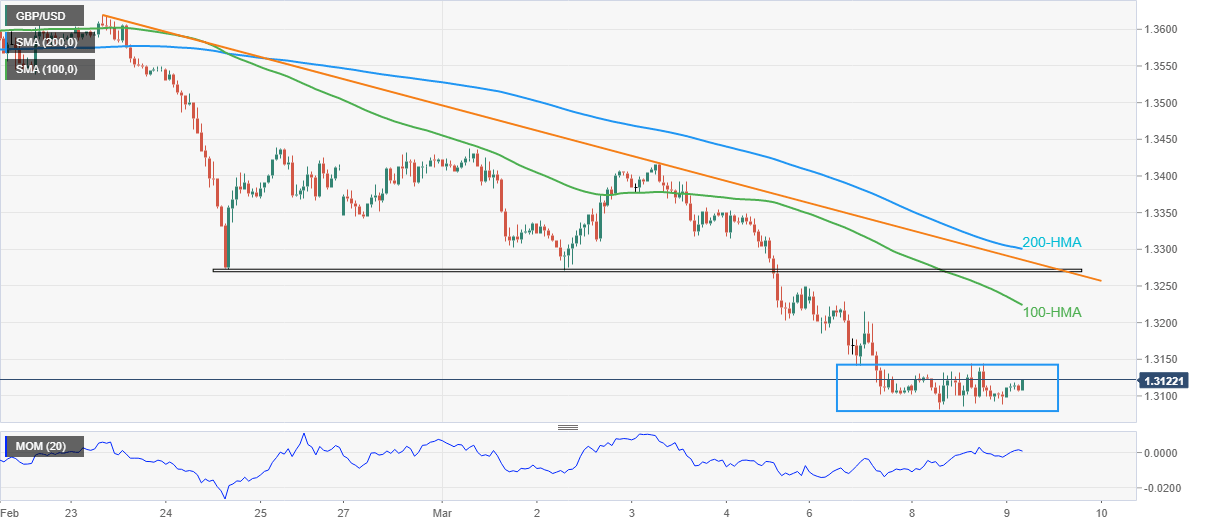

GBP/USD Price Analysis: Dribbles inside weekly range around 1.3100

- GBP/USD prints the first daily gains in four, bounces off 16-month low.

- Multiple hurdles to the north challenge the pair’s further recovery amid sluggish Momentum line.

GBP/USD bears take a breather around 1.3120 as the quote snaps a three-day downtrend heading into Wednesday’s London open.

However, an immediate rectangle formation joins sluggish Momentum to restrict the quote’s further upside around 1.3145.

Even if the quote manages to cross the 1.3145, the 100-HMA and the previous support from late February will challenge the cable pair’s further upside respectively around 1.3225 and 1.3270.

It’s worth noting that a downward sloping trend line from February 23 and the 200-HMA, close to 1.3285 and 1.3300 in that order, will act as the last defenses for the GBP/USD bears.

On the contrary, the quote’s fresh declines will need to conquer the aforementioned rectangle’s support line, near 1.3080.

Following that, a south-run towards the 1.3000 and then to November 2020 bottom surrounding 1.2850 will be in focus.

GBP/USD: Hourly chart

Trend: Bearish

Author

Anil Panchal

FXStreet

Anil Panchal has nearly 15 years of experience in tracking financial markets. With a keen interest in macroeconomics, Anil aptly tracks global news/updates and stays well-informed about the global financial moves and their implications.