GBP/USD Price Analysis: Climbs firmly above 1.2450 ahead of Monday’s US borrowing cap talks

- GBP/USD has scaled firmly above 1.2450 as the USD Index is facing pressure due to the postponement of the US debt-ceiling talks.

- The Pound Sterling to remain in action ahead of preliminary UK’s S&P PMI data.

- GBP/USD witnessed a steep fall after a breakdown of the upward-sloping trendline plotted from 1.2275.

The GBP/USD pair has climbed back above the immediate resistance of 1.2450 in the early Asian session. An absence of positive development in US debt-ceiling talks this weekend has fueled worries of a default by the US Treasury. US President Joe Biden and House of Representatives Joseph McCarthy are scheduled to meet on Monday as less than two weeks are left for US Treasury to avoid a default on obligated payments.

S&P500 futures have added decent loss in early Tokyo amid sheer volatility. The US Dollar Index (DXY) is returning back to 103.00 after a short-lived pullback move. Rising chances of a steady interest rate policy by the Federal Reserve (Fed) and volatility associated with US debt-ceiling issues have restricted the upside for the USD Index.

The Pound Sterling is to remain in action ahead of preliminary United Kingdom’s S&P PMI (May) data. Manufacturing PMI is seen higher at 48.0 while Services PMI is expected to soften to 55.5.

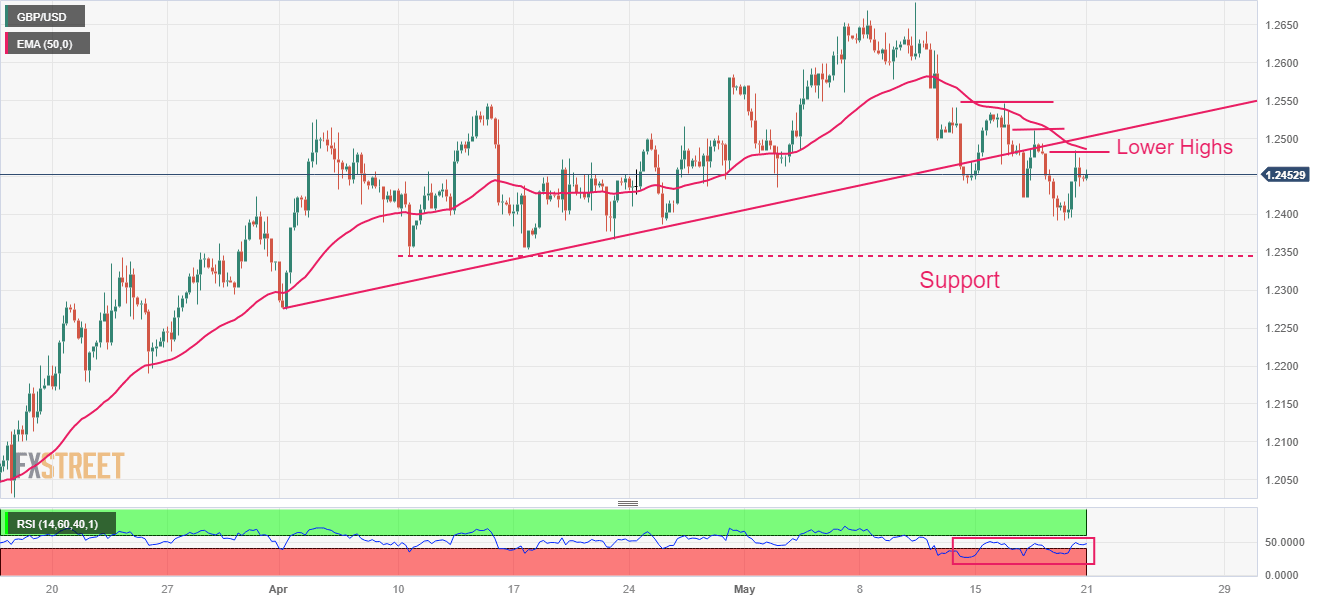

GBP/USD witnessed a steep fall after a breakdown of the upward-sloping trendline plotted from April 03 low at 1.2275 on a four-hour scale. The Cable is consistently making lower highs, indicating the strength of the US Dollar bulls. Potential support is placed from April 10 low at 1.2344.

The 50-period Exponential Moving Average (EMA) at 1.2486 is acting as a barricade for the Pound Sterling bulls.

Meanwhile, the Relative Strength Index (RSI) (14) has not shifted into the bearish range of 20.00-40.00 comfortably. An occurrence of the same will strengthen the US Dollar bulls further.

Should the asset decline below May 19 low at 1.2390, US Dollar bulls will get strengthened further and will drag the Cable toward April 10 low at 1.2344 followed by April 03 low at 1.2275.

On the flip side, a recovery move above May 09 high at 1.2640 will drive the major toward the round-level resistance at 1.2700 and 26 April 2022 high at 1.2772.

GBP/USD four-hour chart

Author

Sagar Dua

FXStreet

Sagar Dua is associated with the financial markets from his college days. Along with pursuing post-graduation in Commerce in 2014, he started his markets training with chart analysis.