GBP/USD Price Analysis: Cable seeks buyer’s attention but 1.2800, UK economic woes prod upside

- GBP/USD edges higher after posting the first weekly gain in five.

- UK’s opposition Labour Party forecasts the lowest growth among G7 countries.

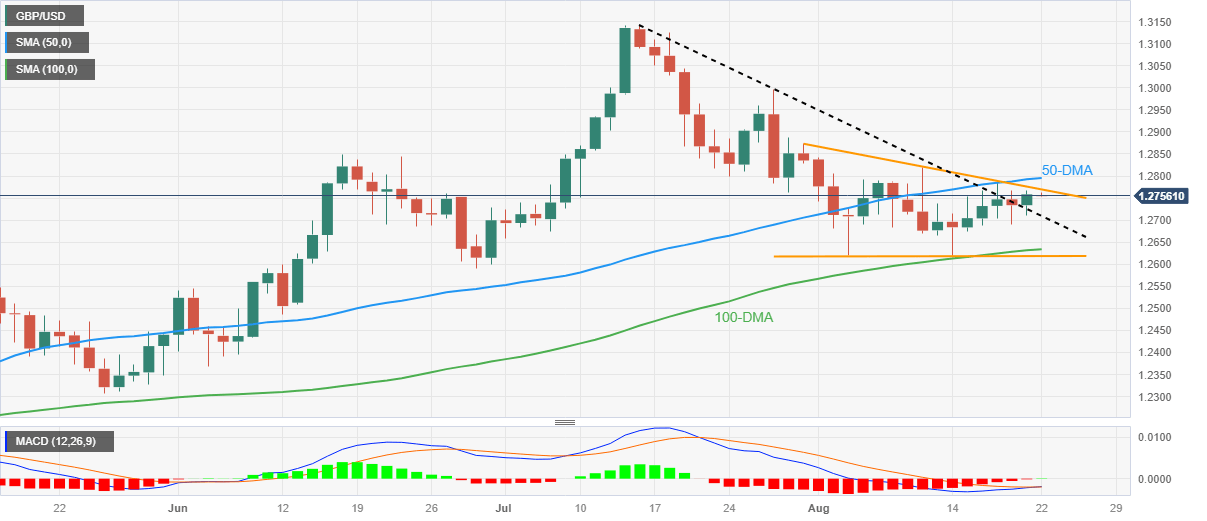

- Bullish triangle formation, looming bull cross on MACD lure Cable buyers.

- 50-DMA, cautious markets challenge Pound Sterling optimists.

GBP/USD seesaws around 1.2755-60 as bulls hit barriers during early Tuesday in Asia, snapping a four-week downtrend, as well as posting a firmer start of the week.

The Guardian came out with the news quoting Britain’s opposition Labour Party leader Keir Starmer to mention that UK growth is forecast to be slowest in the Group of Seven Nations (G7). The news also cites the opposition party terming the British economy as stuck in a low-growth trap.

Apart from that, the market’s cautious mood ahead of this week’s top-tier central bankers’ speeches at the Jackson Hole Symposium also prods the GBP/USD buyers.

However, a three-week-old bullish triangle formation and an impending bull cross on the MACD lure the GBP/USD pair buyers after it managed to cross the five-week-old descending resistance line, now immediate support near 1.2700, the last week.

That said, the stated triangle’s top line, around 1.2770 by the press time, restricts the immediate upside of the Pound Sterling ahead of the 50-DMA level of 1.2800.

Following that, June’s peak of around 1.2850 and the late July swing high near 1.2870 may test the Cable buyers before giving them control.

On the contrary, a downside break of the resistance-turned-support surrounding 1.2700 will defy the bullish bias and may drag the GBP/USD price toward the 100-DMA support of near 1.2630.

Even so, the Pound Sterling bears will remain cautious unless witnessing a daily closing below the aforementioned triangle’s bottom line, close to 1.2615 by the press time.

GBP/USD: Daily chart

Trend: Further upside expected

Author

Anil Panchal

FXStreet

Anil Panchal has nearly 15 years of experience in tracking financial markets. With a keen interest in macroeconomics, Anil aptly tracks global news/updates and stays well-informed about the global financial moves and their implications.