GBP/USD Price Analysis: Defends 1.4200 during another battle with key hurdle

- GBP/USD bulls take a breather around weekly top.

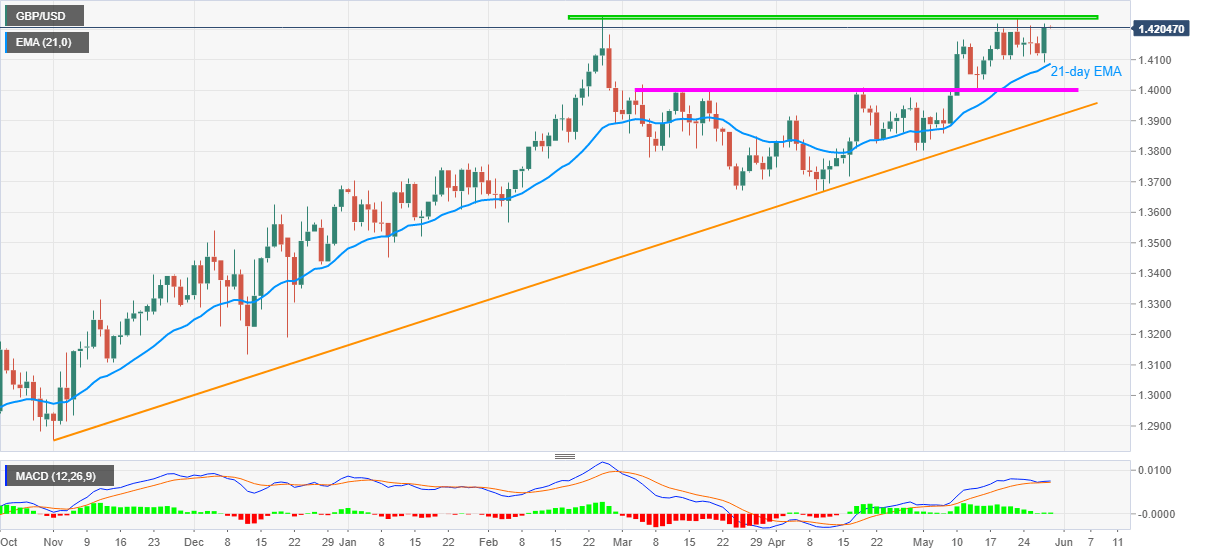

- Receding bullish bias of MACD battles sustained trading beyond 21-day EMA.

- 1.4245 becomes strong resistance, ascending trend line from November 2020 adds to downside filters.

GBP/USD seesaws around the week’s top, clinging to 1.4200 of late, during the early Asian session on Friday. The cable pair marked the heaviest jump in three weeks the previous day, not to forget bouncing off 21-day EMA. However, sluggish MACD and the key hurdle around 1.2235-45 probes the Sterling buyers.

Given the fading strength of bulls, per MACD, coupled with the nearness to the strong resistance, GBP/USD may witness a pullback towards retesting the 21-day EMA support, around 1.4085 by the press time.

Also acting as the important short-term support could be the three-month-old horizontal area around 1.4010–4000, a break of which will highlight a six-month-old ascending support line near 1.3900.

Meanwhile, a clear run-up beyond the 1.4245 hurdle will propel GBP/USD towards April 2018 top surrounding 1.4375 wherein the 1.4300 round-figure could offer an intermediate halt.

It’s worth mentioning that the GBP/USD could confirm the three-year-long rounding bottom bullish chart formation on the successful break of 1.4375, which in turn could lead buyers toward the 2014 levels above 1.6000.

GBP/USD daily chart

Trend: Pullback expected

Author

Anil Panchal

FXStreet

Anil Panchal has nearly 15 years of experience in tracking financial markets. With a keen interest in macroeconomics, Anil aptly tracks global news/updates and stays well-informed about the global financial moves and their implications.