GBP/USD Price Analysis: Gains traction below 1.2500, investors await BoE’s Bailey speech

- GBP/USD trades in positive territory for the second consecutive day on the weaker USD.

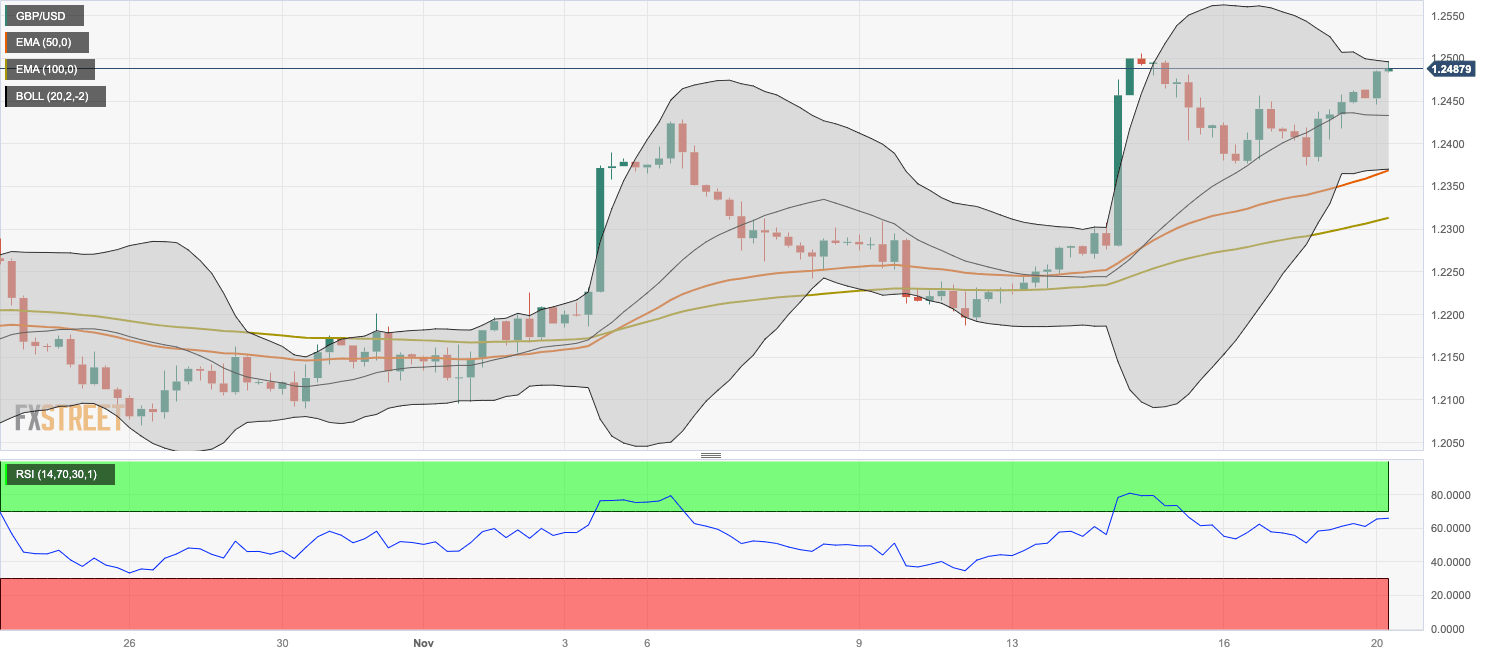

- The pair holds above the 50- and 100-hour EMA on the four-hour chart, RSI indicator holds in the bullish zone.

- The key resistance is seen at the 1.2500–1.2505 region; the 1.2370–1.2375 zone acts as a key support level.

The GBP/USD pair holds positive ground around 1.2485 during the early European session on Monday. The recovery of the pair is bolstered by the softer US Dollar (USD) and lower US Treasury bond yields. Investors will take more cues from Bank of England (BoE) Governor Andrew Bailey's speech on Monday ahead of the Federal Open Market Committee (FOMC) Meeting Minutes on Tuesday.

From the technical perspective, GBP/USD holds above the 50- and 100-hour Exponential Moving Averages (EMAs) with an upward slope on the four-hour chart, suggesting the path of least resistance is to the upside. Furthermore, the Relative Strength Index (RSI) holds in the bullish territory above 50, which means further upside looks favorable.

That being said, the critical resistance level for the major pair will emerge near the confluence of the upper boundary of the Bollinger Band and a high of November 14 at the 1.2500–1.2505 region. A decisive break above the latter will see a rally to a high of September 11 at 1.2548. The next upside barrier is seen at a high of September 6 at 1.2588.

On the flip side, the 1.2370–1.2375 zone acts as a key support level. The mentioned level is the congestion of the lower limit of the Bollinger Band, the 50-hour EMA, and a low of November 16. The additional downside filter to watch is the 100-hour EMA at 1.2313. A breach of the level will see a drop to a low of November 8 at 1.2242, followed by a low of November 10 at 1.2187.

GBP/USD four-hour chart

Author

Lallalit Srijandorn

FXStreet

Lallalit Srijandorn is a Parisian at heart. She has lived in France since 2019 and now becomes a digital entrepreneur based in Paris and Bangkok.