GBP/USD Price Analysis: Bears take control below monthly support

- GBP/USD bears are in control, for now, and aim for a monthly support area.

- The daily chart's M-formation's neckline is important.

GBP/USD is performing on the bid on Thursday afternoon US session, trying to resurface from the recent lows around 1.3050 following a strong move in the greenback. Meanwhile, however, the pair remains vulnerable to further losses from a longer-term perspective and the following illustrates the market structures across the monthly, weekly and potentially, from a daily point of view also.

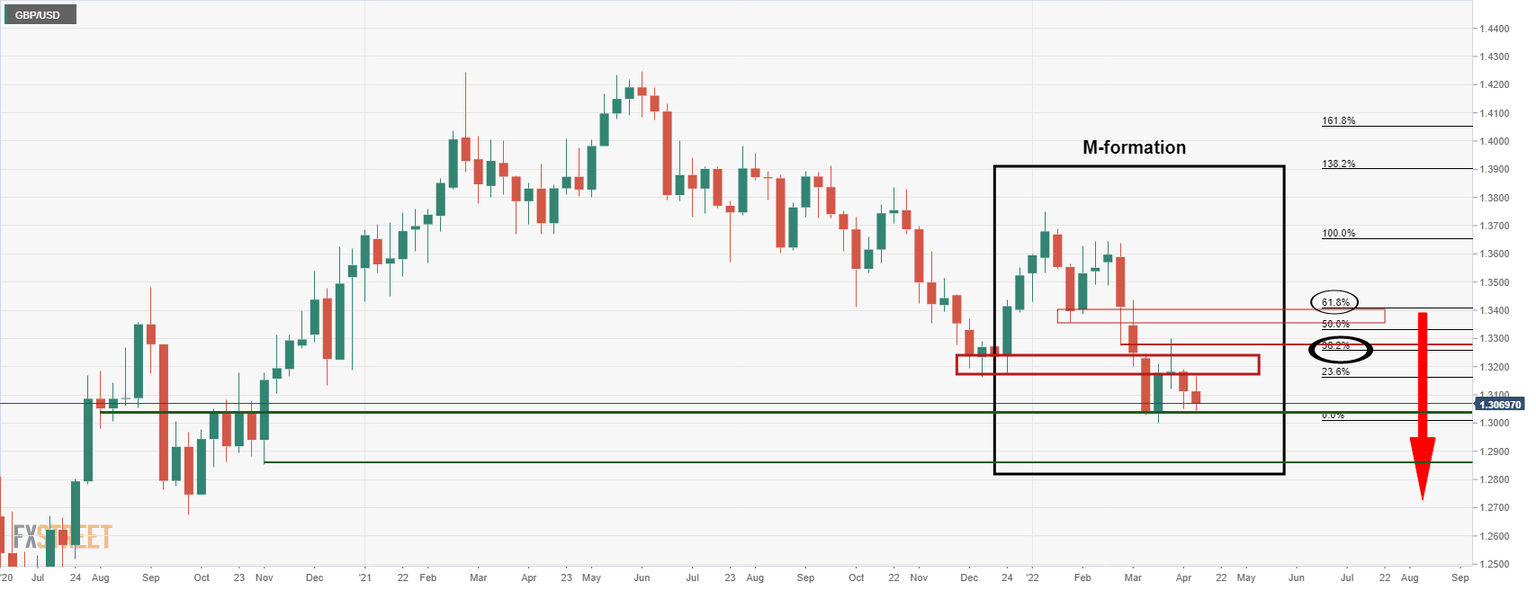

GBP/USD monthly chart

The monthly chart is highly bearish following a restest into the 50 EMA, followed by the Tweezer Top and a bearish Fractal. The pair has subsequently continued south and broken support that now would be expected to act as resistance on a subsequent retest of the structure.

GBP/USD weekly chart

Meanwhile, the weekly chart's M-formation, a reversion pattern, has seen the price revert towards the neckline in a 38.2% Fibonacci retracement. This is potentially far enough to lure in the bears at a discount and thus see prices extend lower in the coming weeks towards the monthly support area.

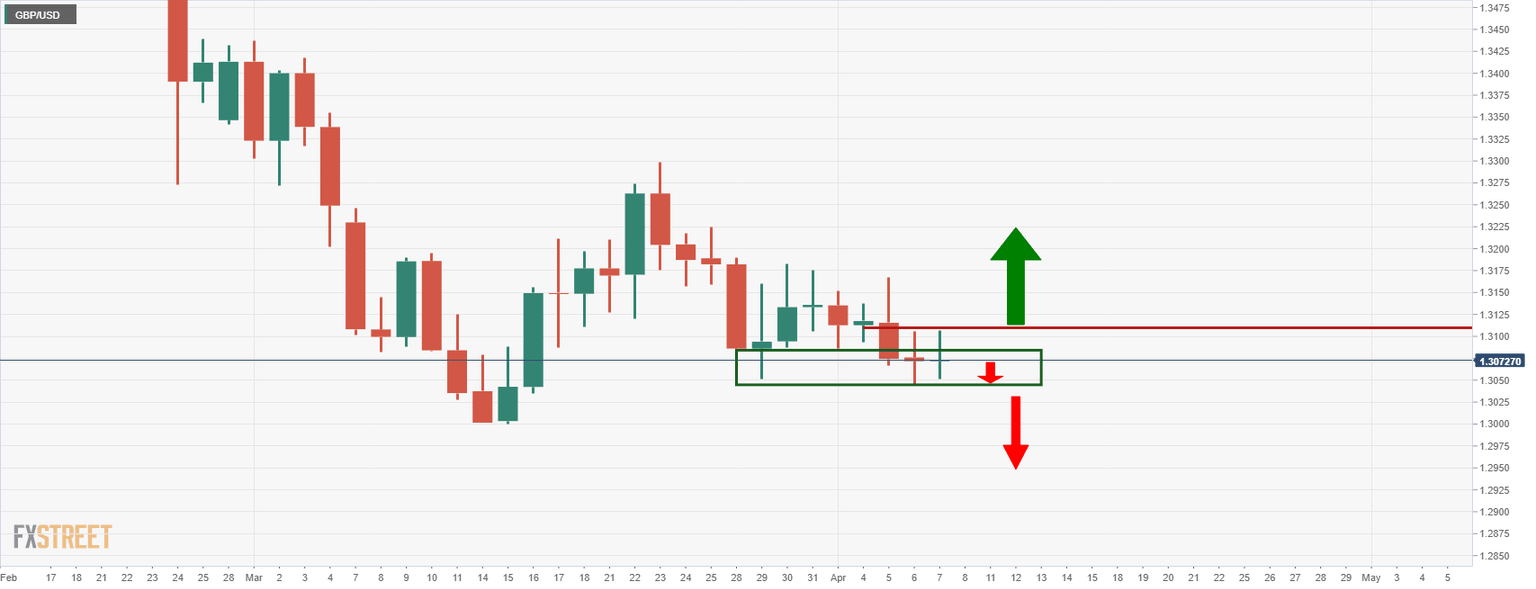

GBP/USD daily chart

From a daily point of view, however, there could still be some upside to come as the price is drawn to the M-formation's neckline. This will need to hold on a retest and bears will need to protect this area if the downside is going to play out in the foreseeable future. If the price breaks the neckline, then the bulls could well take back control in the meantime.

Author

Ross J Burland

FXStreet

Ross J Burland, born in England, UK, is a sportsman at heart. He played Rugby and Judo for his county, Kent and the South East of England Rugby team.