GBP/USD Price Analysis: Clings to gains below 1.3800, lacks follow-through

- GBP/USD gained traction for the second consecutive session on Tuesday.

- A modest USD strength seemed to cap the upside amid fresh Brexit jitters.

- Bears need to wait for a sustained break below ascending channel support.

The GBP/USD pair gained traction for the second consecutive session on Tuesday and climbed to 1.3800 neighbourhood during the early European session, albeit lacked follow-through. The uptick could be solely attributed to some cross-driven strength stemming from a fresh leg down in the EUR/GBP cross. That said, a modest US dollar strength kept a lid on any further gains for the major amid fresh Brexit jitters.

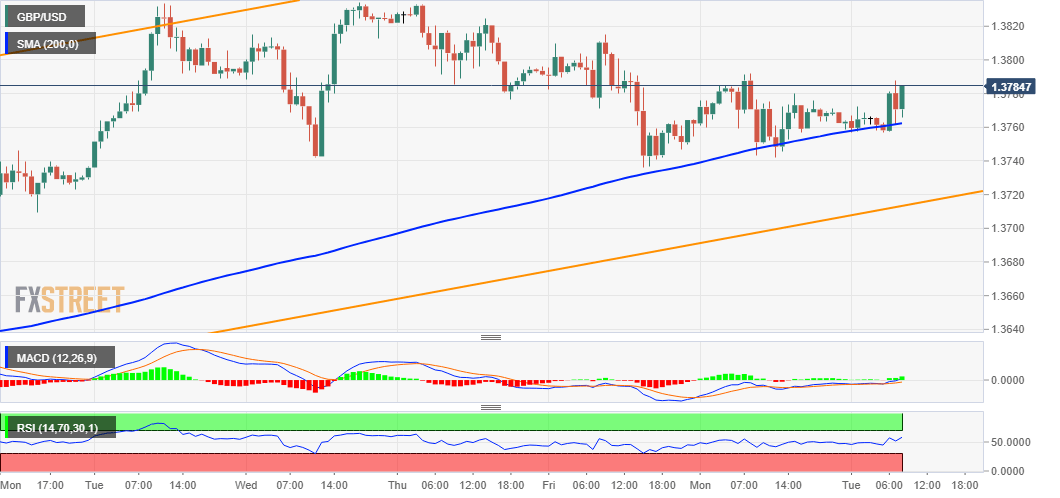

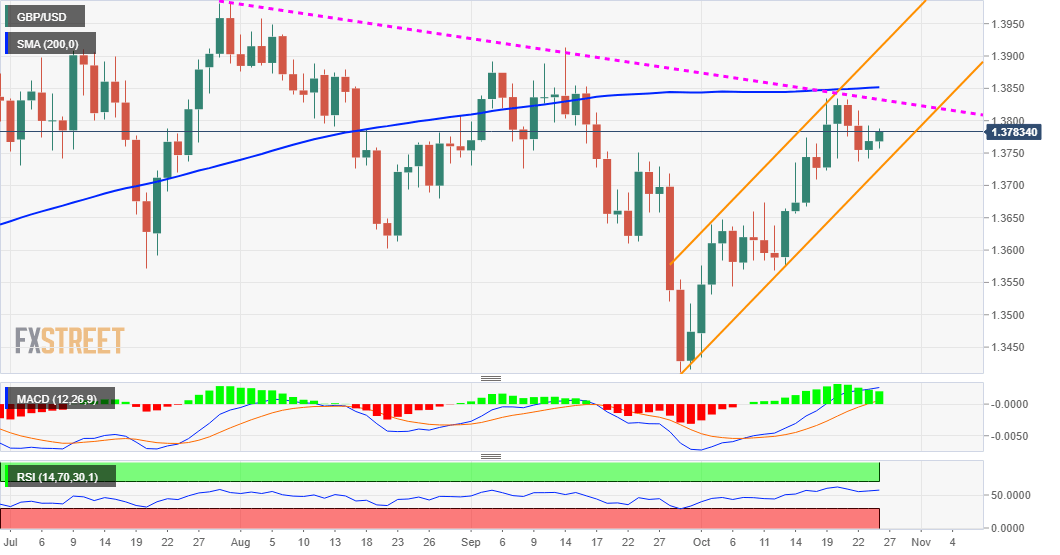

From a technical perspective, the GBP/USD pair has been showing some resilience near the 200-hour SMA. This is closely followed by the lower boundary of an ascending channel extending from the vicinity of the 1.3400 mark, or September swing lows. The latter, currently around mid-1.3700s, should now act as a key pivotal point for short-term traders. A convincing break below will set the stage for an extension of the recent rejection slide from the very important 200-day SMA.

GBP/USD 1-hour chart

The GBP/USD pair might then accelerate the corrective decline towards testing the 1.3700 round-figure mark. The next relevant support is pegged near the 1.3675-70 horizontal zone, which if broken decisively would turn the pair vulnerable. Meanwhile, technical indicators on the daily chart – though have been losing positive traction – are still holding comfortably in the bullish territory. This, in turn, warrants caution before placing aggressive bearish bets around the GBP/USD pair.

On the flip side, any meaningful positive move beyond the 1.3800 mark might continue to confront stiff resistance near the 1.3830-35 confluence region. This comprises 200-day SMA and a downward sloping trend-line extending from late July. Some follow-through buying has the potential to lift the GBP/USD pair further towards challenging the trend-channel hurdle, currently around the 1.3885 region. A sustained strength beyond will be seen as a fresh trigger for bullish traders.

GBP/USD daily chart

Technical levels to watch

Author

Haresh Menghani

FXStreet

Haresh Menghani is a detail-oriented professional with 10+ years of extensive experience in analysing the global financial markets.