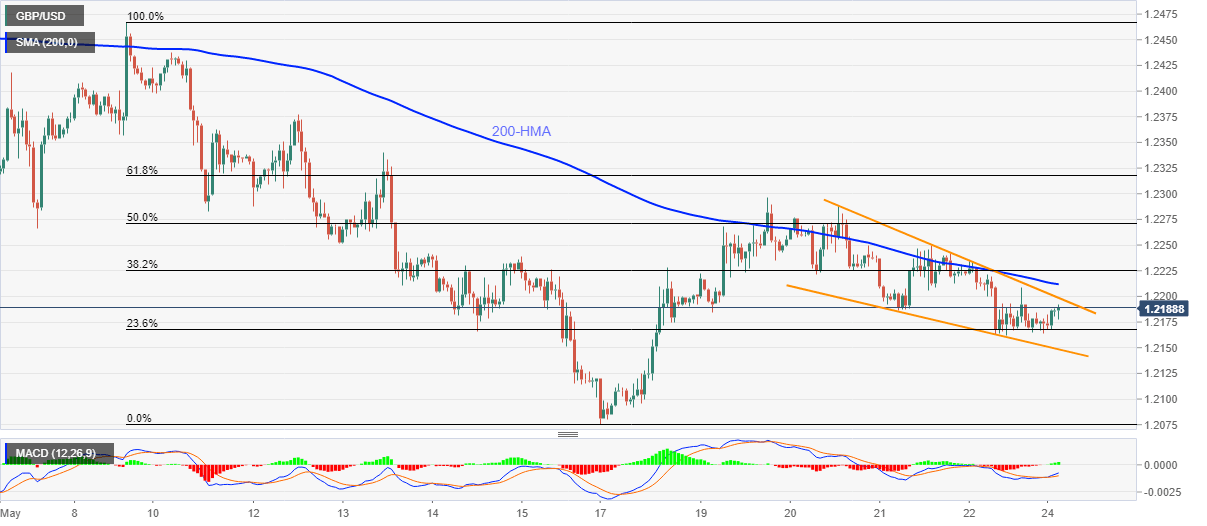

GBP/USD Price Analysis: Portrays falling wedge on hourly chart below 1.2200

- GBP/SD extends recoveries from 1.2162 to intraday high of 1.2191.

- 200-HMA adds to the upside resistance.

- Bears can refresh monthly low amid a gradual weakening.

GBP/USD rises to 1.2191, up 0.15% on a day, during Monday’s Asian session. In doing so, the Cable pair extends its recoveries from Friday’s low of 1.2162 while staying inside a bullish chart formation.

Considering the pair’s sustained trading below 200-HMA, bulls are less likely to enter immediately on the upside break of falling wedge resistance, at 1.2200 now.

However, a successful break of 1.2215, comprising 200-HMA, could propel the quote towards the last weekly top near 1.2300.

Meanwhile, a downside break below the formation’s support line of 1.2148 could challenge the monthly low near 1.2075.

Though, the pair’s extended fall below 1.2075 might not hesitate to challenge 1.2000 round-figures.

GBP/USD hourly chart

Trend: Bearish

Author

Anil Panchal

FXStreet

Anil Panchal has nearly 15 years of experience in tracking financial markets. With a keen interest in macroeconomics, Anil aptly tracks global news/updates and stays well-informed about the global financial moves and their implications.