GBP/USD Price Analysis: Bears take control in long squeeze

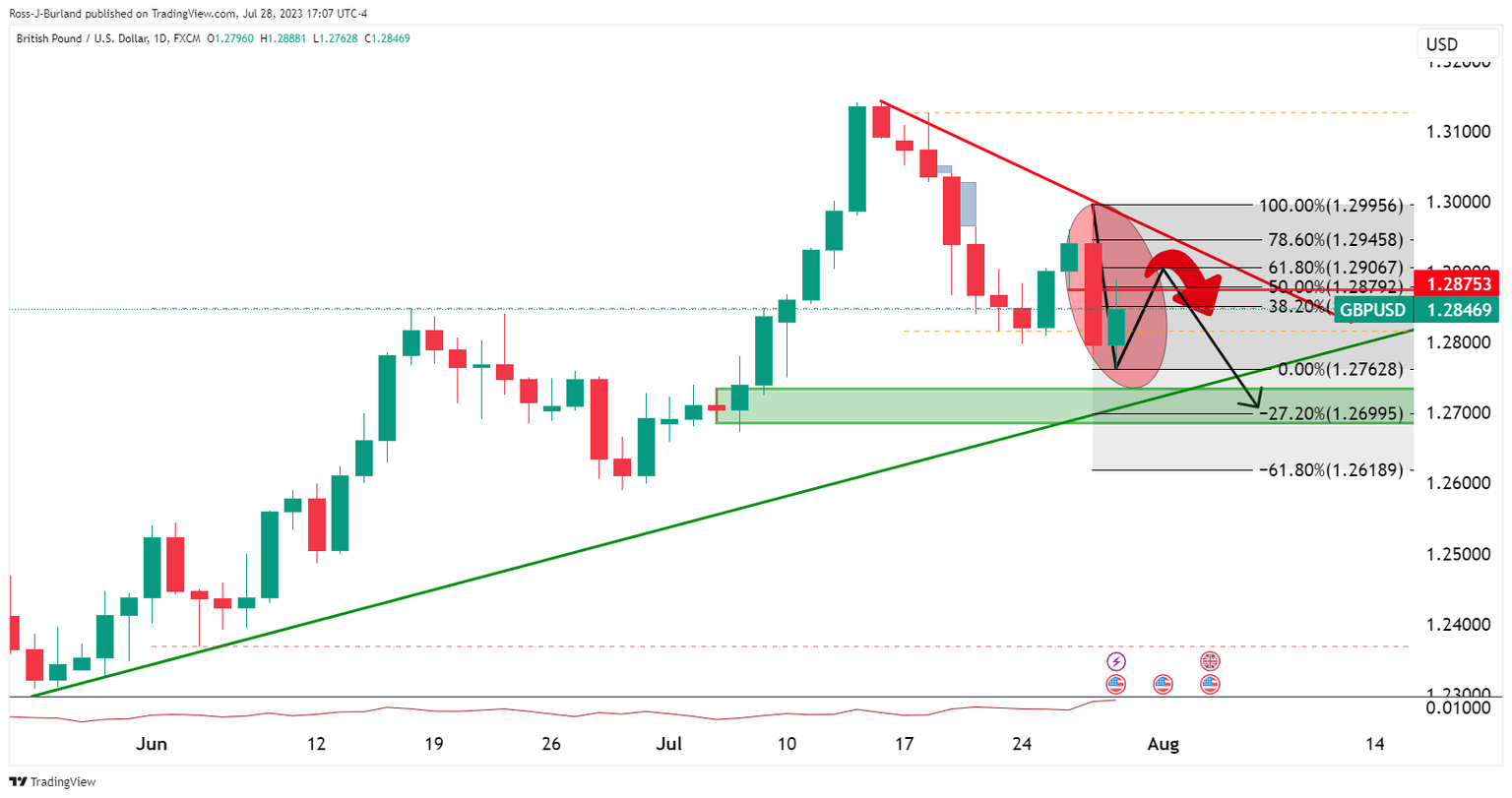

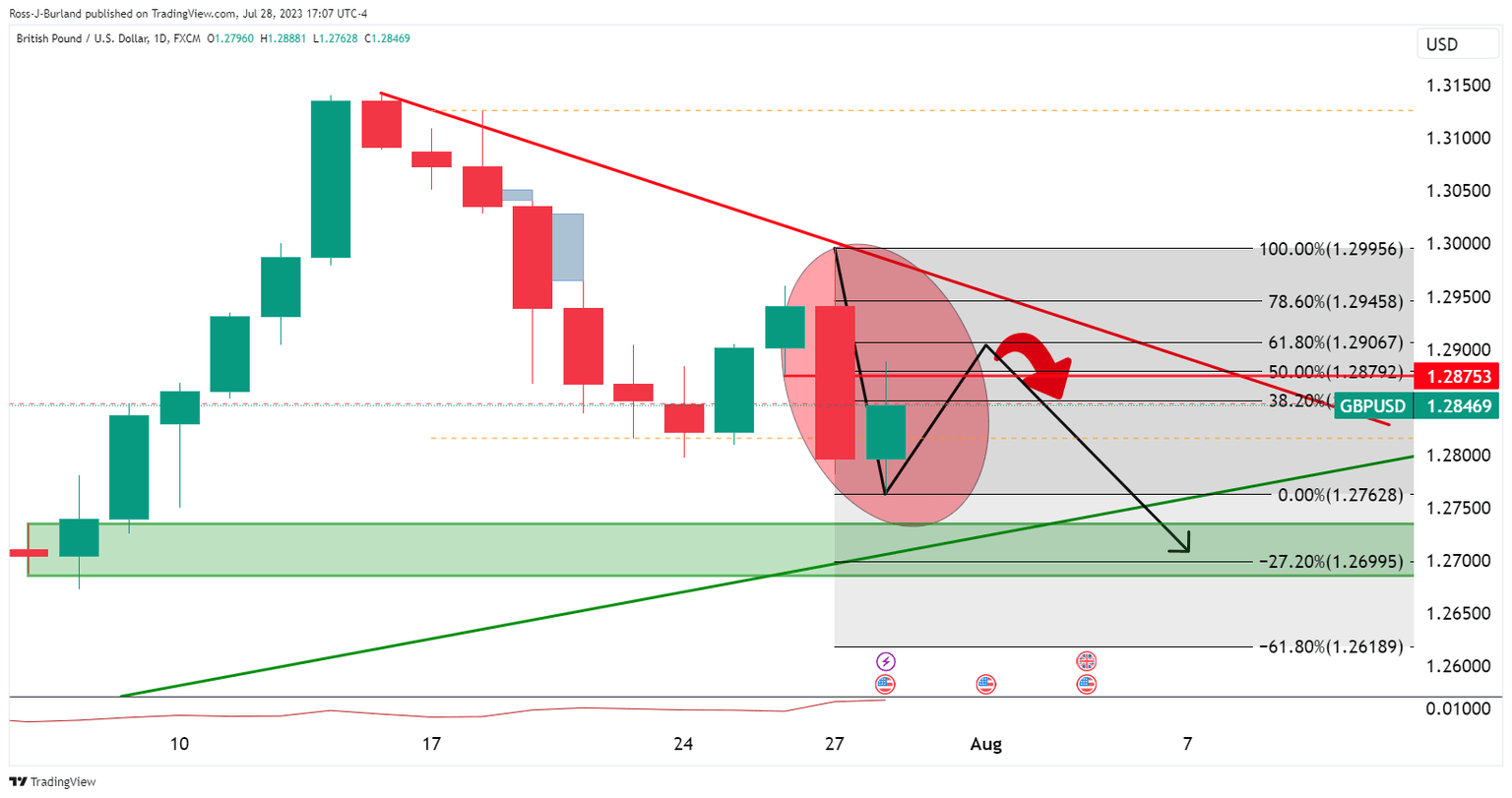

- GBP/USD bears eye a 50% mean reversion if not the 61.8%ratio.

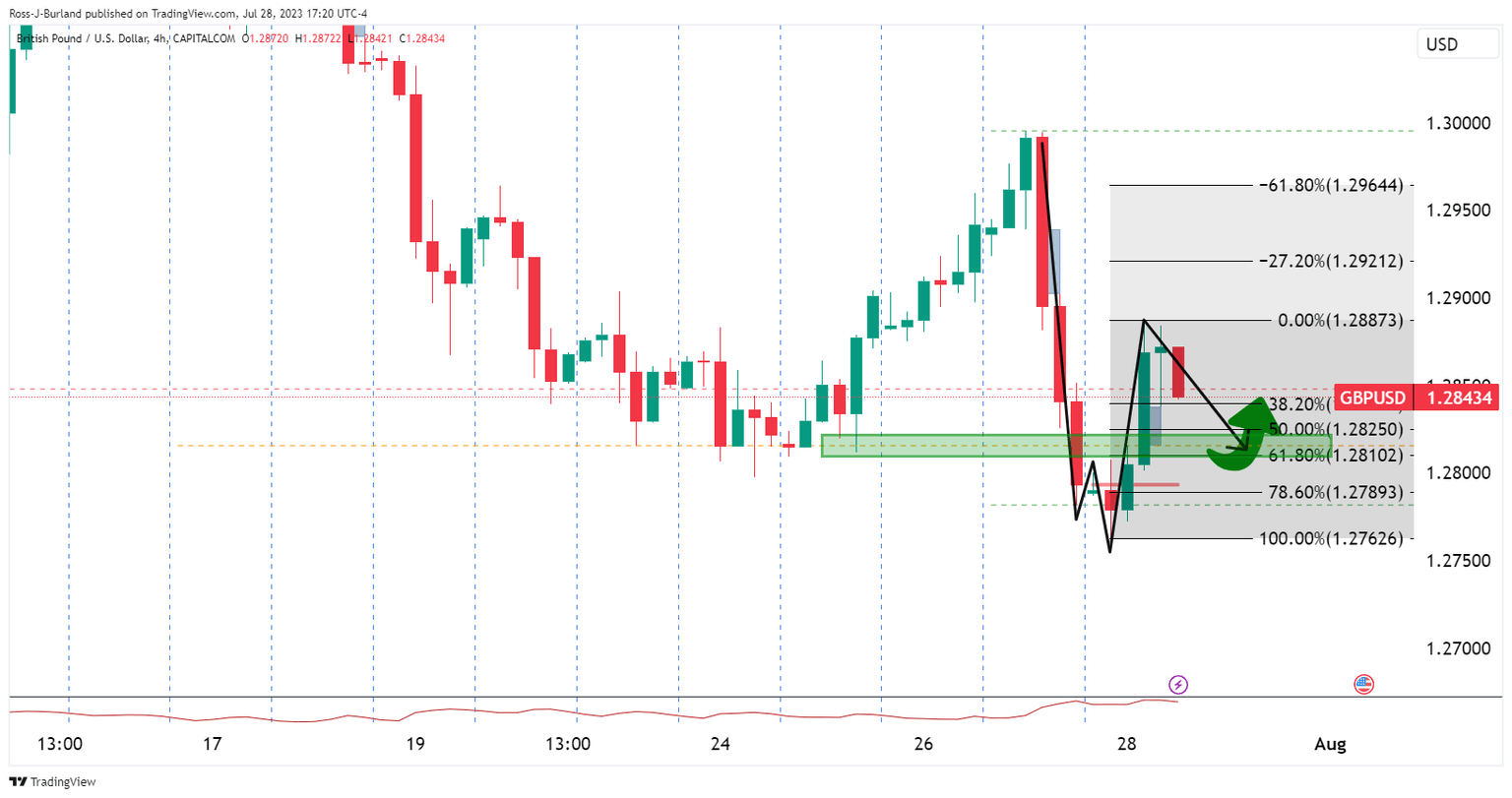

- The 4-hour W-formation neckline support has a confluence with the 78.6% Fibonacci.

GBP/USD ended at around 1.2840 on Friday after reaching its lowest level since July 6 while investors remain concerned that the hawks will continue to circle over the Federal Reserve following the release of stronger-than-expected second-quarter Gross Domestic Product data from the US.

Meanwhile, in the UK, weaker-than-expected PMI data and lesser inflation are pointing towards a less hawkish outcome at the Bank of England next week. Markets still anticipate a 25 bps hike at the central bank's August meeting but money markets see a peak of 5.75% in November, lower than prior projections. This leaves a bearish focus on the charts for GBP/USD and bears are already moving in at the end of the week:

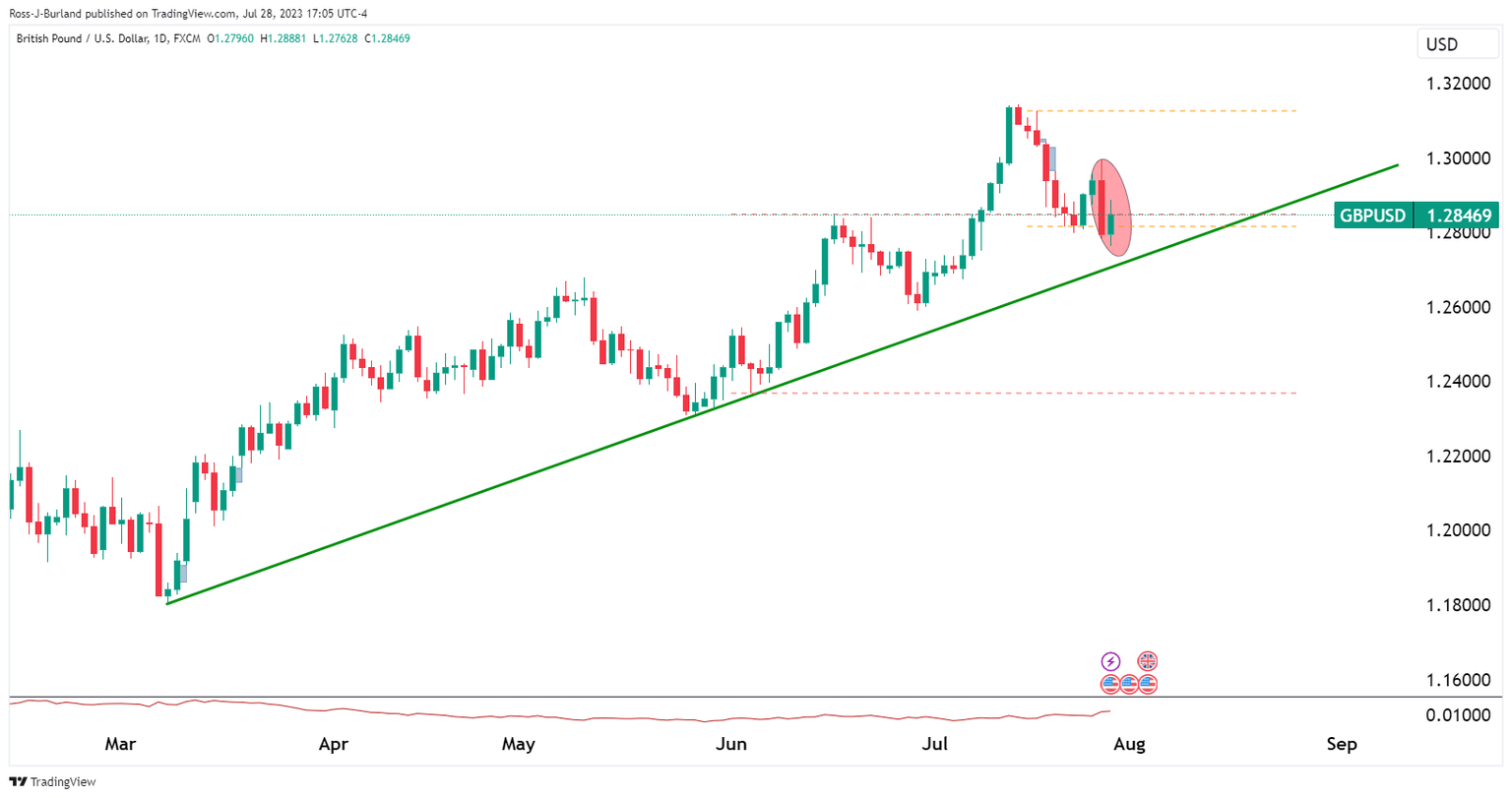

GBP/USD daily charts

We could be somewhat premature in the sell-off but that is not to say that we do not have any downside in play for the initial balance next week:

GBP/USD H4 chart

The W-formation is compelling and could be a pull on the price towards last week's lows that meets a 50% mean reversion if not the 61.8%ratio. The neckline support has a confluence with the 78.6% Fibonacci.

Author

Ross J Burland

FXStreet

Ross J Burland, born in England, UK, is a sportsman at heart. He played Rugby and Judo for his county, Kent and the South East of England Rugby team.