GBP/USD Price Analysis: Bears take breather above 1.1900

- GBP/USD has turned sideways above 1.1900 ahead of US NFP and UK manufacturing data.

- The 10-year US Treasury yields have dropped firmly to near 3.83% amid mixed responses on the US labor market.

- The Cable has met with the horizontal resistance plotted from 1.1915.

The GBP/USD pair is displaying a back-and-forth action in a narrow range of 1.1904-1.1940 continuously from the late New York session. The Cable has turned sideways as investors are awaiting the release of the United States Nonfarm Payrolls (NFP) and the United Kingdom’s manufacturing data for fresh impetus.

The US Dollar Index (DXY) is facing heat in extending its recovery above 105.35 as mixed responses from US labor market-linked indicators have confused investors about the strength of the labor market. A significant jump in Initial Jobless Claims data released on Thursday, and a four-fold planned lay-off, as reported by Reuters, indicates signs of deceleration in the employment status, which has improved demand for US Treasury bonds. The 10-year US Treasury yields have dropped firmly to near 3.83%.

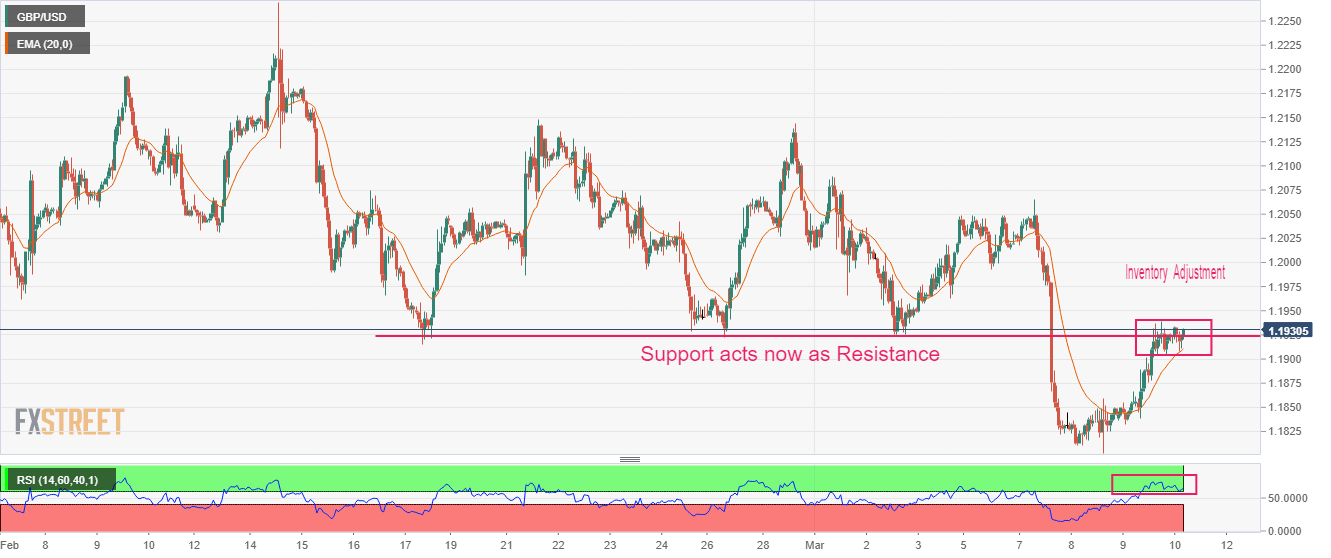

Stretched recovery in the GBP/USD pair has met with the horizontal resistance plotted from February 17 low at 1.1915 on an hourly scale. The Cable is demonstrating an inventory adjustment phase, which could be a transfer of inventory from institutional investors to retail participants.

The 20-period Exponential Moving Average (EMA) at 1.1910 is providing cushion to the Pound Sterling.

Meanwhile, the Relative Strength Index (RSI) (14) has slipped to near 60.00 but has not surrendered the bullish range yet.

Should the Cable break below the round-level support of 1.1900, US Dollar bulls will drag the asset further toward March 08 high at 1.1860 followed by November 17 low at 1.17633.

On the flip side, a move above February 24 high at 1.2040 will drive the asset toward February 23 high around 1.2080. A breach of the latter will expose the asset to February 21 high around 1.2140.

GBP/USD hourly chart

Author

Sagar Dua

FXStreet

Sagar Dua is associated with the financial markets from his college days. Along with pursuing post-graduation in Commerce in 2014, he started his markets training with chart analysis.