GBP/USD Price Analysis: Bulls move in to take control

- GBP/USD bulls are taking back control on a break of structure.

- The rally has taken out the bearish trendline resistance.

Sterling rose against a weaker dollar on Tuesday as British inflation remains in focus. This has forced the price higher and placed the bulls back in control as the following analysis will illustrate

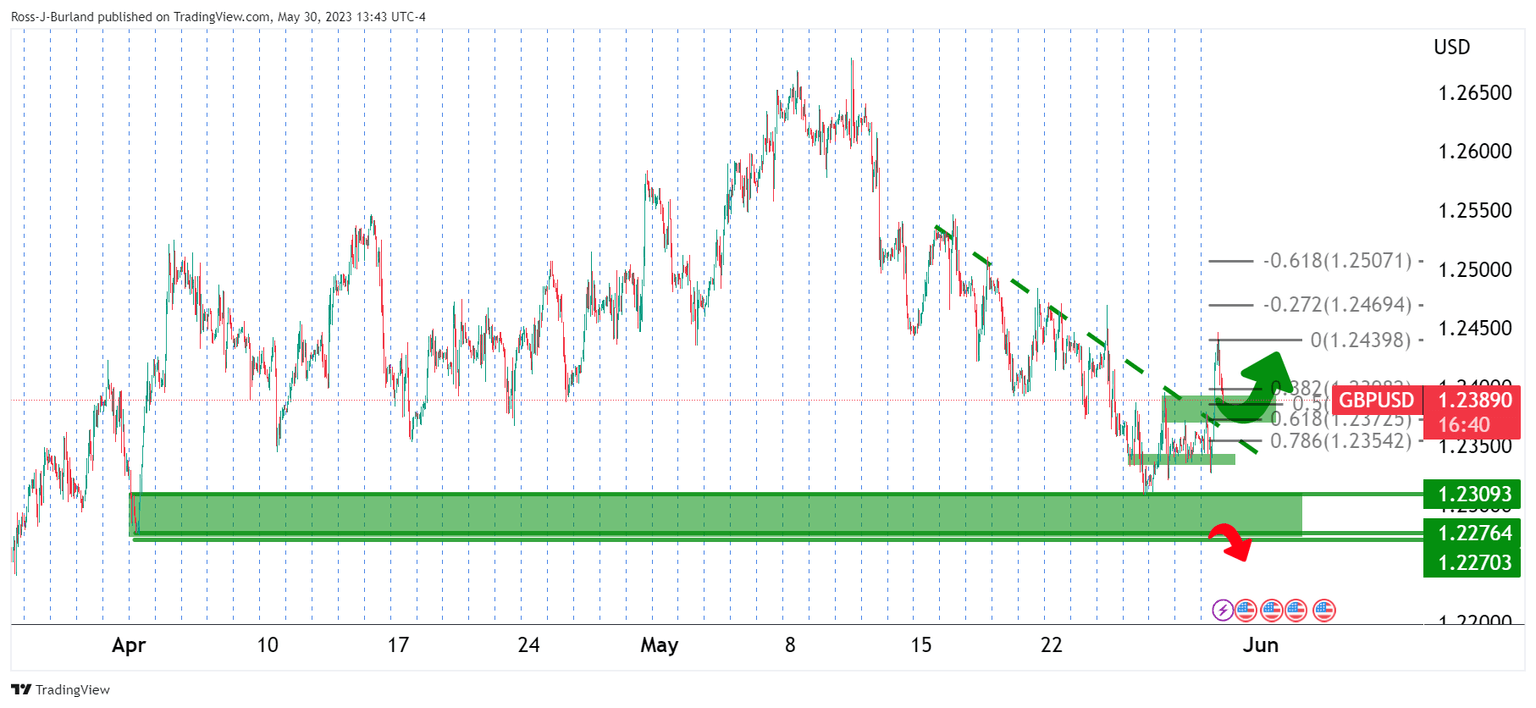

GBP/USD H1 charts

The price has broken to the backside of the old bearish trendline resistance. This is a bullish development. The bulls could be encouraged to buy in again by the deep correction of the bullish impulse.

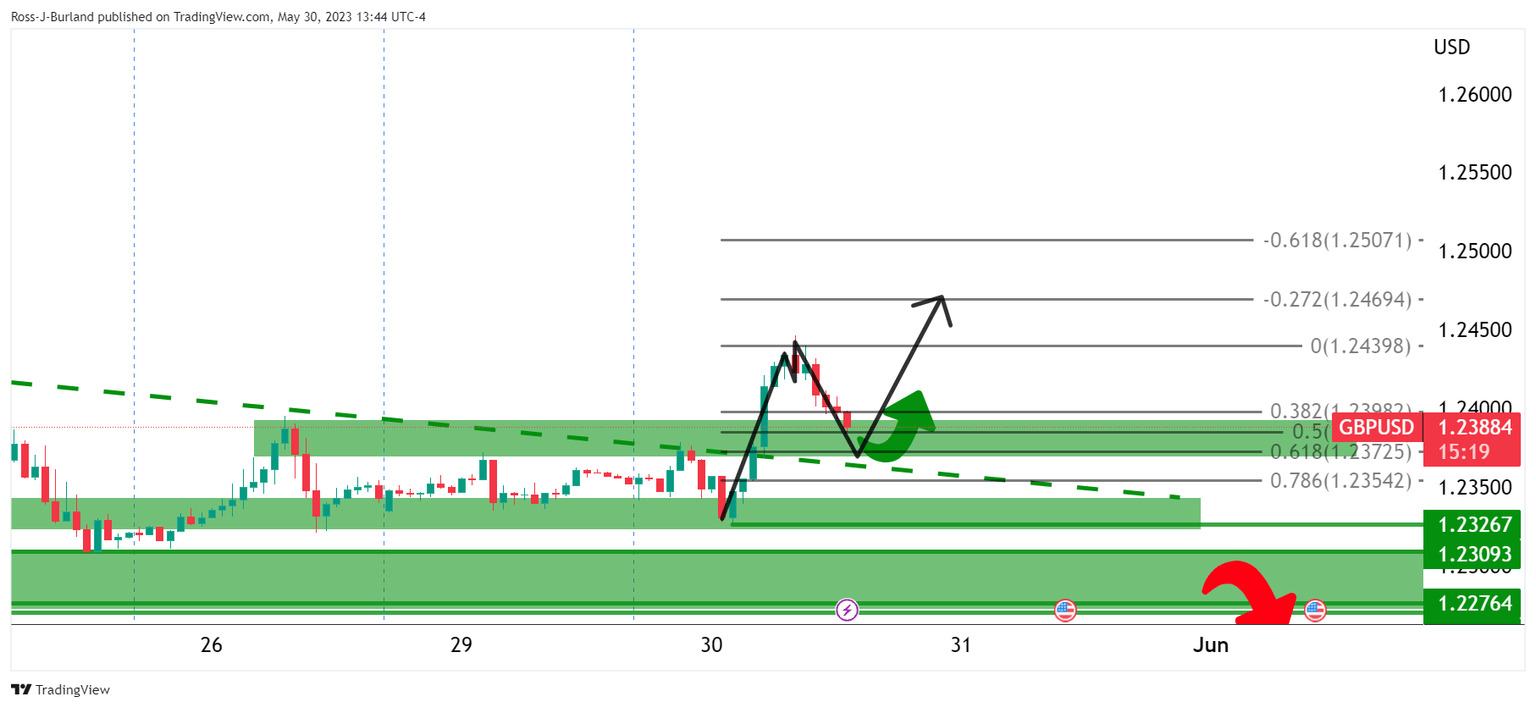

The price has made an M-formation and would be expected to run back toward the neckline of the pattern. A bullish continuation could occur on a break of the neckline.

The bulls will need to commit to the backside of the M-formation´s bearish impulse and trendline resistance while breaking the neckline and double top.

Author

Ross J Burland

FXStreet

Ross J Burland, born in England, UK, is a sportsman at heart. He played Rugby and Judo for his county, Kent and the South East of England Rugby team.