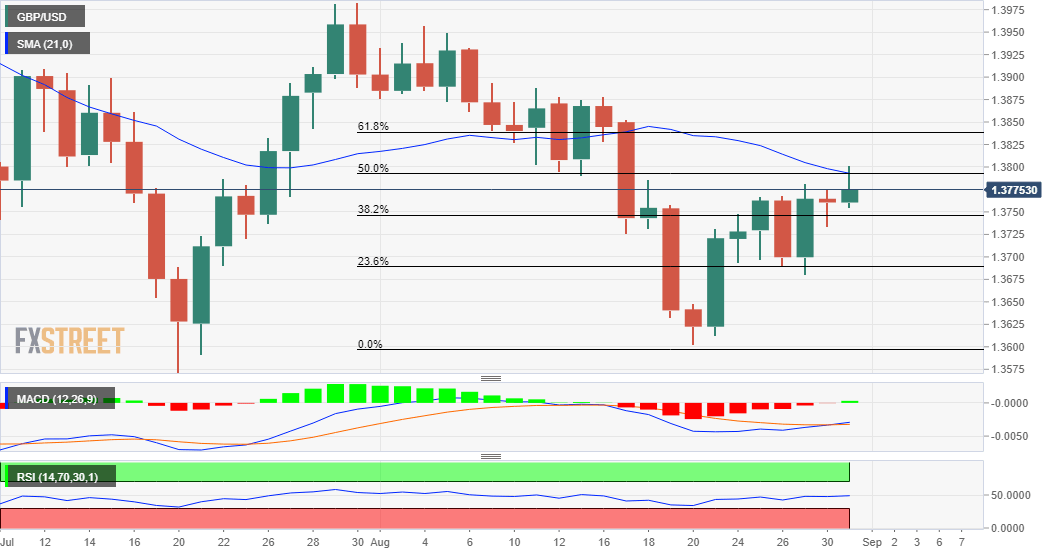

GBP/USD Price Analysis: Intraday positive move falters near 200-DMA/50% Fibo. confluence

- GBP/USD struggled to capitalize on its intraday move and faced rejection near the 1.3800 mark.

- Mixed technical indicators on hourly/daily charts warrant some caution for aggressive traders.

- Bulls would wait for a sustained move beyond the 200-day SMA and 50% Fibo. confluence hurdle.

The GBP/USD pair retreated around 30-35 pips from two-week tops and was last seen trading with only modest intraday gains, around the 1.3765-70 region.

A combination of factors continued weighing on the US dollar and assisted the GBP/USD pair to regain positive traction on Tuesday. However, the recent spike in new COVID-19 cases in the UK acted as a headwind for the British pound and capped gains for the major.

Looking at the technical picture, the positive move stalled near the 1.3800 confluence hurdle. This comprises the very important 200-day SMA and the 50% Fibonacci level of the 1.3984-1.3602 downfall, which should now act as a pivotal point for short-term traders.

Meanwhile, technical indicators on hourly charts are holding comfortably in the positive territory but are yet to confirm a bullish bias on the daily chart. This makes it prudent to wait for a sustained move beyond the mentioned barrier before placing fresh bullish bets.

From current levels, the 38.2% Fibo. level, around the 1.3745 region is likely to protect the immediate downside. A convincing break below might prompt some technical selling and drag the GBP/USD pair back towards testing sub-1.3700 levels, or the 23.6% Fibo. support.

On the flip side, the 1.3800 mark might continue to act as a strong barrier, which if cleared decisively will set the stage for additional gains. The GBP/USD pair might then climb to the 61.8% Fibo. level, around the 1.3840 region, before aiming to reclaim the 1.3900 mark.

GBP/USD daily chart

Technical levels to watch

Author

Haresh Menghani

FXStreet

Haresh Menghani is a detail-oriented professional with 10+ years of extensive experience in analysing the global financial markets.