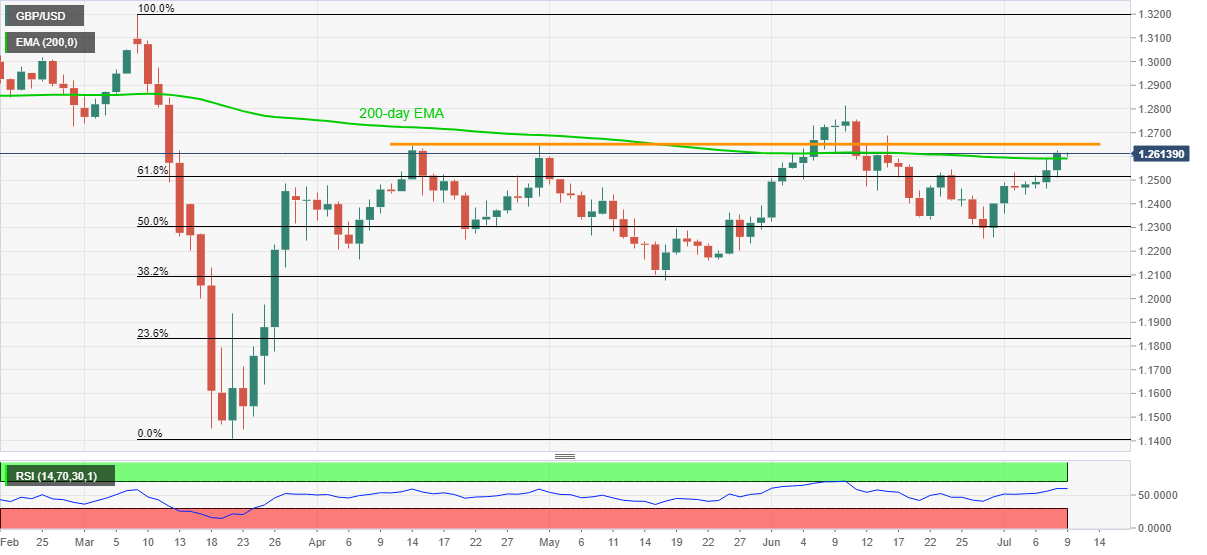

- GBP/USD nears three-week top, recently bounced off 1.2600.

- A successful trading above the key EMA enables the quote to confront a three-month-old horizontal resistance.

- 61.8% Fibonacci retracement adds to the downside support.

GBP/USD remains on the front foot around 1.2613 during the early Asian session on Thursday. In doing so, the Cable keeps the previous day’s break above 200-day EMA. As a result, the bulls are targeting a horizontal area comprising multiple highs marked since April 14.

Other than the 1.2645/55 immediate resistance region, the early-June top of 1.2730 and 1.2800 round-figure may act as buffers ahead of the June 10 peak of 1.2813.

It’s worth mentioning that the pair’s rise past-1.2813 could aim for 1.3000 psychological magnet before refreshing the yearly top beyond 1.3200.

Meanwhile, a daily close below 200-day EMA level of 1.2590 could drag the quote to 61.8% of Fibonacci retracement of March month’s fall near 1.2515.

Also acting as the near-term key supports will be July 03 bottom near 1.2440 and June 22 low surrounding 1.2330.

GBP/USD daily chart

Trend: Bullish

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

AUD/USD struggles below 0.6400; focus remains on FOMC meeting

AUD/USD stays defensive below 0.6400 early Tuesday, lacking bullish conviction. China's economic woes, US-China trade war fears and the RBA's dovish shift continue to act as a headwind for the Aussie. The pair fails to draw support from a weaker US Dollar ahead of Retail Sales data.

USD/JPY: Volatile within range near 154.00 ahead of US Retail Sales data

USD/JPY is moving back and forth in a range at around 154.00 in the Asian session on Tuesday. The pair feels the weight of the Japanese commnetary and a softer risk tone. Howevrer, a renewed US Dollar uptick keeps the dowside checked ahead of the US November Retail Sales report.

Gold price remains confined in a range ahead of the crucial Fed decision on Wednesday

Gold price struggles to gain any meaningful traction and remains confined in a narrow range. Expectations for a less dovish Fed and elevated US bond yields cap the non-yielding XAU/USD. Geopolitical risks lend support to the safe-haven precious metal ahead of the FOMC meeting.

Ripple's XRP could rally to $4.75 as RLUSD set to officially launch on Tuesday

Ripple confirmed in a press release on Monday that its RLUSD stablecoin will officially launch on Tuesday across exchanges, including MoonPay, Uphold, CoinMENA, Bitso and ArchaxEx.

Five fundamentals for the week: Fed dominates the last full and busy trading week of the year Premium

Christmas is coming – but there's a high likelihood of wild price action before the holiday season begins. Central banks take center stage, and there is enough data to keep traders busy outside these critical decisions.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.