GBP/USD Price Analysis: Bulls in the market moments before the Fed

- GBP/USD bulls are in the market ahead of the Fed.

- Bulls are above support in the right-hand shoulder.

It´s Federal Reserve day and that spells volatility and technicals tend to be hard to go by as navigating the fundamentals does not stick to what is seen on the charts. Nevertheless, GBP/USD is above water and there is a bullish bias as the following illustrates:

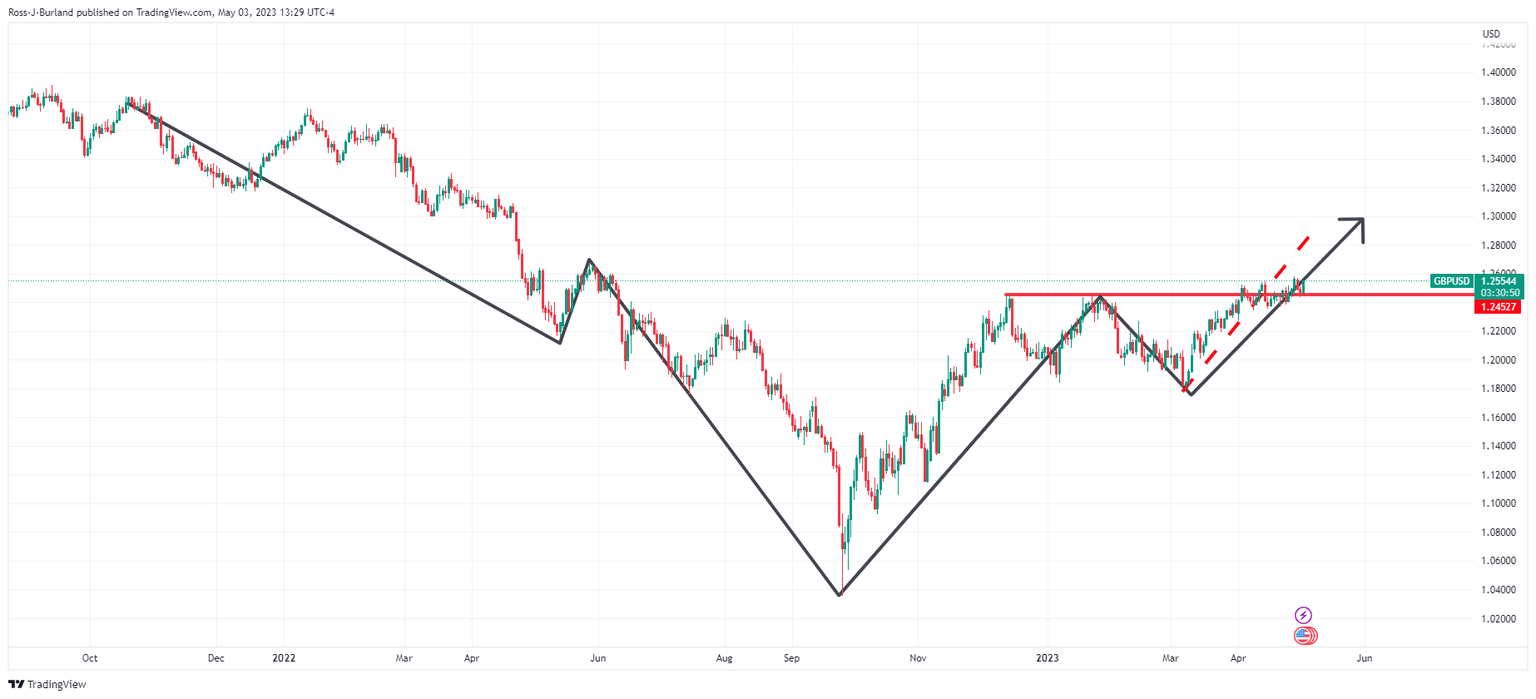

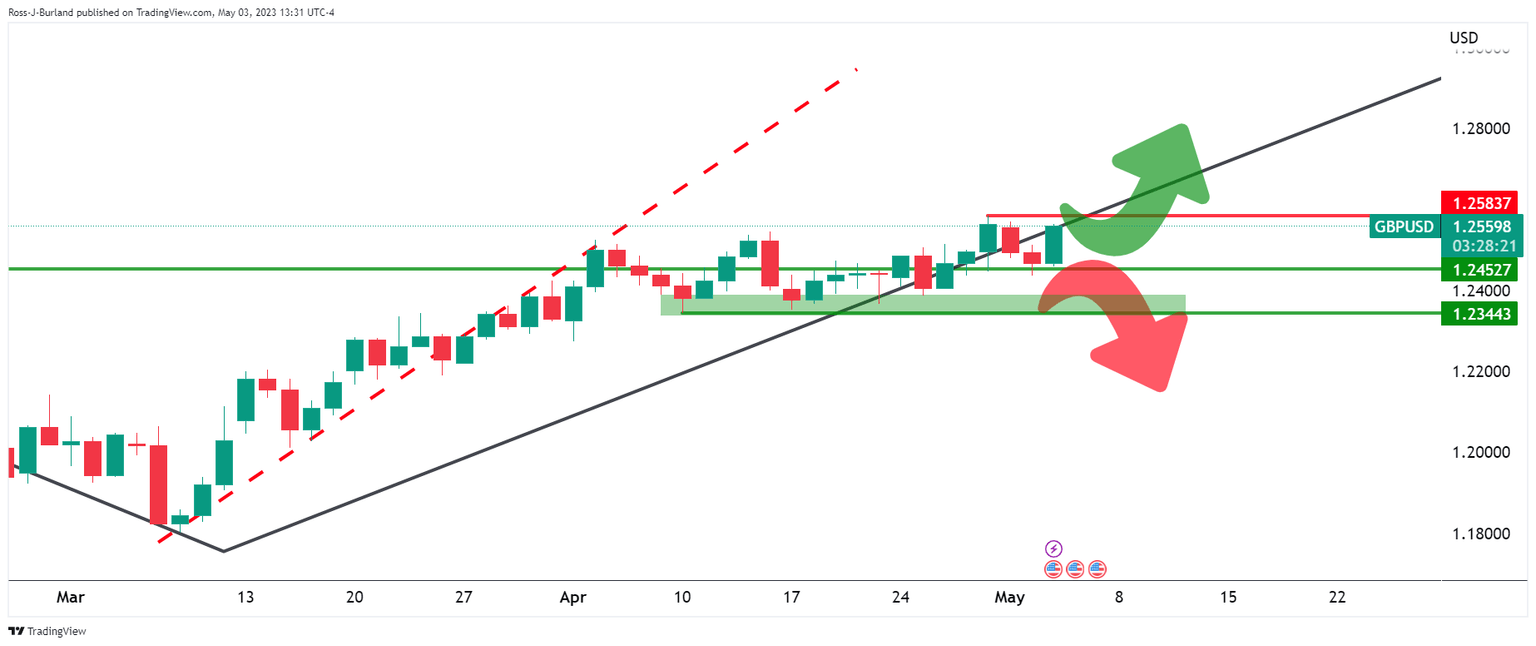

GBP/USD daily charts

As illustrated, GBP/USD is trading above support and within the right-hand shoulder of the inverse head and shoulders.

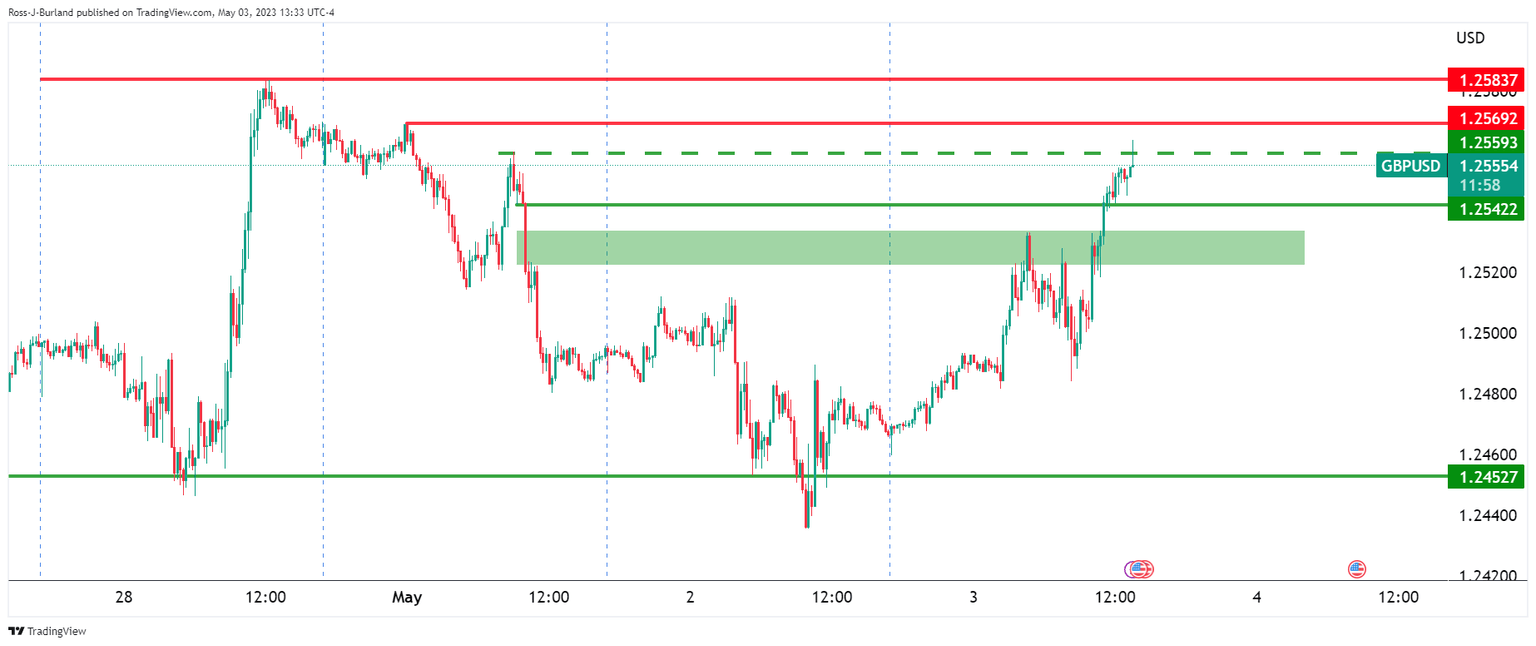

GBP/USD M15 chart

On the lower timeframes, the bulls will be in the clear while above the1.2540s with a first target in the 1.2570s.

Author

Ross J Burland

FXStreet

Ross J Burland, born in England, UK, is a sportsman at heart. He played Rugby and Judo for his county, Kent and the South East of England Rugby team.