GBP/USD Price Analysis: Cable braces for a bumpy road, 1.2630 guards immediate recovery

- GBP/USD defends corrective bounce off 11-week low, edges higher of late.

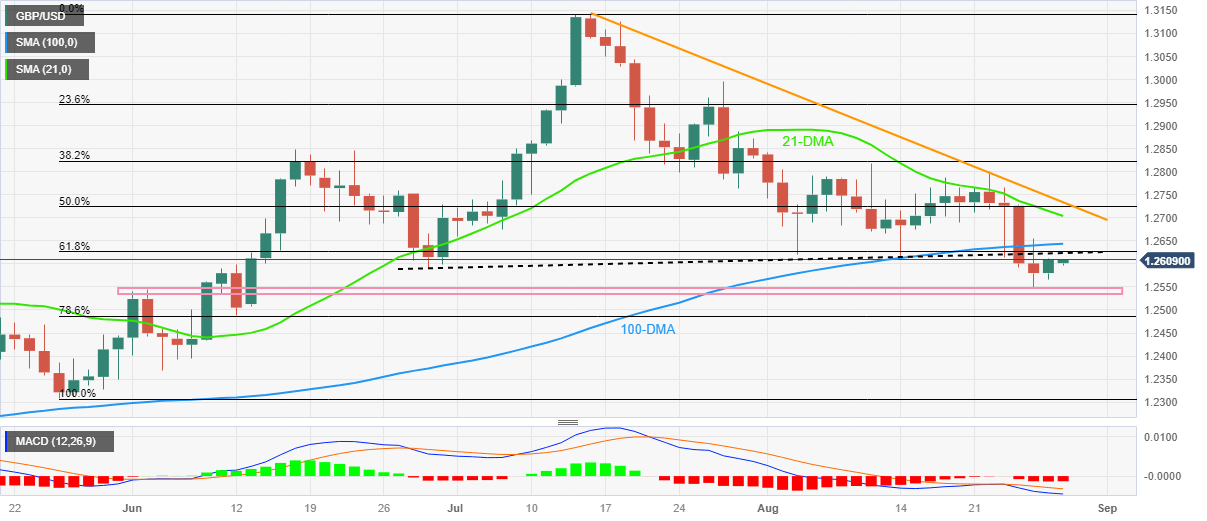

- Convergence of previous support line, 61.8% Fibonacci retracement joins bearish MACD signal to prod Cable buyers.

- Key DMAs, resistance line from mid-July also challenge Pound Sterling buyers.

- Three-month-old horizontal support appears a tough nut to crack for bears.

GBP/USD grinds higher past 1.2600 after an upbeat start of the week, picking up bids near 1.2610 amid early Tuesday morning in Asia. In doing so, the Cable pair extends the late Friday’s corrective bounce off a three-month-old horizontal support zone towards the previously key technical supports.

That said, a convergence of the 61.8% Fibonacci retracement of the May-July upside and the previous support line from late June, around 1.2630 at the latest, restricts immediate recovery of the Pound Sterling buyers, especially amid the bearish MACD signals.

Even if the quote manages to cross the 1.2630 upside hurdle, the 100-DMA and 21-DMA will challenge the GBP/USD buyers respectively around 1.2645 and 1.2705.

In a case where the Cable pair remains firmer past 1.2705, a downward-sloping resistance line from mid-July, around 1. 2740 by the press time, will be crucial to watch for the bulls before taking control.

On the flip side, the aforementioned horizontal support zone comprising multiple levels marked since early June, close to 1.2550–35, will be crucial to keep the GBP/USD buyers hopeful.

Should the Pound Sterling remain bearish past 1.2535, the odds of witnessing a slump towards May’s monthly bottom of around 1.2300 can’t be ruled out.

Overall, GBP/USD remains on the bear’s radar event if the short-term recovery can’t be ruled out.

GBP/USD: Daily chart

Trend: Limited upside expected

Author

Anil Panchal

FXStreet

Anil Panchal has nearly 15 years of experience in tracking financial markets. With a keen interest in macroeconomics, Anil aptly tracks global news/updates and stays well-informed about the global financial moves and their implications.