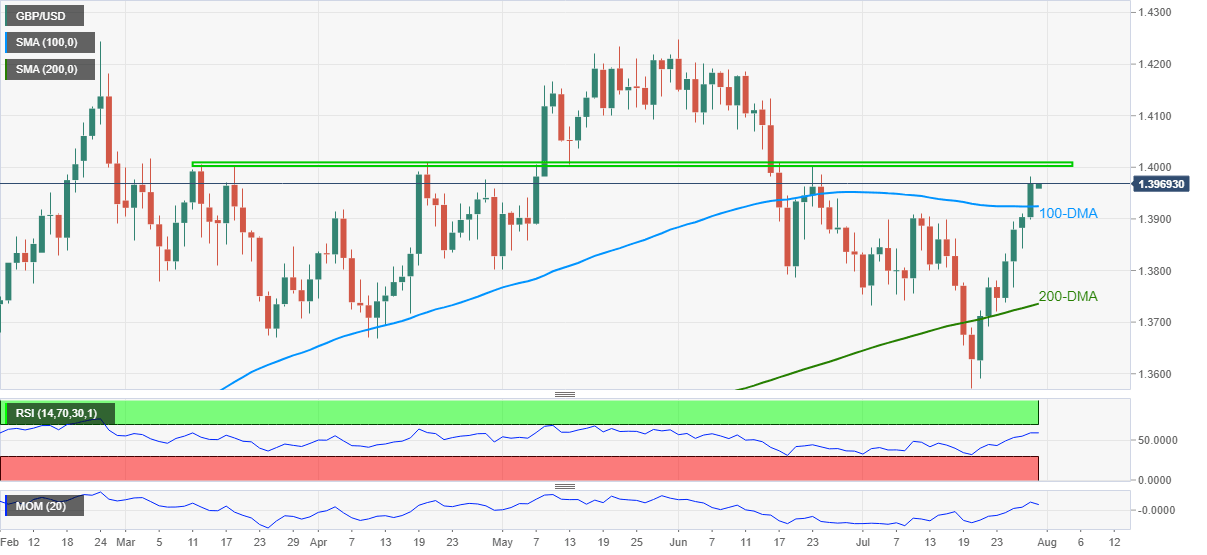

GBP/USD Price Analysis: Bulls again keep 1.4010 on radar

- GBP/USD edges higher after refreshing five-top, also crossed 100-DMA.

- Multiple levels marked since March challenge bulls despite upbeat RSI, Momentum.

- July 12 top adds to the immediate support, early July low can lure buyers past 1.4010.

GBP/USD seesaws around 1.3970 amid early Asian session trading on Friday, after renewing the multi-day tops the previous day. The cable pair rose past 100-DMA for the first time since June 23 on Thursday amid stronger RSI and Momentum lines.

However, a 20-week-old horizontal area surrounding 1.4005–10 becomes the key hurdle to the pair’s further upside, a break of which needs strong catalysts.

Given the Momentum line’s recent downtick, GBP/USD prices may witness a pullback towards 100-DMA retest, around 1.3920 by the press time. Though, early July’s wing high near 1.3910 and the 1.3900 threshold could test the sellers afterward.

Should the quote remains weak past 1.3900, the 200-DMA and July 02 lows surrounding 1.3730 will be in focus.

On the contrary, a successful upside clearance of 1.4010 enables the GBP/USD bulls to aim for the 1.4100 figures but multiple lows marked since mid-may could test the pair’s further rise.

In a case where the pair rallies past 1.4100, the 1.4190 and the yearly top near 1.4250 should lure the buyers.

GBP/USD: Daily chart

Trend: Bullish

Author

Anil Panchal

FXStreet

Anil Panchal has nearly 15 years of experience in tracking financial markets. With a keen interest in macroeconomics, Anil aptly tracks global news/updates and stays well-informed about the global financial moves and their implications.