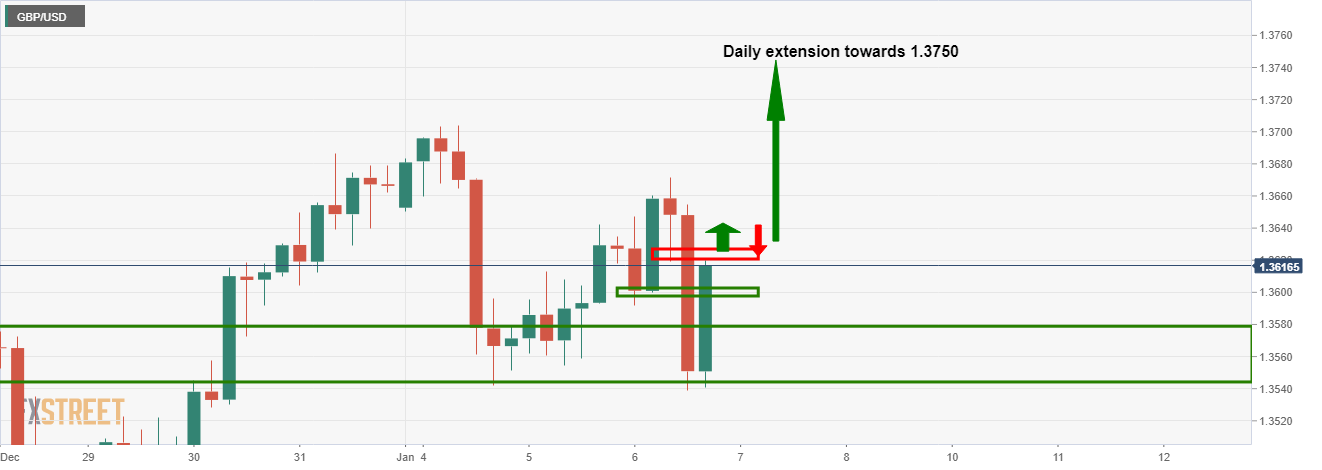

- GBP/USD is on the verge of a daily upside extension towards 1.3750.

- The 4-hour chart is where the current price action is being monitored for a break of critical resistance.

The price of the pound vs the US dollar is headed into a supply territory on the longer term charts and a healthy correction to the downside could be in order in coming days and weeks.

However, for the meantime, there is bullish market structure and price action on the lower time frames which are illustrated in the following top-down analysis.

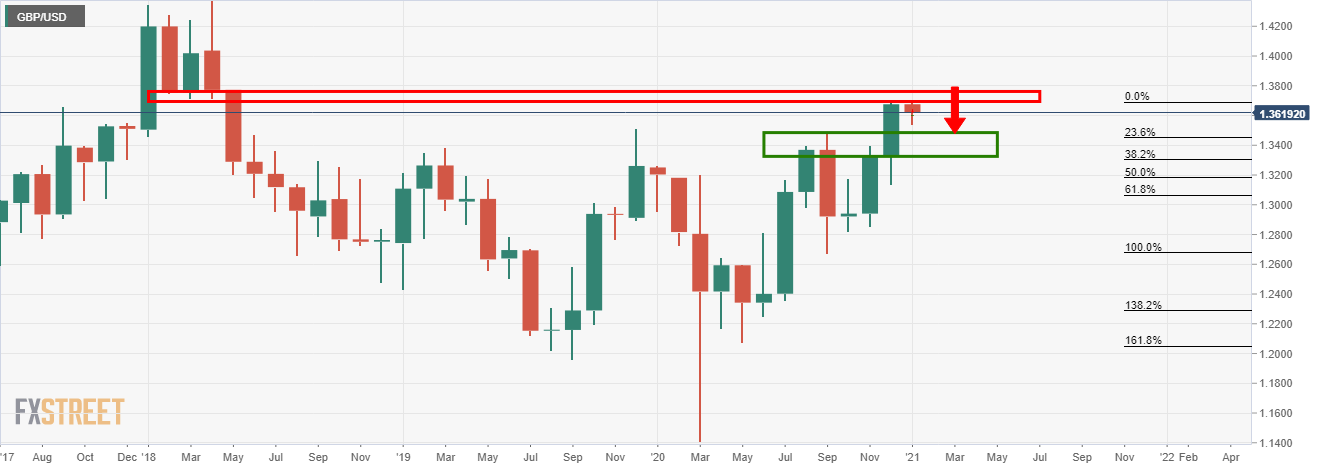

Monthly chart

Bulls have been in charge of late in a continuation of the 2020 recovery.

However, there is a strong layer of resistance ahead in a supply zone where the next bearish correction would be expected to initiate a run to prior resistance now turned support.

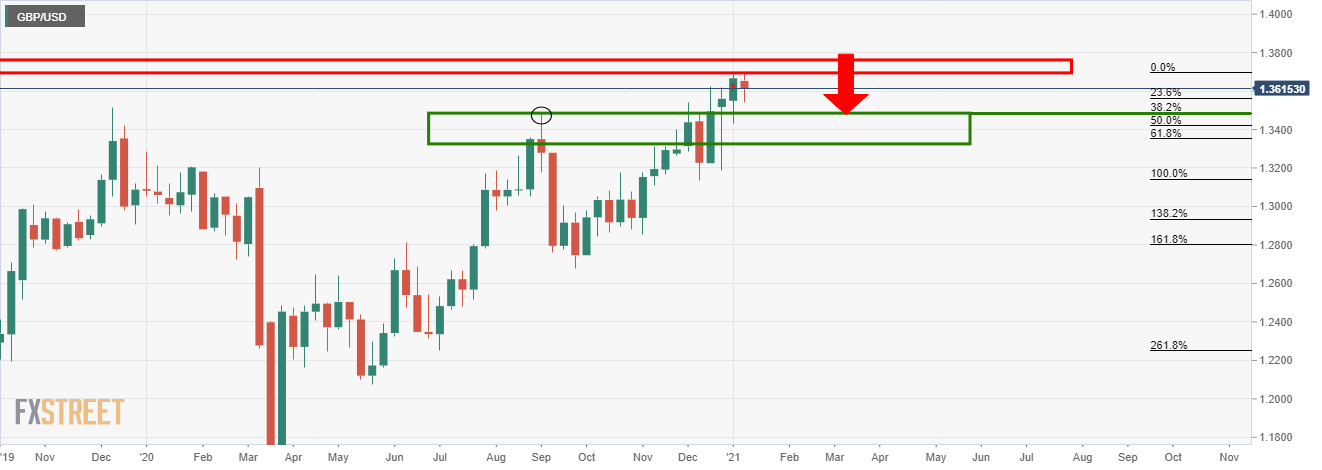

Weekly chart

It is early days yet on the weekly chart, but should the market remain in a narrow range, a weekly doji could lead to an immediate downside correction to the 38.2% Fibonacci and the confluence with prior resistance looking left.

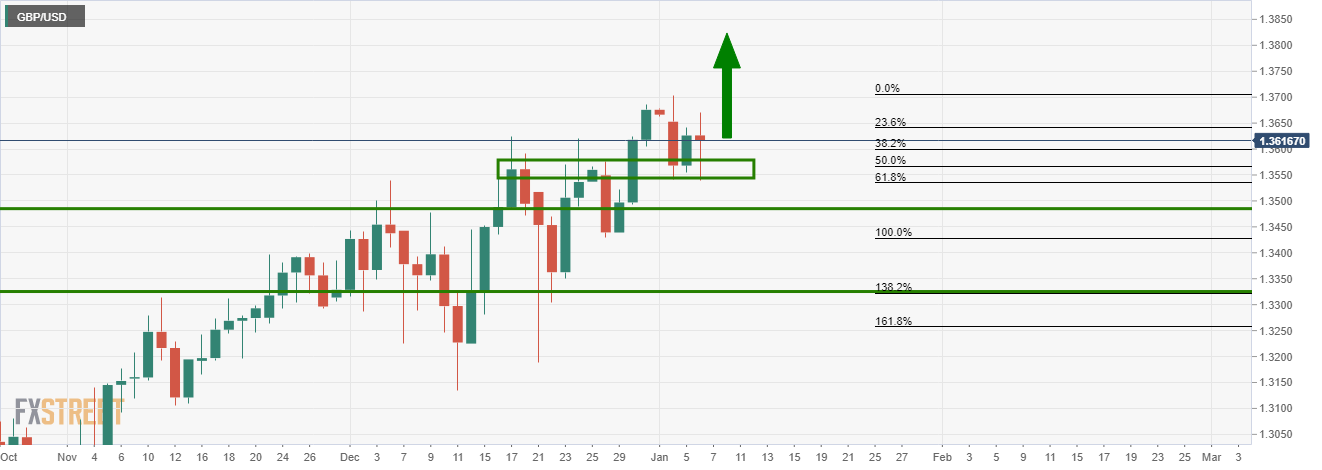

Daily chart

However, from a daily perspective, the W-formation's neckline has already prover resilient as a support and there has been a healthy correction into deep Fibos.

Therefore, an upside continuation on the daily time frame is expected.

4-hour chart

On the 4-hour chart, the price broke the first level of resistance which is now expected to act as support.

A break of the next layer of resistance, an old support and pin bar low, will open prospects of a high probability trade setup to the upside and towards 1.3750.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

AUD/USD: Door open to extra weakness

AUD/USD retreated for the third consecutive day, breaking below the 0.6300 support to challenge the provisional 55-day SMA, always on the back of further gains in the Greenback and a poor labour market report in Australia.

EUR/USD looks under pressure, survives above the 200-day SMA

EUR/USD succumbed to the continuation of the bid bias in the Greenback, adding to post-Fed losses and coming closer to the key 1.0800 neighbourhood on Thursday.

Gold corrective slide may be complete

After hitting a record high above $3,050 early Thursday, Gold retraced to the $3,030 region amid the stronger Dollar and diminishing US yields, all amid investors' repricing of the latest FOMC event.

Meme coin platform Pumpfun launches PumpSwap, promising creator revenue sharing

Solana meme coin generator Pumpfun announced on Thursday the launch of its own native decentralized exchange (DEX), PumpSwap, to facilitate the trading of meme coins and other SOL-based crypto tokens.

Tariff wars are stories that usually end badly

In a 1933 article on national self-sufficiency1, British economist John Maynard Keynes advised “those who seek to disembarrass a country from its entanglements” to be “very slow and wary” and illustrated his point with the following image: “It should not be a matter of tearing up roots but of slowly training a plant to grow in a different direction”.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.