GBP/USD Price Analysis: Builds on UK CPI-inspired rally, climbs to 1.2300 ahead of FOMC

- A combination of supporting factors pushes GBP/USD to its highest level since early February.

- The strong UK CPI lifts bets for more BoE rate hikes and provides a goodish lift to the Sterling.

- The prevalent USD selling bias remains supportive of the move ahead of the FOMC decision.

The GBP/USD pair catches fresh bids on Wednesday and the buying interest picks up pace during the first half of the European session in reaction to the strong UK consumer inflation figures. The momentum lifts spot prices to a fresh high since February 02, with bulls now awaiting a sustained strength beyond the 1.2300 mark before positioning for any further appreciating move.

The hotter-than-expected UK CPI print adds pressure on the Bank of England (BoE) to hike interest rates by 25 bps at the very least on Thursday, which, in turn, boosts the British Pound. The US Dollar (USD), on the other hand, drops to a fresh multi-week low amid expectations for a less hawkish Fed and further pushes the GBP/USD pair higher ahead of the key central bank event risks.

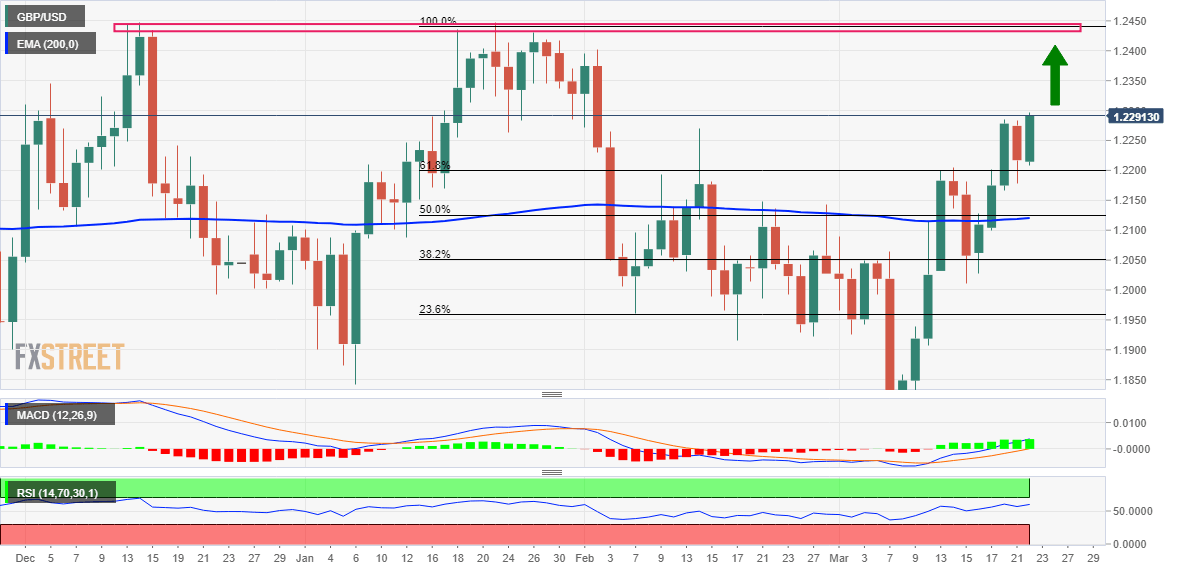

From a technical perspective, the emergence of fresh buying on Wednesday validates this week's breakout through the 1.2200 mark, representing the 61.8% Fibonacci retracement level of the January-March downfall. Given that positive oscillators on the daily chart are still far from being in the overbought zone, some follow-through buying beyond the 1.2300 level will be seen as a fresh trigger for bulls.

The GBP/USD pair might then climb to test the next relevant hurdle near the 1.2320 region before eventually climbing to the 1.2400 round-figure mark. The momentum could get extended further towards the double-top resistance near the 1.2450 region, or the YTD peak touched in January, above which bulls are likely to aim to reclaim the 1.2500 psychological mark for the first time since June 2022.

On the flip side, the 1.2235 area now seems to protect the immediate downside ahead of the 1.2200 mark (61.8% Fibo.) and the overnight swing low, around the 1.2180-1.2175 region. A convincing break below might prompt some technical selling and drag the GBP/USD pair towards the 1.2125 confluence, comprising the 50% Fibo. level and the 200-day Exponential Moving Average (SMA).

The latter should act as a strong base for the GBP/USD pair, which if broken decisively might shift the near-term bias back in favour of bearish traders and pave the way for deeper losses. The subsequent downfall could drag spot prices further towards the 38.2% Fibo. level, around the 1.2050-1.2045 region en route to the 1.2000 psychological mark and the 23.6% Fibo. level, near the 1.1955-1.1950 zone.

GBP/USD daily chart

Key levels to watch

Author

Haresh Menghani

FXStreet

Haresh Menghani is a detail-oriented professional with 10+ years of extensive experience in analysing the global financial markets.